When you’re securing your assets for your business, your estate, or someone else, it’s important to understand your options. Often, the two choices that arise are a trust and a foundation, both of which secure assets and wealth for future use and distribution. But which is better, a trust or foundation? Both have their benefits and drawbacks, so the answer will depend on your needs and what you intend to gain from your investment.

To better understand which choice is right for you, we’ll start by defining foundations and trusts.

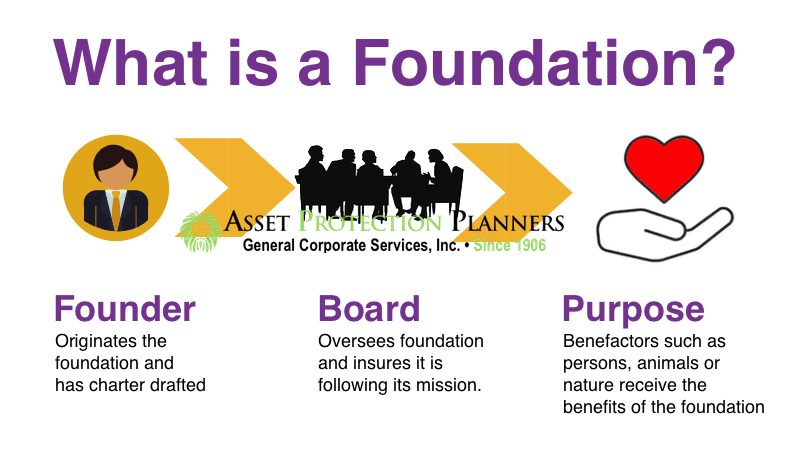

What Is a Foundation?

A foundation, often called a private foundation, is a charitable organization that might not qualify as a public charity by governmental standards, according to Investopedia. Thus, this organization type is considered a nonprofit. It is often created through a single primary donation from a business or individual. The the foundation’s own board of trustees or directors manage the funds and programs within the foundation. Instead of funding through periodic donations like a public charity often is, an initial donation usually funds the foundation. In different countries, such as Nevis and the Cook Islands, one can continue to invest in and receive funds from a foundation. Private foundations are only tax-exempt when they meet the requirements of a 501(c)(3) of the Internal Revenue Code.

Foundations generally fit into two categories: private operating foundations and private non-operating foundations. Private operating foundations run the organizations or charities that they fund with the income from their investments. Private non-operating foundations, on the other hand, disperse their funds into other charitable organizations. All private foundations must distribute income annually for charitable purposes.

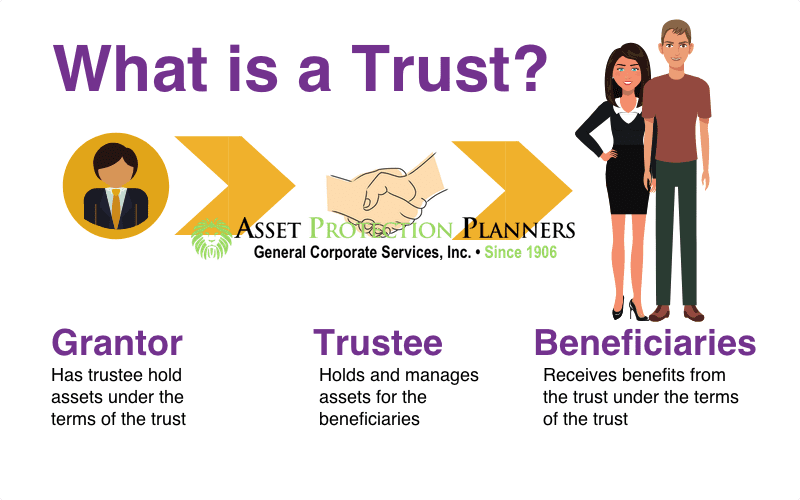

What Is a Trust?

