What is an offshore trust? What are the advantages and disadvantages? If you’re new to the world of asset protection trusts, you’ve probably asked yourself these questions. Luckily, Asset Protection Planners has the answers. We’ve set up countless offshore trusts over the years and compiled our expertise into this guide.

After reading this article, you’ll know exactly how offshore asset protection trusts work. You’ll also be able to decide if this trust type is right for you. We’ll cover:

- Dispelling a Myth About Offshore Trusts

- What Is an Offshore Trust?

- Understanding Offshore Trusts

- How Offshore Trusts Differ from Domestic Trusts

- Who Needs an Offshore Asset Protection Trust?

- Benefits of Setting Up an Offshore Trust

- How Are Offshore Trusts Taxed?

- Are Offshore Trusts Safe?

- The Best Place to Set Up an Offshore Trust

- Should I Set Up an Offshore Trust?

- How to Set Up an Offshore Trust

Dispelling a Myth About Offshore Trusts

Before we get started, let’s dispel a common misconception. Contrary to what movies depict, offshore trusts aren’t shady tools used by the ultra-wealthy to run away from the law. Properly established offshore trusts are tools that effectively protect your money from creditors and aggressive lawyers.

Strict provisions are in place to ensure that every offshore trust is established ethically and properly. We’ll show you how powerful these protections are and how wrong the popular image of offshore trusts is.

What Is an Offshore Trust?

An offshore trust is a trust that’s created in a foreign jurisdiction, like the Cook Islands or Nevis. These trusts operate like domestic trusts but have stronger asset and creditor protections, thanks to their location.

Though domestic trusts are typically used for estate planning purposes, offshore trusts are usually designed to protect against creditors and lawsuits. US courts do not have jurisdiction over foreign lands, so if a creditor wins a case against you in the United States, they still cannot access your offshore trust. Even if a creditor shows your trustee that they won a case against you, your trustee has no obligation to follow that ruling – in fact, doing so would go against their duty to protect your assets.

The bottom line: an offshore trust is a trust that was created overseas that offers stronger protections than a domestic trust ever could.

Understanding Offshore Trusts

To truly understand how offshore trusts work and are constructed, you need to understand a few key terms. First up is the settlor. The settlor is the person who establishes the trust and funds it with their assets. Settlors may also be referred to as grantors, trustors, or trust creators.

The next notable party in a trust is the beneficiary. This is a person, entity, or group of people that benefits from the trust. Beneficiaries can typically ask the trustee to make distributions from the trust.

Finally, there is the trustee. This is a person or company that manages the trust. The trustee must follow the terms of the trust deed and is legally required to act in the best interest of the settlor and beneficiaries.

How Offshore Trusts Differ from Domestic Trusts

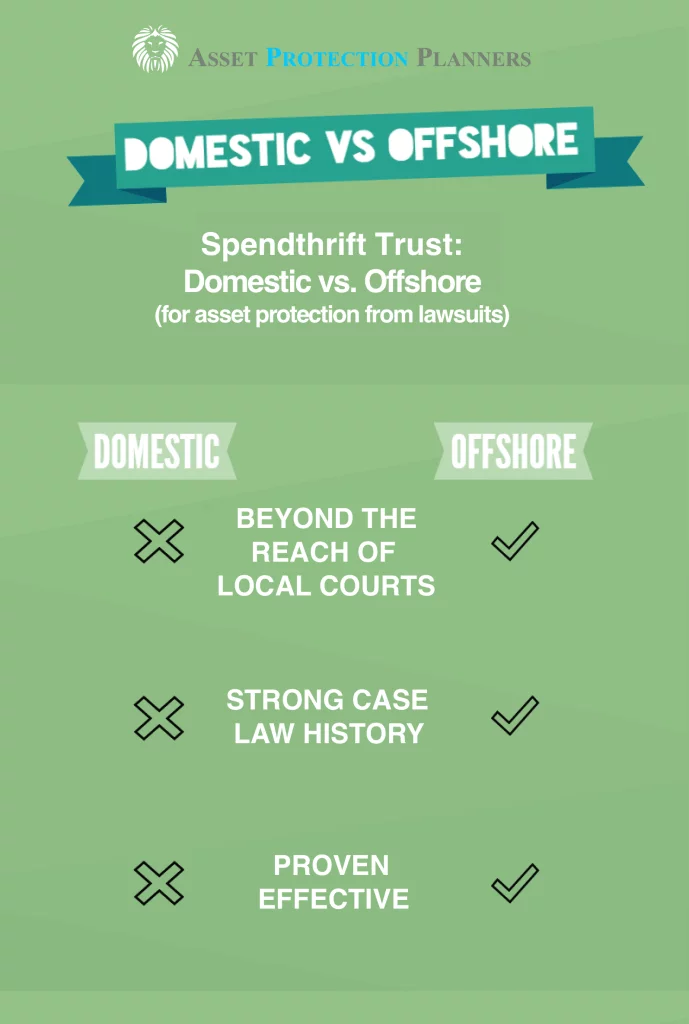

Offshore trusts are quite similar to domestic trusts. However, their overseas location makes a world of difference in how effectively they protect against creditors and lawsuits. Here’s a quick overview of the main differences between domestic and offshore trusts:

