Asset protection is a set of strategies designed to keep property safe from creditors. It includes everything from setting up an LLC to creating an offshore trust. When properly set up, asset protection strategies can defend your wealth from lawsuits, divorce, and more.

In this article, we’ll explain how asset protection works and detail common tools used in the practice:

- Asset Protection: Key Terms

- Who Needs Asset Protection?

- Popular Asset Protection Strategies

- Major Threats to Your Assets

Asset Protection: Key Terms

Before learning how to protect your assets, you need to know some key terms:

Debtor

A debtor is any entity, such as a person or business, that owes assets to someone else. Without an asset protection strategy, a creditor can seize a debtor’s wealth. A good example of a debtor is someone who lost a lawsuit and owes money to the plaintiff.

Creditor

A creditor is a person or entity to whom money is owed. Asset protection strategies are designed to prevent creditors from taking debtors’ assets. Examples of creditors include plaintiffs who have won court cases and lenders who are owed money.

Claims

Claims are legal actions filed by one party against another. Usually, a claim seeks to recover compensation from a defendant for an actual or perceived wrongdoing. A personal injury claim is a common example of this action.

Assets

The term “assets” refers to any property owned by a person or entity. There are three main asset categories:

- Current Assets – Current assets are resources that can be converted into cash within one year. These assets can include cash, accounts receivable, inventory, and cash equivalents like cryptocurrency. Prepaid expenses such as insurance, rent, and interest are also current assets.

- Fixed Assets – Fixed assets are longer-term resources such as buildings or equipment. These types of assets can depreciate with age. For example, equipment such as computers can become obsolete.

- Financial Assets – Financial assets are investments in the assets of other institutions, such as stocks, bonds, preferred equity, and other securities.

Who Needs Asset Protection?

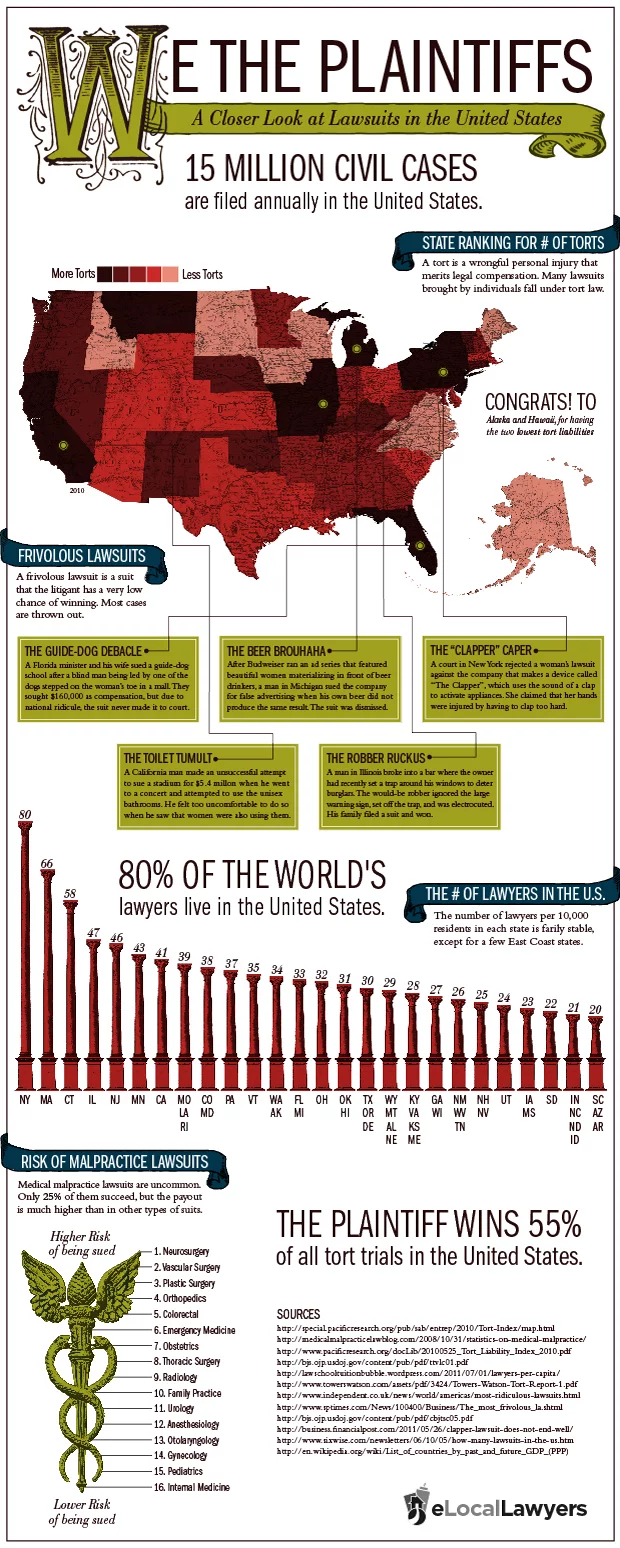

Whenever lawsuits are a constant threat, you need asset protection. Unfortunately, the USA is the most litigious country on the planet and is home to more than one million attorneys. This overabundance of lawyers leads to 15 million civil lawsuits each year and creates an environment where anyone could be sued at any time.