According to Investopedia, a trust creates a legal relationship among three parties. One party, we call the trustor, settlor or grantor (all words essentially have the same meaning), gives another, the trustee, the right to hold the title to property or assets. The trustee does this for the benefit of the third party, the beneficiary. People often use trusts to add legal protection the trustor’s assets. Another common use is for estate planning; that is, to ensure that assets are distributed according to the trustor’s intentions, save time in the transfer of assets to heirs, and sometimes reduce inheritance or estate taxes. Many people also use trusts to own assets anonymously. So, they are often the choice for estate planning, tax planning, and privacy.

Trusts come in various forms. A living trust holds assets during an individual’s lifetime and usually manages and distributes them, in whole or in part, after death. Whereas, a testamentary trust specifies how an individual’s assets will be used after their death. Trusts can either be revocable, and thus changed or terminated by the trustor during his or her lifetime, or irrevocable, and thus unchangeable. Though, in certain jurisdictions, such as the Cook Islands, a settlor can request that the trustee makes certain changes even if the trust is irrevocable. Most trusts are funded, where the assets are placed into it during a trustor’s lifetime, but some are unfunded agreements that become funded upon the trustor’s death.

Now that we understand a foundation vs. trust separately, let’s compare them more closely.

Trust vs. Foundation Comparison Table |

||

| Item | Trust | Foundation |

| Description | A three-party relationship where a “settlor,” (a.k.a. “grantor” or “trustor,”) transfers assets to a “trustee,” who hold assets for the “beneficiaries.” The trustee must follow the terms of the trust and act in the best interest of the other parties. Depending on the trust purpose, one party can hold one or more of the three roles. | A foundation an stand-alone legal entity that is separate from the assets of the founder. It is not a company. It does not issue shares. It does not have owners. It is a nonprofit organization. It usually gives support to others through grants directly or to other charities. Some foundations engage in other activities besides grantmaking. |

| Examples | -Parents who make a trust so that their children and grandchildren receive their assets after they die. -People who have concerns about lawsuits, setup an asset protection trust to keep assets away from creditors. -Those who want to own real estate privately transfer property into a land trust. -An elderly person sets up a Medicaid trust and transfer all assets into the trust so that (after a 5-year holding period) personal assets do not exceed amount that qualifies for Medicaid support. |

Individuals, families, companies or public entities (such as hospitals and churches) set up foundations to support a charitable cause such as childhood disease, hunger, education, general healthcare, etc. Some well-known foundations include The Make-A-Wish Foundation, The Bill and Melinda Gates Foundation, PBS Foundation, Rockefeller Foundation, Nobel Foundation, Walton Family Foundation |

| Legal Origin | Common law (England) | Civil law (mainland Europe) |

| Who Originates the Organization? | Settlor (AKA Grantor, Trustor) | Founder |

| Founding Document | Trust deed | Charter |

| Manager | Trustee | Board of Directors (AKA counsel) Also typically has a Chief Executive and other officers) |

| Manager Role | Role of trustee -Follows terms of the trust -Administers trust according to the trust agreement -Making decisions that follow trust guidelines -Preparing or delegating creation of records, statements as needed -Communicating with beneficiaries -Answering questions of beneficiaries |

Role of board of directors -Decides its organizational direction -Make sure it follows its mission. -Establishes the ethics standards -Monitors its results -Insures responsible management |

| Ownership Type | Beneficial interest (beneficiaries essentially “own” the trust) | Has no owners (there are no shareholders). |

| How Assets are Titled | [Trustee name], as trustee of [name of trust] | In name of foundation |

| Publicly filed? | Certificate of trust but not the trust itself | Publicly filed similar to a corporation |

| Common Types | -Asset protection (offshore and domestic) -Estate planning (living trust or inter vivos trust) -Real estate (land trust) -Personal property (automobiles, household goods, etc.) -Charitable -Special needs (for those with disabilities) |