- Protection against domestic rulings: A trust established in a foreign jurisdiction isn’t subject to US laws. Even if someone wins a case against you in the States, they’ll have to re-try the case in the jurisdiction where you’ve established your trust.

- Strong case law history: Popular offshore trust jurisdictions have had dozens of years to build up a case law history that makes their trust protections even stronger.

- Beneficiary flexibility: Many offshore trust jurisdictions allow the settlor and beneficiary to be the same person. This makes it much easier to retain access to your assets even when they’ve been placed in a trust. Additionally, this benefit does not weaken asset protections, which would be the case with a domestic trust.

Learn more about Offshore vs. Domestic Asset Protection Trusts.

Who Needs an Offshore Asset Protection Trust?

Offshore asset protection trusts are best suited to those who have substantial wealth or are at a high risk of being sued. The typical value minimum for these trusts is around $250,000, so if your net worth is lower, another type of trust could be more effective.

Benefits of Setting Up an Offshore Trust

- Powerful asset protection – An offshore trust is one of the best ways to protect your assets from creditors. Your local courts do not have authority over foreign lands. Therefore, the trustee company can ignore foreign court orders to turn over your money. Conversely, we have seen US-based domestic trusts penetrated over and over again by results-oriented judges.

- Tax simplicity – From a tax perspective, offshore trusts are very easy to manage. The tax responsibility simply flows through to the settlor and/or beneficiary. There is typically no tax at the trust level. So, you pay taxes as if you earned the profits in your name. Still, it’s worth speaking with a CPA to ensure proper handling of taxes.

- Investment freedom – An offshore trust is treated like a non-US entity. It opens up financial opportunities and investments unavailable to US citizens. Plus, it can save you money abroad while being sued or pursued by creditors at home.

- Unprecedented safety – The United States is home to 80% of the world’s lawyers and generates 96% of the world’s lawsuits. By removing your assets from the states, you greatly decrease your likelihood of being sued for your wealth. In addition to that safety boost, none of the Cook Islands trusts that we’ve established have ever been breached.

There are countless benefits to setting up an offshore trust. They include:

How Are Offshore Trusts Taxed?

The offshore trust itself does not pay taxes. Instead, the settlor handles the tax burden for a trust. When the settlor dies, the tax burden shifts to the beneficiaries, who pay taxes upon receiving distributions.

US citizens, residents, and green card holders are taxed on worldwide income, not just US earnings. Aside from requiring a few additional forms, the IRS treats US and foreign profits identically. If are not a US citizen and you live in a country that does not tax worldwide income, you may find that an offshore trust enables you to enjoy some tax savings.

The IRS has a ‘throwback’ rule that applies when a settlor dies. It indicates that if a beneficiary lets income pile up in the trust, the tax applies when the trust earns the income, plus interest; not merely when the beneficiary received it. So, when the trust transfers to the beneficiary, holding lots of principal in the trust is fine. Just know that taxes on undistributed income will pile up in the trust.

Ultimately, offshore trusts still pay taxes. The big benefit of establishing an offshore trust is asset protection from lawsuits and judgments. Be sure to check with a CPA before taking action on any tax-related matters.

Are Offshore Trusts Safe?

Offshore trusts are absolutely safe. They’re much safer than keeping your money in a standard checking or savings account at home. However, that’s only true if you work with an experienced trust establishment professional. Failing to do so could leave your assets open to various threats and even malicious trustees.

To ensure that our trusts are ironclad against creditors and other threats, we use time-tested asset protection trusts. We have had relationships with our international trustee and law firms for decades. Plus, we only establish trusts in reputable, politically stable countries, such as the Cook Islands, Nevis (in the Caribbean), and Belize.

Finally, to make your offshore trust even safer, we place an offshore limited liability company inside the trust. The trust holds a 100% membership interest (ownership) in the LLC, with you as the initial LLC manager and bank account holder. If you end up in legal trouble, you can temporarily hand over control of the LLC to our trustee partners or law firm. Then, your creditors will have to fight us in an offshore court, which is nearly impossible to do. After the trouble subsides, you control the LLC once again.

