What is a Cook Islands foundation and how does it work? For those searching for asset protection, trusts are not the only alternative. Establishing your own foundation provides some of the same benefits as trusts, while offering flexibility and wealth protection. In June, 2012, the Cook Islands Foundation Act became law, making it the good standard in asset protection.

Based on the experience of foundation law in other venues, especially Guernsey and the Isle of Man, this legislation contains special provisions providing superior client planning options and more straightforward credit action requirements, as well as strict privacy regulations. As noted in Trusts & Trustees, published by Oxford University Press in July, 2014, “Strong legislation combined with highly regarded courts and exemplary service…in the Cook Islands has created the ideal environment in which to establish a foundation.”

Foundation vs. Trust

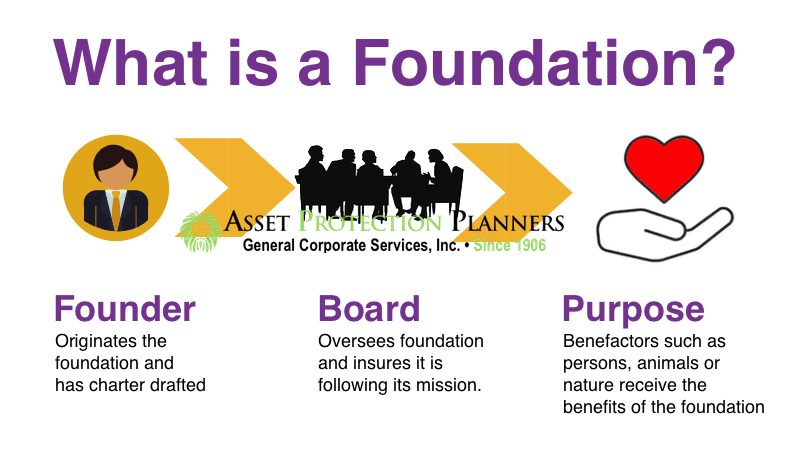

Experts have long know the Cook Islands Trusts as the ultimate asset protection vehicles. The Cook Islands International Trusts Act contains some of the same provisions as the Cook Islands Foundation act. However, while there are some similarities between the two, a foundation is not a trust. Instead, it more like a corporation than a trust. A trust is a relationship; a relationship among the trustee, settlor and beneficiaries. A foundation, however, is a separate legal entity. A foundation is not a corporation, as it has no shareholders. Some people set up foundations as charitable organizations, or for estate planning and inheritance purposes.

As noted in the Cook Island News when the Act became law in 2012, “Trusts are derived from the common law which is the basis of law in the Cook Islands. This means that much of the law we rely upon is not necessarily written in specific statutes. Instead, rather it comes from the precedents of hundreds of years of case law. Foundations, on the other hand, are a civil law concept. As such, many understood in the new markets we are pursuing, such as China, which is a civil law country.”

Forming a Foundation

A founder, either an individual or corporation, establishes the foundation. This entity provides the assets, known as an endowment, that the foundation administers. These assets are under contractual, not proprietary, administration. The foundation may enter into third-party agreements and can sue another party under its own name. The downside is that it is possible for a foundation to become a defendant in a lawsuit.

In the Cook Islands, it is possible to form a foundation even if the law in the founder’s jurisdiction does not allow such formation. The founder is always a separate entity from the foundation. So, if the founder files for bankruptcy or is otherwise insolvent personally, the foundation is not voidable.

Foundation Management

Councils mange Cook Island Foundations, but only one council member is necessary. We call the manager of a foundation a supervisor or enforcer. A foundation cannot engage in regular commercial activity or trading.

Foundation Registration

The Cook Islands requires each foundation to have a foundation instrument. This document details the foundation’s name and its objects, as well as the name of its Cook Islands registered agent. Your provider will file the instrument with the Registrar, and will pay the fees set out in the Schedule. One does not need to write the instrument in English. If someone writes it in another language, however, the foundation must attach a certified translation of the instrument in English. If there is any inconsistency between the non-English instrument and the certified translation, the certified translation shall prevail.

Two foundations cannot share the same name, or prove so close that it is easy to mistake them. As per the Cook Islands Foundations Act, they do not permit “offensive, misleading or otherwise undesirable” names. Finally, each name must end with the word “Foundation.” If a name does not comply with the Act regulations, the Registrar may direct the foundation to change the name. If the foundation does not submit a new, acceptable name within six weeks of this direction, the Registrar may supply a new name for the foundation. As per the objects in the instrument, they cannot be unlawful, immoral or contrary to public policy.

While the foundation must also have rules complying with the Cook Islands Foundation Act, these rules do not require filing with the Registrar. The rules must include specifics of the foundation’s operation, council establishment procedures and how the council exercises its powers, registered agent appointment, enforcer functions and how additional assets are endowed. The rules might also include dissolution of the foundation and subsequent asset distribution. Authorization for the foundation to derive earnings from investments is included in the rules.

