Is a Family Limited Partnership Right for You?

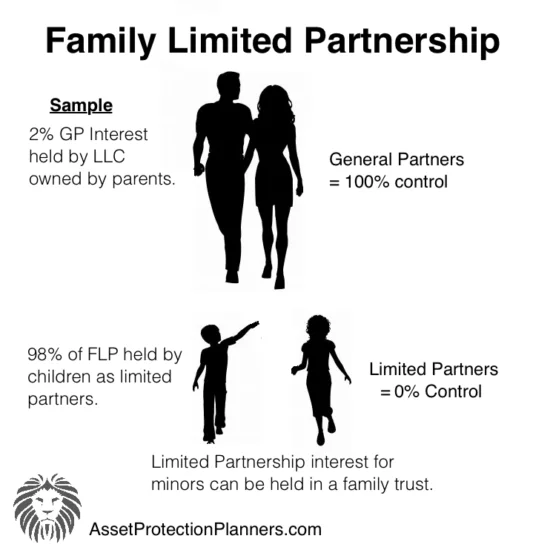

A Family Limited Partnership (FLP), by definition, is a limited partnership that is owned and controlled by the members of a family. Similar to other LP’s the Family Limited Partnership includes two types of partners: general partners and limited partners. The role of a general partner is to manage and control the its actions. It also bears 100% of the liability of the entity. Limited partners cannot legally manage the FLP and they are shielded, or have limited liability, from legal actions taken against the entity. The most they can lose is the capital that they contributed to the FLP.

The partnership, itself, doesn’t pay tax. Rather, the partners are responsible for reporting partnership income on their personal tax returns. It is paid in proportion to the percentage of interest they hold in the organization.

A typical scenario is that the parents own, say, two percent of the FLP and serve as general partners. Then the children equally share the remaining 98% and serve as limited partners. There can be a clause in the limited partnership agreement that a 100% vote is needed in order to vote Mom and Dad out. Since the children own less than the entirety of the FLP, Mom and Dad remain in charge as general partners and the kids have little to no say in its operation until both parents pass.

Family Limited Partnership Asset Protection

Whether you have a small company or a large business, asset protection is important. In fact, it should of primary import. Asset protection may seem expensive and time-consuming. As you know, it is much more simple and time-efficient than going through a lawsuit and losing everything. All your personal and business assets – everything that you worked so hard to achieve – can get wiped out if your company were to encounter a legal issue and were not structured properly.

Perhaps you have one or more businesses that family members own. Maybe you have significant assets that you want to pass down to younger generations such as children or grandchildren. Then an asset protection vehicle called a family limited partnership may be what you need. An FLP is a type of entity that families utilize primarily to hold assets in a consolidated fashion. The family determines the objectives of the entity and the FLP helps divide and control, income and appreciation.

Separate Safe and Dangerous Assets

It is important to only own “safe” assets inside of your FLP. So, you could own the stock in a corporation that runs a construction company. But you would not want to run the business, itself as an FLP. That is because if someone sues the business, it could expose all of the other assets inside of the FLP to that lawsuit. You can hold your bank account, your stock market portfolio, the LLCs that own rental properties and household furnishings in the FLP.

The reason is that these are all safe assets because they are unlikely to create liability. Yes, the items inside the LLC are dangerous assets. On the other hand, the membership certificates that you hold in the LLC are safe assets. It would be a mistake, however, to own a motor vehicle inside in your FLP because in a vehicular accident. Both the owner of the car and driver of the car are vulnerable. So, if you own the car in an LLC, you can hold your LLC membership interest inside of the FLP. The LLC, thus, shields the FLP from automobile liability. So, it is important to understate how an LLC protects you. Then you can place your LLCs inside of your FLP. This structure can provide a tax-efficient and powerful asset protection and estate planning fortress.

What Does a Family Limited Partnership Do?

The main goal of an FLP is to centralize all assets of the family, including business and personal interests. What this means is that in the event lawsuit against a limited partner, a judgment creditor cannot readily touch the assets inside of your limited partnership. You may end up losing some business assets if someone sues a corporation inside of your FLP. But you won’t lose everything you own. You’ll still be able to hang onto your home, personal bank accounts, stocks and personal items that you hold dear.

In an FLP, each family member owns shares of the business, which the FLP can gift away over the course of many years. That way, you’ll be exempt from the gift tax, which would otherwise eat away at your profits.

An FLP is also useful for tax purposes. It allows a person to transfer assets to other family members, thereby reducing your tax liability. It’s worth noting that an FLP is not necessarily limited to an actual business. You have the ability to put assets such as the companies that own family farms, ranches and real estate in an FLP. You can do so even if these assets do not generate income like a normal business would.

On top of this, there are possible valuation discounts when transferring limited partnership interests from one party to another. Here is the theory. The limited partners have limited control So, the IRS deems the assets that represent their portion of the interested in the FLP as worth less than they actually are for tax calculation purposes. This allows you to transfer much more to your children during your lifetime without a tax impact than you would be able to outside of the entity.

Who is Considered Family in a Family Business?

Sure, you may be close to your second cousin, but is he family for the legal purposes of an FLP? Not usually. For tax purposes, the IRS defines family as a person’s spouse, children, parents, grandparents and grandchildren.

Advantages of a Family Limited Partnership

An FLP offers the following benefits:

- Significant estate tax savings. An FLP is an excellent tool to take tax burdens away from the older generation – the parents – and transfer them to children. This means that the net worth of the parents grow in the children’s laps. As limited partners, the children do not have management over FLP assets. Mom and Dad can spend all of the money on themselves if they want to. But when they die there is not a great wealth transfer because, as limited partners, the children already passively held it before their deaths. The savings can, instead, go towards larger inheritances.

