Are you looking for a way to protect your assets from lawsuits and aggressive creditors? If so, a Cook Islands Trust could be exactly what you need. People and companies have used Cook Islands’ favorable trust laws for decades to retain control of their assets during tumultuous times.

Asset Protection Planners has been helping people establish effective offshore asset protection trusts in the Cook Islands for nearly three decades. In fact, our firm has established more Cook Islands Trusts than any firm worldwide. Using the knowledge we’ve gained over the years, we’ve put together a detailed guide on what Cook Islands Trusts are, how they work, and who needs them:

- What is a Cook Islands Trust?

- The History of Trusts

- Features and Benefits of Cook Islands Trusts

- How We Use Cook Islands Trusts to Protect Your Assets

- Who Should Consider a Cook Islands Trust?

- Who Should Not Consider a Cook Islands Trust?

- Common Uses of Cook Islands Trusts

- How to Set Up a Cook Islands Trust

- Cook Islands Trust Costs and Maintenance

- What Role Do Trustees Play in Cook Islands Trusts?

- What to Keep in Mind When Creating a Cook Islands Trust

What is a Cook Islands Trust?

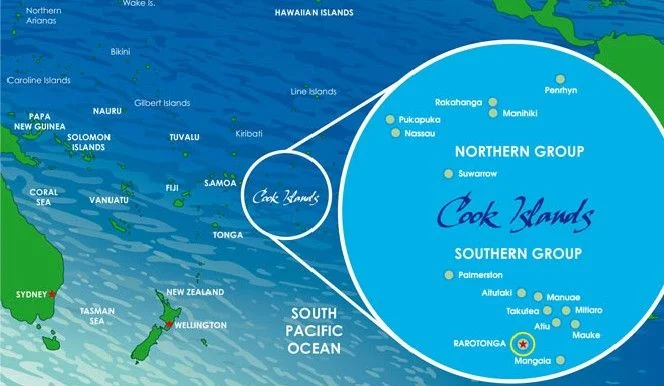

A Cook Islands Trust is a type of offshore asset protection trust established within the Cook Islands, a chain of 15 small islands located northeast of New Zealand. While these islands originally gained fame as a tropical vacation destination, they’re now better known as a home for ironclad asset protection trusts.

More than 40 years ago, the Cook Islands passed the Cook Islands International Trusts Act of 1984. This act laid out the legal framework for offshore asset protection trust establishment within the Cook Islands. It also codified the commonly-cited benefits of Cook Islands Trusts — namely asset protection, the right to refuse foreign rulings, and confidentiality.

In 1989, the Cook Islands legislature amended the International Trust Act. These amendments were primarily focused on strengthening existing asset protection statutes. In particular, these amendments allowed the settlor (the one who establishes the trust) to be listed as a beneficiary of the trust. Prior to this, most asset protection trust laws required one to give assets to a trustee without retaining any beneficial interest in the trust or its assets. Cook Islands’ robust statutes led other jurisdictions, such as Nevis and Belize, to imitate these provisions.

Ultimately, the 1989 amendments allowed for the creation of trusts that protected assets in ways that no other jurisdiction did at the time. As the first jurisdiction to offer such laws, the Cook Islands has a significant case law history, which further bolsters the protection provided by their trusts.

To make their protections even stronger, the Cook Islands government goes to great lengths to ensure that all trusts under its jurisdiction are ethically established, legally operated, and properly regulated. These trusts are not used to hide assets. Instead, they are designed to help keep your assets safe.

Thanks to these strict regulations, the Cook Islands are internationally viewed as a respectable trust establishment jurisdiction. This sterling reputation helps make it nearly impossible for lawyers to portray such a trust as anything but legitimate.

The international respect afforded to Cook Islands Trusts, coupled with their ability to protect assets from a variety of threats, has made them a popular choice for individuals hoping to guard their wealth. According to the Cook Islands Financial Supervisory Commission (FSC), there are 2,200 to 3,000 trusts created per year as of this writing. Of the countless organizations that set up trusts, we have established more trusts than anyone else in the world and have been creating Cook Islands Trusts since 1996.

The History of Trusts

Trusts have been around since the 11th and 12th-century crusades when William the Conqueror created the Common Law of England in 1066. As part of Common Law, soldiers who headed into battle could transfer title to their land to a person they trusted. This ensured that the land could still be used productively for the crown.

For centuries, trusts were used domestically. And while they provided some level of asset protection, it was not ironclad. That all changed when the Isle of Man codified the Trustee Act of 1961. This act addressed the powers of trustees and covered how trustees are appointed and discharged.

Furthermore, it plainly laid out the capabilities of the courts, limiting their ability to reach trust-held assets. By painstakingly detailing the function of trustees and the extent of court powers, this act turned the Isle of Man into the world’s premier offshore asset protection trust destination.