Founder Powers

With a Cook Islands Foundation, founders may name or remove beneficiaries in a way similar to a trust. Foundations do not have to pay tax in the Cook Islands, and neither do foundation beneficiaries. Founders may also have the ability to revoke the foundation. Other powers delegated to the founders depend on the reserving these capabilities in the foundation rules. Powers often relegated to the founders include the foundation’s investment goals and strategies. Overall, founders have the ability to establish the foundation’s regulations.

Exceptional Privacy

The Cook Islands offer exceptional privacy. This includes foundation provisions making it illegal to disclose information about the foundation or identify the founder and council members.

Creditor and Tax Protection

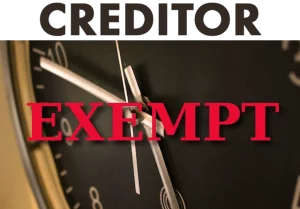

One huge advantage of a Cook Islands Foundation is protection from creditors or reckless lawsuits. Much like the Cook Islands asset protection trust, here is only a two-year statute of limitations for a creditor to file a claim attempting to set the foundation aside or question the transfer of assets to the foundation. A creditor must commence any action against a founder regarding “fraudulent transfers” within one year of the date of the assert transfer to the foundation. Actions must commence against the foundation itself within two years of the date that the debtor in question put the assets into the foundation. Failure to commence such a claim within that time period means the creditor will not hold legal standing to allege fraudulent transfer.

In the Cook Islands, a creditor has the onus of proof showing a founder’s intentionally made the transfer to defraud, and the standard of proof required is beyond reasonable doubt. To be clear, the word defraud here is a civil (not criminal) legal term meaning to keep assets away from creditors. This is very difficult to prove in the Cook Islands.

Should a creditor prove successful in arguing a transfer to a foundation was made with intent to defraud, there is only one remedy. While the creditor might receive assets from the foundation as damages, there are no punitive damages against foundations.

Taxation and Estate Planning

Under Cook Islands law, a foundations and its beneficiaries are exempt from taxes in this jurisdiction. It is important to note many people, such as U.S. people, are taxed on worldwide income. So, just because there are no taxes due in the Cook Islands does not mean they may not be due back home.

On another note, forced heirship laws from other countries are not enforceable in the Cook Islands. So, that that means you can decide who inherits your wealthy. Many South American jurisdictions dictate how one must distribute an estate. Thus, many Latin Americans set up foundations or trusts to avoid this drawback.

Moving an Existing Foundation to the Cook Islands

An existing foundation in another country can relocate and register as a Cook Islands Foundation. This new registration does not affect the foundation’s continuity or require a name change. Cook Islands fee structures are competitive with other major offshore foundation jurisdictions.

Cook Islands Law

One advantage of a Cook Islands Foundation is that, although someone may sue a foundation, the case is heard before a Cooks Island court and judged based on Cook Islands law. If someone in another jurisdiction wins a case against a founder, in order to collect a judgment they must appear in a Cooks Islands court. A flight from New York to the Cook Islands takes 14 hours, including two stops.

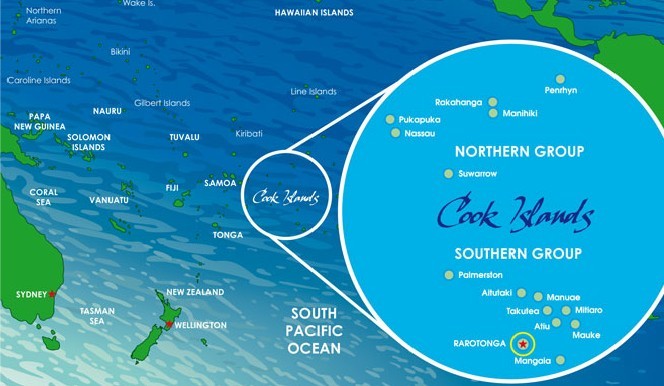

The Cook Islands are located in the South Pacific, between American Samoa and French Polynesia, and northeast of New Zealand, whose currency they use. Technically, although Cook Islanders are considered New Zealand citizens, they also hold Cook Islands nationals status. The Cooks are a self-governing country with Commonwealth status.

The Cook Islands features a system of government based on English law, with a 24-member Parliament and a prime minister. The economic and judicial environment is considered stable. Its financial industry is well-regarded, and its judiciary, consisting of top New Zealand judges, is considered high caliber.

For practical purposes, there is another Cook Islands advantage. Its time zone makes it convenient for both American and Asian clients.

Foundation Dissolution or Termination

If the foundation’s rules do not address the circumstances under which it terminates, there are several circumstances as per the Cook Islands Foundation Act addressing dissolution or termination. These include foundational bankruptcy, completion – or failure – of the foundation’s stated purpose, or a High Court order dissolving or terminating the foundation. For the High Court to make such an order, any of the following may file an application with the High Court:

- Founder

- Council members

- Enforcers

- Beneficiaries

- Creditors,

- Registrar

Form a Cook Islands Formation

The Cook Islands Foundation Act offers outstanding and effective wealth protection. You can also read about private foundations. Moreover, you can do a comparison for what is best by reading this article, what is better a foundation or trust? Another attractive alternative is the Nevis multiform foundation. For more information or to form a Cook Islands Foundation, please utilize one of the telephone numbers shown above or complete the consultation form on this page.