A Family Limited Partnership is a legal entity. It is created when someone correctly files a properly drafted certificate. Then, two or more members of a family sign a limited partnership agreement. In such arrangement, one or more of the partners is a “limited partner.” The limited partner is only liable only for the amount that they have invested in the partnership. The other partner, called the “general partner,” controls the partnership.

Why Use a Family Limited Partnership?

Families with substantial assets often face challenging decisions. For instance, they need to consider how to handle and protect their assets. This could be property, money, real estate, or any other investments. Here we discuss one path any family can take to protect its wealth. This is especially so for real estate and business ownership. One good solution is to establish a Family Limited Partnership (FLP).

First, you need to properly establish and utilize your FLP. When done correctly the formation of this entity provides multiple benefits. First, it can help protect assets. Second, the FLP can enhance estate planning through noncontrolling interest for children and valuation discounts to family members. Third, it can provide increased income tax savings. An FLP, when formed the right way, can substantially decrease what the family pays in taxes. This works very well on real estate because it offers the opportunity to cut gift and estate taxes.

Furthermore, an FLP offers a shield against creditors seizing assets through litigation. At the same time, an FLP brings an increased number of flexible options typically not offered by trusts. According to the NY Times, one reason why an FLP offers families much more leeway with planning and asset management is this. Unlike most irrevocable asset protection trusts set up for family use, an FLP allows for families to make amendments.

Family Limited Partnership (FLP) Background

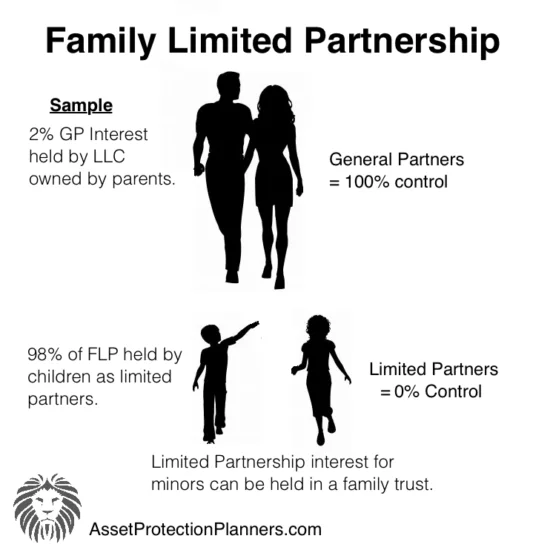

An FLP works as a limited partnership, but its ownership and power lies with family members. Just as other limited partnerships do, an FLP houses two partner types: a general partner and a limited partner.

A general partner in an FLP retains power over every management or investment decision. In addition to control, the general partner also retains all of the liability from the FLP. When someone sues the FLP, it leaves general partners vulnerable. That is why we often put a corporation or LLC in that position. On the other hand, a limited partner typically does not participate in the control or management of the FLP. As such, the limited partner has limited liability from the FLP.

FLP Taxation

A limited partnership as an entity itself is typically not taxed. However, there are still specific tax law requirements owners of the FLP must meet and follow legally. Those who own the FLP show their portion of its income and deductions on their personal taxes.

The main contributors of the assets in an FLP are usually the primary family members. This is often the the parents or grandparents. The formation of an FLP has many features of a trust. It offers added benefits of asset protection, flexibility and tax savings. The parents typically place assets in the FLP. They, in turn, often receive a lesser general partner interest and a greater limited partner interest. If the parents so decide, they can share a percentage of their interest to other family members. They can award this distribution to family members directly, or through a trust for estate planning purposes.

Getting Started with A Family Limited Partnership

When forming an FLP, it is important to structure it properly. The primary family members usually act as the present owners. The partnership agreement also addresses the future ownership of the FLP.

When forming an FLP we file a legal document with the state of choice. Then our legal department creates as a written limited partnership agreement. Next, you can open a bank and/or brokerage account in the name of the FLP. The general partners (or representatives of the corporation or LLC serving as general partners) are signatories on the accounts. Thus, we file the documents and you sign the agreement. Then, you open the accounts. Once accomplished, the primary family members can complete all of their desired asset transfers. This includes items such as cash, stock, or real estate. FLPs do not hold primary family member’s individual life insurance, home, or retirement accounts.

Why Choose a Family Limited Partnership?

There are several reasons why families decide to create FLPs. Most of these concepts have to do with asset protection and wealth distribution. Some benefits of an FLP include the following:

- Transferring a limited partnership’s interest to family members can decrease the gift and estate taxes. Limited partners do not have control. So the IRS considers the value of the holdings of the limited partners less valuable for accounting purposes. They call this a “valuation discount.”

- The primary family members serving as general partners can maintain control over how the FLP distributes assets.

- Partners can use annual gift tax exclusion when transferring limited partnership interest to others. Therefore, you can reduce or eliminate gift taxes.