-Independent (Usually funded by individual or family) -Corporate (Funded by a corporation but is a separate legal entity. Often corporate officers manage and may give endowments) -Operating (Purpose may be research, public benefit, etc. Most funds or grants go toward purpose stated in its charter). |

| Taxation | Two broad tax categories are “Simple” trusts and “Complex” trusts. With simple trusts, the parties associated with the trust (settlor, beneficiary) pay taxes on trust profits. With complex trusts, the trust, itself, pays taxes on trust profits. | In tax Reform Act of 1969 private foundations are exempt from most taxation by providing social benefits under the following criterion. (1) The foundation must pay at least 5% of the value of its endowment and none of it must be to the benefit of a private individual. (2) It must not own/operate a for-profit business. (3) It needs to file detailed reports and conduct audits each year. (4) It must meet accounting requirements of nonprofit organizations. The operating and administrative expenses count toward the 5% minimum annual outgo. |

Benefits of Both Foundations and Trusts

There are several benefits that foundations and trusts enjoy, according to Carey Olsen. Both trusts and foundations are flexible arrangements. They are both run on the discretion of the trustee or board, which determine how the benefits are distributed and when according to the trustor or founder’s intentions. The settlor of a trust or founder of a foundation can choose to reserve some powers and rights in maintaining their intentions, or in vetoing decisions made by the trustees or board.

There is no duration set by law for either trusts or foundations, and they can be set up to last for an unlimited amount of time. This makes either attractive options for dynastic private wealth structures, as they can hold family wealth for many generations.

Privacy is an important aspect in both investment types. People can create trusts and foundations for individuals based on private arrangements. While some information about foundations is required to be publicly available, there is no requirement to identify the founder, beneficiaries, or purpose of a foundation publicly. Trusts do not require any registration of documents or information in the public domain.

Foundation vs. Trust – Which is Better for Asset Protection?

So, what is better for asset protection from lawsuits, a foundation or a trust? The trust with the strongest case law histories and statutes are those in the Cook Islands and Nevis. There is a short statute of limitations on fraudulent transfer of one to two years. This means that once you transfer assets into the trust and the requisite time passes, the courts will not entertain challenges to the transfers into the trust. Plus, even if the asset conveyance challenge happens immediately, the opponent must show the transfer was done to deny that particular creditor access to trust funds. Moreover, the creditor must prove its case beyond a reasonable doubt.

Similarly, with a foundation, in order to enjoy asset protection, you will need to have council members who are outside your country of residence, such as in Nevis, Cook Islands or Panama. You may hold the manager role initially. But when problems arise, like the trust, you will need to turn over the reins to a person or group of people in the country where you formed the foundation. Otherwise, when the judge says, “give me the money,” you will have to comply.

The Bottom Line

So, what is better? For asset protection, a trust has long standing case law to show that it works. That is, if the trust is in the Cook Islands or Nevis, the asset protection results are quite robust. Foundations do not have substantial case law as asset protection devices. The exception is in Nevis. One can operate the Nevis Multiform Foundation as a trust, company, or partnership. That means that the Nevis foundation can enjoy the powerful asset protection provisions inherent in the Nevis trust. So, in that vein, the Nevis trust or foundation set up in the form of a trust are nearly identical creatures, in theory.

Bottom line? For asset protection use the trust. Then put an LLC inside of the trust so you can hold the LLC management position and sign on the company bank account until the “bad thing” happens. Then the your trustee of the trust that owns the LLC will step in as LLC manager to protect you.

Managing the Trust or Foundation

One of the big differences between a trust and a foundation is how they’re managed. Indah explains that trusts have a trustee that has a fiduciary responsibility toward the beneficiaries of the trust. Management of the trust is left to the trustee, keeping the beneficiary’s interests in mind. While trusts often stick to just the relationship between these two entities, a trust can add a protector. The protector ensures that the trustee follows beneficiary’s interests by having the right to veto the decisions of the trustee. The trustee only has legal ownership of the trust’s assets, but the beneficial ownership of those assets stays with the beneficiary.