The Best Place to Set Up an Offshore Trust

Almost every financial professional in the world agrees that the Cook Islands is the best jurisdiction for offshore trusts. As part of New Zealand, which is the least corrupt country per the Corruption Perceptions Index, the Cook Islands is a trustworthy jurisdiction that also has trust-friendly laws for foreigners.

See the Best Offshore Trust Jurisdictions Compared.

Should I Set Up an Offshore Trust?

Why would you want to set up an offshore asset protection trust? To begin with, moving assets beyond the reach of US attorneys gives you a much stronger protective shield. In the US, theories of legal liability increasingly favor the plaintiff and judgment creditor. In certain offshore jurisdictions, laws favor the judgment debtor (the one who lost the lawsuit). It’s your choice. It’s your money. So, why not put your money in a place where your needs are prioritized?

Remember, creating an offshore trust doesn’t mean you lose control of your money. You can still log in and see your money online, access funds with a debit card, receive and send wire transfers, and even do stock trades. In short, you still have control, but your legal opponents can’t do anything to get the money in your trust.

How to Set Up an Offshore Trust

Creating an offshore trust is much like making a domestic one. You fill out an application and provide due diligence or know-your-client documentation. This documentation helps keep malicious actors from setting up an offshore trust.

Here are the steps involved in offshore trust setup:

- We send you a trust application. We need to know your proper legal name and those who should inherit your assets upon your passing.

- You provide the necessary due diligence. This typically includes a notarized photocopy of a passport or driver’s license. You must also provide evidence of your address and a bank reference letter.

- We use the information you provide to draft your trust.

- We email your trust so you can sign it.

- You then mail us the originally signed trust along with the original due diligence documents.

- Our trust company/law firm signs your trust, and you receive a signed copy along with certification of registration, if applicable.

Call Asset Protection Planners to Set Up Your Trust

If you’re likely to be sued or have a high net worth, your bank account isn’t the safest place for your money. Setting up an offshore trust is a good way to protect your wealth for yourself, your loved ones, and future generations. If you’re ready to set one up, we’re ready to help.

Get the protection you need today, click the button below to schedule a consultation with us now.

Offshore Trusts Frequently Asked Question

How does an offshore asset protection trust shield assets from creditors in different jurisdictions?

Offshore asset protection trusts are effective tools for safeguarding your wealth. They work by moving your assets into the trust’s ownership rather than keeping them in your possession. The legal separation between you and your assets is the key to an offshore trust’s effectiveness.

The real power of offshore trusts lies in their ability to protect assets across different jurisdictions. Belize, Nevis, and the Cook Islands are popular places to establish a trust because their laws prioritize asset security and trust-holder privacy. They often don’t recognize foreign court rulings, adding an extra layer of protection.

Here’s how offshore trust protection works in practice. Imagine you have an offshore trust in the Cook Islands. If a creditor tries to come after these assets through a U.S. court, they’ll quickly run into major legal obstacles, as the Cook Islands doesn’t recognize foreign court judgments. The creditor would need to start a new case in the Cook Islands, pay steep filing fees, and navigate tough local laws designed to protect trusts.

The trust’s structure acts as a robust shield against creditors. By transferring assets into the trust, the trust holds the assets instead of you. This makes it significantly more difficult for creditors to assert claims over those assets.

In addition to legal and privacy benefits, many offshore trusts also have “flee clauses.” These clauses allow you to quickly change the jurisdiction of your trust if someone threatens its assets. Some popular offshore trust destinations even require creditors to put up large bonds before filing lawsuits to discourage frivolous claims.

Although they’re powerful, offshore trusts aren’t bulletproof. They work best as part of a comprehensive asset protection strategy. Be sure to consult a legal professional, asset protection consultant, or financial advisor to ensure you’re taking advantage of all available tools. Asset Protection Planners has attorneys and consultants on staff who can help.

Offshore trusts also work better when they are created at the right time. Trusts that are created right before an unfavorable judgment can work, but they can also create tension in the courtroom. It’s advisable to set up a trust long before any legal troubles arise, or at least before the outcome becomes obvious.

Setting up an offshore asset protection trust isn’t something you should do without assistance. It requires careful planning and expert guidance. You’ll want to work with an experienced offshore trust creation team, like the one at Asset Protection Planners, that understands international trust law and the specific rules of your chosen jurisdiction. We can help ensure your trust is properly structured and compliant with all relevant laws.

Remember, the goal here is legitimate asset protection, not hiding assets from the tax man. When used ethically, these trusts can provide peace of mind and financial security against lawsuits and overzealous creditors.

All told, if you set up an offshore trust effectively, you’re putting your assets in one of the safest places imaginable. With your assets thoroughly protected, you can ensure the security of your wealth and the future of your beneficiaries.

Related Articles