- Significant income tax benefits. Estate taxes aren’t the only way in which you’ll save money. By creating an FLP and adding your children as partners, you can share income with them. This is because they are limited partners. Thus, they’ll own part of the company. This can reduce the overall income taxes for the family. However, be careful if you have young children. For children under the age of 14, the IRS taxes income above $1,600 at the highest rate of the parents. Therefore, be wary of this rule if you have minors you want to add to the family business.

- It’s easy to transfer ownership. When a partner in a large corporation dies or decides to quit the company, transferring the ownership can be problematic. In an FLP, you can do the transfer systematically. Since an FLP has limited partners already in place, you can transfer partnership interest over time. Transfer ownership gradually. When done in that manner, there is not a giant taxable transfer from the estate to the heirs.

Disadvantages of a Family Limited Partnership

While FLPs have elements that would benefit most companies, here are some disadvantages to consider:

- Children may be on the hook for capital gains taxes. Gifted property and inherited property are different. That is, different tax rules apply. This means that there are vastly different exemption amounts before taxes are due. If children receive property through an FLP, they may have to pay capital gains taxes if the assets have appreciated in value. Therefore, it’s a good idea to discuss this possibility with your CPA so that financial surprises don’t pop up for your children after you are gone.

- Transferring ownership to minors can be a challenge. Speaking of children, an FLP may not the best tool for transferring ownership of the family business to children under the age of 18. This is because a parent or guardian would have to hold the child’s interest. But you may overcome this if you hold their interest on their behalf instead of holding it directly.

- The General Partner (GP) is vulnerable to lawsuits against the FLP. If someone sues the FLP, the general partners could be on the hook. You overcome this by doing the following. First, as mentioned above, only own safe assets inside of the FLP directly. So have the FLP hold the ownership interest in corporations and LLCs but don’t run the businesses directly as a family limited partnership. Second, use an LLC as the general partner rather than having the mother and father in that position. Instead, have Mom and Dad own the LLC that serves as the GP.

Setting Up Your FLP

An FLP must have at least two people: a general partner and a limited partner. The process works similarly to a trust. You place assets in the FLP and act as the general partner. As a general partner, you control the day-to-day aspects of the organization: the assets, operation and distribution of cash, investments, and shares and membership interest in other companies. In a nutshell, you remain in control while you transfer the assets into their portion of the entity.

Creating an FLP is much harder than it looks. It’s a complex process that can end up being costly if you don’t know how to get it properly set up. Here are eight steps to follow:

-

Come up with a name.

Avoid calling it a family partnership. Instead, use terms such as “management” or “investment.” Some states require that you add “Limited” or “L.P.” to the name. Once you have a name for the FLP, you’ll need to check to make sure it’s available, since you can’t use the same name as an existing FLP.

-

Take state laws into consideration.

The rules governing an FLP vary from one state to another. There are different tax codes, different forms of valuation and different rules for transferring ownership and shares. Because each state is different, you may want to have your FLP formed in a state that has the least number of restrictions, or one that has laws that you can all agree on.

-

File the FLP.

It is important to do this professionally. This is not a do it yourself operation. You have chosen the name and considered the state laws. The next step is to file a certificate of limited partnership. This certificate generally includes the name of the partnership, the name and address of the registered agent, the name and address of each general partner, and the purpose of the partnership. Each state may have other requirements as well. It is a general partnership one until the state files the limited partnership. As such, the rules regarding general partnerships are different. So there are limitations and laws regarding partners’ rights and transfers of interests.

-

Get a taxpayer ID from the IRS.

Even though you may not pay income tax, an FLP is a legal entity. As such, you’ll still need to file income tax returns, and in order to do so, you’ll need a tax identification number, also referred to as an employer identification number (EIN) from the IRS.

-

Draft an agreement.

This agreement is of special importance and you should hire a professional. We are not saying this simply because we provide this service (which we do). We are saying it because it is accurate. In order to avoid future conflicts among family members, you’ll want to have an expert draft a partnership agreement and have each partner sign it. This agreement should indicate how the partnership will share profits and losses, admit new partners (if allowed), manage and dissolve the partnership, and compute capital accounts. Moreover, the agreement is an essential element; especially if you want your FLP to provide you all of the asset protection services that the law allows. You will follow the rules of limited partnerships based on your state until you execute the agreement.

-

Fund the FLP.

Once you sign the agreement, it’s time to fund the partnership. When you transfer assets into the partnership, you generally will see no loss or gain, especially when you receive partnership interests in exchange. However, there is one exception. If the IRS views the FLP as an investment company, it will consider the partnership as a deemed sale. One way in which the IRS will consider your FLP an investment company is if you have more than 80% of the partnership’s assets in cash and securities. Having an investment company can negatively affect your taxes. So, make yourself aware of the rules for managing an FLP so you won’t have to give a large portion of your profits to Uncle Sam.

-

Open a bank account.

The account should be in the FLP’s name. The general partners are signatories on the account.

-

File income tax returns.

Even though the partnership is not subject to tax, a tax return still needs to be filed for informational purposes. As mentioned, tax responsibility falls on the partners.

Use the Right Tools

Asset protection is a must for any business. An FLP is just one tool available to small family-owned businesses. While it can offer many benefits, consider the pros and cons and act accordingly. Will an FLP protect your family’s assets? Is it the right legal tool for you? There are numbers above to use as well as an inquiry form on this page to discuss your situation.

—

Linsay Thomas, Technical Editor, contributing author