A foundation, on the other hand, is set up a little differently. Once the founder of a foundation gives assets to that foundation, they become the property of the foundation and no longer belong to the founder. Instead of using a trustee, a board or council manages a foundation, which usually consists of three or more members. The board acts following the foundation charter, which indicates the will of the founder. In certain jurisdictions, the founder can become a protector of the foundation, which gives them the power to veto actions of the board. This allows the founder to still retain some control over how the assets in the foundation are used and managed. If a jurisdiction cannot allow the founder to become a board member or protector, the founder can assign a nominee founder to fill this role.

Common law governs the structure of a trust and guides how the trustee should operate and organize the trust. The founder of a foundation has some freedom in deciding how to structure and operate the organization.

Tax Season

Fees and taxes on trusts and foundations vary greatly because of their different statuses. According to the IRS, there is an excise tax of 2% on the net investment income of most domestic tax-exempt private foundations. This includes private operational foundations. Exempt operating foundations are not subject to tax. In certain cases, the tax for a foundation can be reduced to 1%. These taxes must be reported on a Form 990-PF.

Trusts are taxed differently depending on their type, Investopedia explains. Instead of a fixed tax rate that foundations have, the taxes on a trust are dependent on the income that’s distributed to its beneficiaries. There are tax deductions for that income that is distributed to beneficiaries, and the beneficiary then pays income tax on the taxable amount. Capital gains from this amount may be taxable either to the beneficiary or the trust. If the income or deduction is part of a change in the principal or part of the estate’s distributable income, then the trust pays the income tax and it is not passed on to the beneficiary. With simple trusts, as the tax code calls them, the income tax responsibility flows through the trust to the parties associated with the trust. Complex trusts, on the other hand, pay their own taxes.

Now, here comes the disclaimer. Keep in mind, that you should not rely on this information solely because tax and other laws change and your situation may vary. So be sure to get and maintain the advice of a knowledgeable licensed accountant and/or attorney when you use a trust or foundation.

Vehicles for Charitable Contributions

If your purpose is mainly to make and gain charitable contributions, there are a few different types of charitable trusts and foundations. Foundation Source describes the one foundation and two trust types.

Using a private foundation for charitable contributions allows donors to have complete control over granting and investment decisions. The founder and contributors can fund it with almost any kind of asset, including private equity, tangible assets, real estate, and intangible personal property. A private foundation has flexibility in the activities that manage the assets. It can allow such things as grants to individuals, scholarship programs, program-related investments, direct charitable activities, and international granting.

There are two main types of charitable trusts. The first is a charitable remainder trust (CRT). A CRT provides the donor or other parties indicated with cash flow while also securing a current-year personal income tax deduction. The donor contributes assets to a trust, which in return makes annual distributions to the donor or someone else for a stated term. After the end of the term, any remaining assets in the trust go to whatever charities the donor has chosen. A family’s private foundation can be the recipient of those assets.

The second type of charitable trust is a charitable lead trust (CLT). A CLT is designed to allow tax-free gifts to a donor’s family. To do this, assets are first donated to the trust, which then provides cash flow to the donor’s chosen charitable organizations for a specified period of time. Any assets remaining in the CLT after that period pass on to the donor’s family, free of any estate or gift taxes.

How to Set up a Foundation or Trust

When you’re ready to take the next step in creating a trust or foundation, make sure you have a clear idea of what you want to invest and why. Decide what advantages are most important to you and what your overall intention is. You can also start considering who you might want to be your trustee or a member of your board, as these individuals will have a lot of responsibility in maintaining your assets. It’s important to choose people that you can trust.

To set your goals into action, you don’t need to figure out how to set up a foundation or trust. Getting the most out of your assets and ensuring that you’re within the correct legal parameters means getting professional help. Whether you’ve decided on the right investment or still need a little help deciding on a foundation vs trust, we can help you better understand your options. Contact us today to set up a foundation or trust to give yourself, and your family, brighter a future.