- Primary family members can make a transfer of interest. When doing so, they can also reduce or discount the value of the limited partnership interest for tax purposes.

- The primary family members retain not only control but flexibility. An FLP allows for the primary family members to make changes as needed.

- An FLP also offers protection from litigation. Judgment creditors will have difficulty breaking through the FLP structure. A properly drafted partnership agreement can help prevent from seizing a debtor’s limited partnership interest. It can also keep them from taking assets held inside of the LP.

- It can help in a divorce. If you have a properly structured FLP in can prevent one spouse from taking partnership from the other spouse. It can also keep them from touching the assets inside.

- An FLP can group all family investments in one place to reduce fees and taxes. Instead of trying to keep multiple accounts active, an FLP allows you to place family holdings in one account. This is in lieu of an account for each child or family member. Then parents can award children or other family members specified percentages of ownership interest.

FLPs and Asset Protection

Families often use FLPs to increase asset protection. Any assets you have titled to your limited partnership are now property of the limited partnership. This factor offers a good deal of protection to family members. This is because acts by one partner outside of the FLP do not cross over to the FLP. One partner’s interest is separate from the acts of another partner. This is the case even if they create a liability problem for that individual. The law protects the partners from each other. That is, one partner may make a bad decision and gets himself or herself in legal trouble. The other partners, on the other hand, will not feel the effects. They will not, therefore, not lose their interest in the FLP.

The most important concept associated with the FLP is that you must make sure someone has drafted it correctly. This is essential in order for it to provide effective asset protection services. This is not a job for an amateur. For instance, a partnership agreement lays out rules, regulations, and limitations as to what partners are allowed to do. Adding written rules into the FLP partnership agreement that take case law rulings into account can offer even further protection.

Charging Order Protection

Let’s say one partner’s actions create liability for himself. In this case, only the distributions from that partner’s percentage are available to that creditor. This is called a “charging order.” If the general partner decides not to make distributions, the one who holds the charging order gets nothing. Revenue Ruling 77-137 says that whoever has the rights to receive distributions must pay taxes on them. Moreover, this is the case whether they actually receive the distributions or not. So, the one who has the charging order against your family member’s interest gets nothing but a tax bill. No money. Just a bill. That is the beauty of the FLP. You have family members working together for the best interest of each partner.

The formation of the FLP prevents, by law, any creditor from taking over the partnership. It prevents them from trying to manage things, or forcing a percentage of the partnership’s wealth getting tied up with other partnership owners. So, the FLP keeps the control in the hands of the family and out of the hands of its enemies.

How Family Limited Partnerships Reduce Income Taxes

A partnership differs vastly from a corporation because a partnership is not required to pay taxes, itself. Instead, FLPs traditionally use a method known as pass-through taxation. Pass-through taxation means that each year, the partnership must file its taxes and declare its income and expenses. The partnership as an entity does not pay those taxes. Instead, each partner reports their portion of profits generated from within the partnership his or her personal tax returns. The general partners need to send an annual statement to every partner. The statement declares the total income, deductions, or losses of each partner’s share.

How does this method help to reduce taxes? It is because the primary account holders and their children share tax responsibility. The children are often in lower tax brackets. So, it typically reduces the amount of annual income earned for all. The parents may, if they wish, pay these taxes, albeit at a lower rate.

Furthermore, primary account holders can decide that the income earned by the children does not necessarily get awarded to them immediately. They can include this concept in their partnership agreement. Parents can hold distributions to children in the FLP and release them at a later time. Then, the primary account holders can control distributions even further. For instance, if the concept is laid out in the partnership agreement, part of each child’s distribution can pay income taxes. The rest can go into a savings account and then distributed to the children at a later date.

How a Family Limited Partnership Can Reduce Estate Taxes

With an FLP, general partners can help cut back taxes by gifting the FLPs interest to their children. This move allows for the primary account holders to keep control over the FLP. Then, if desired, they can spend the proceeds on themselves or, subsequently, transfer their assets to the next generation. Thus, principles can request that a professional drafts the partnership so Mom and Dad have complete control. They can spend all of the money on themselves during their lifetimes should they so choose.

The IRS also provides a tax break to those who transfer their LP interest to other family members. As stated above, when the principles make transfers, they can discount the assets to demonstrate real market value. These discounts can range anywhere from twenty to fifty percent. There were some fairly recent changes regarding the calculation of valuation discounts. So, be sure to check with an experienced CPA come tax time.

Using the knowledge obtained here regarding FLPs. Hopefully you can now make a solid decision about whether or not you want to form one. You should have a good idea about how you will go about forming one. Then, you should have idea about some things you want to include in your original FLP documentation agreement. All of these factors deserve careful consideration. Accordingly, you can make the proper decision you need to both protect your personal wealth. This tool can also protect that of that of your family for years to come. For more information, there are numbers on this page as well as a form to complete. You can use this contact information if you want to proceed or if you need further guidance reach.