Some people need asset protection plans more urgently than others, such as:

- Doctors working in high-risk fields (e.g., emergency medicine and surgery)

- Business owners

- Celebrities and influencers

- Wealthy individuals

Without an asset protection strategy, anyone belonging to the above groups is in danger of losing their wealth.

However, lawsuits aren’t the only threat to a person’s wealth. Debt and divorce are other common wealth busters; they don’t involve fame or fortune and could financially ruin anyone.

Popular Asset Protection Strategies

You can use several tools while building an asset protection strategy. Some, like insurance, are widely used, while others are more specialized. Notable examples of asset protection strategies include:

Asset Protection Trusts

Asset protection trusts (APTs) are one of the most powerful tools for keeping assets away from creditors. These irrevocable trusts create legal separation between the creator (settlor) and their assets.

As an irrevocable trust, APTs are difficult to alter, which is what protects your assets. That is, if you would readily change it, a judge could force you to change the beneficiary to your opponent. When creditors win a suit against you, the courts grant them the right to claim your assets. However, these trusts hinder a creditor from withdrawing the trust’s assets since the trust holds the assets instead of you.

APTs can be established both domestically and offshore. Between these options, offshore asset protection trusts are more powerful. Domestic trusts are routinely undone by creditor-friendly laws and results-oriented judges in the United States. Conversely, offshore trusts are designed to protect assets and are run by trustees who can refuse to enforce U.S. court orders.

Corporations and Limited Liability Companies (LLCs)

Operating your business as a corporation or LLC is a sound asset protection strategy. Corporations and LLCs can provide a legal shield between you and your business when someone sues your company. Because of their tax advantages, people tend to use LLCs to hold investment assets. People often use corporations for business operations.

Additionally, LLCs can be utilized in tandem with asset protection trusts. Adding an LLC into your trust structure helps you control assets that would otherwise be completely held by the trust. If you are sued while running the LLC, you can cede management control of the LLC to your trustee to protect your assets. Then, when the lawsuit is over, the trustee can return the LLC management back to you.

Insurance Plans

Insurance is the first thing many people use to defend their assets. Aside from home and auto insurance, an umbrella policy might help defend your assets from miscellaneous liabilities. An umbrella policy is not a stand-alone policy and should not be used in place of home, auto, or business insurance.

The flaw of insurance plans as an asset protection strategy is their limited coverage. Someone can always sue you for more than your policy covers. Plus, insurance companies write hundreds of exceptions into policies to avoid paying claims.

Retirement Accounts

A retirement account may protect your savings if you have unpaid debts. If creditors force you into bankruptcy, most state laws protect 401(k)s, IRAs, and other retirement accounts. However, this protection doesn’t come without exceptions. Federal taxes, alimony, and child support can be pulled from your retirement account. Moreover, there is a limit to how much you can contribute each year. Furthermore, laws don’t protect an inherited IRA unless you inherited it from your spouse.

Prenuptial Agreements

A prenuptial agreement, or prenup, is a contract a couple drafts before marriage. These contracts detail which assets belong to each party. If the couple divorces, the assets can be divided based on the terms of the agreement. Prenups can also be used to lay out inheritance plans. For example, if one person in the couple dies, prenups can direct assets go to someone other than the surviving spouse.

Although prenuptial agreements are useful, they do have some weaknesses. Once created, prenups are rarely, if ever, updated. This can lead to situations where countless assets aren’t covered by the prenup’s terms. Furthermore, your spouse can always hire a lawyer to poke holes in the agreement if they are no longer satisfied with the agreement terms.

Major Threats to Your Assets

When creating an asset protection strategy, it’s useful to know what you’re defending against. Typically, your strategy will be used to combat one of the following threats:

Debt

If you end up in significant debt, creditors will attempt to take your assets. They may approach this through wage garnishment, legal action, or debt collection agencies. If you don’t have any form of asset protection, you could end up filing for bankruptcy to erase the debts.

Divorce

Divorce is one of the most pressing threats to your wealth. In most states, ex-spouses are entitled to an even split of any assets obtained during a marriage. Because many people get married young, before they build wealth, this means that most of your wealth is up for grabs when you get a divorce. Even worse, ex-spouses are considered “exception creditors” in most states, a designation that allows them to penetrate common asset protection plans. Only offshore asset protection trusts can truly protect against this threat.

Lawsuits

In the United States, lawsuits are a very common threat to your wealth. You can be sued for countless reasons at virtually any time. Even if you operate in good faith 100% of the time, all it takes is a car accident, a fall on your property, or a business disagreement to destroy everything you’ve worked for. Luckily, some asset protection tools, particularly offshore trusts, can defend against lawsuits. In fact, the protection offered by offshore trusts is so strong that your assets will remain safe even if you lose the case.

Build an Asset Protection Strategy with Asset Protection Planners

Now that you know what asset protection is, you can begin working with an expert to build your strategy. A professional, like those at Asset Protection Planners, can help craft a solution that defends against the most notable threats to your wealth.

Click the button below to schedule your free consultation today.