Eventually, the Cook Islands legislature teamed up with U.S. attorneys to create an even more favorable environment for asset protection trusts. The protections they created surpassed those of the Isle of Man. Since then, the Cook Islands have supplanted the Isle of Man as the top destination for offshore asset protection trusts. Asset protection experts consider Cook Islands statutes far more protective than Isle of Man statutes. Nevis has since copied and improved upon the original Cook Islands statutes. As a result, Nevis has also shown itself as a very favorable jurisdiction.

Since trusts have been around for nearly 1,000 years, courts are exceedingly familiar with how they work. Centuries of case law shows that if there is a foreign trustee of a properly established trust, it effectively protects assets. With such strongly established precedents working in favor of asset protection trusts, they are the ideal way to maintain asset safety against creditors and lawsuits.

Features and Benefits of Cook Islands Trusts

A Cook Islands Trust provides dozens of benefits for wealthy individuals. The benefits of this kind of trust are made possible by a rich history of ethical and legal trust establishment, longstanding case law histories, and strict confidentiality rules.

To help you better understand the value Cook Islands Trusts provide, we’ve laid out some of their primary features and benefits.

Basic Features of Cook Islands Trusts

This table provides a quick overview of the basic features of Cook Islands Trusts. It contains information on trust statute and laws, allowed currency types, and more:

| Cook Islands Trust | Corporate Details |

| General | |

| Type | Asset Protection Trust |

| Law | British Common Law |

| Statute | International Trusts Act (1984) and amendments |

| Time to Establish | 3 business days after your due diligence arrives in the Cook Islands (requires you timely providing the know-your client documents.) |

| Tax | None (follow your own country’s requirements) |

| Double Taxation Treaties | No |

| Monetary | |

| Currency | New Zealand Dollar (NZD) |

| Allowed Currencies | Any (Including US dollar and Euro) |

| Cryptocurrencies Allowed | Yes |

| Parties and Privacy | |

| Minimum number of parties | One |

| Trust Deed | Not publicly recorded |

| Recognizes foreign judgments | No |

| Lifespan of trust | Indefinite, if desired |

| Costs | |

| Setup cost | Varies. Please inquire by calling or completing consultation form above. |

| Annual renewal | Varies. Please inquire by calling or completing consultation form above. |

Benefits of a Cook Islands Trust

Here’s a quick overview of the primary benefits and features of a Cook Islands Trust:

- Strong asset protection case law history

- Part of New Zealand, one of the most trusted and least corrupt countries in the world according to

- Transparency International 1

- Does not recognize foreign court orders or judgments

- Requires an opponent to file a costly lawsuit within the Cook Islands jurisdiction (which they will most likely lose)

- Offers immediate asset protection

- Subject to debtor-friendly laws

- Courts will reject challenges to asset transfers into the trust after the statute of limitations of one to two years has expired

- Assets can be located anywhere in the world

- Transfers to the trust can be made over the internet

- One of the oldest and most tested international asset protection trust structures

- Creditor must prove its case beyond a reasonable doubt (a level of proof usually reserved for criminal cases)

- Creditor must prove that the settlor created the trust to defraud not just any creditor but that particular creditor

- Offers estate planning and international diversification

- Offers significant confidentiality, as trust deeds are not recorded in public records

- Allows for a wide variety of investment options

- Protects assets even if settlor or beneficiaries declare bankruptcy

How We Use Cook Islands Trusts to Protect Your Assets

1 The Cook Islands is self-governed in free association with New Zealand. Cook Islanders also have citizenship in New Zealand.

A properly created and maintained Cook Islands Trust always provides some level of asset protection. However, we are able to strengthen that protection by applying another layer of separation between you and the assets in the trust. Our process involves:

- Setting up a limited liability company (LLC) with you as the manager

- Putting the LLC into the trust

- Creating a bank account in the LLC’s name

- Depositing your assets into the LLC-owned bank account

Once this process is complete, the trust owns 100% of the LLC. As the initial manager of the LLC and a signatory on its bank account, you remain in control of the LLC and its bank account while the legal seas are calm. During this time, you can:

- Move funds in or out of the LLC from any location in the world

- Sell or add tangible assets

- Work with the trustee to amend the terms of the trust

Naturally, you will do these tasks within the bounds of legal and protective provisions, as your personal or professional situation dictates.

When legal seas get stormy, your trustee (our Cook Islands law firm) can step in as a manager of your LLC. Your local courts do not have legal authority over our international law firm. Thus, orders to return the trust funds to your local courts go unanswered. You are cooperating, but your trustee company is not under any legal obligation to do so. Therefore, your funds remain secure within the trust.

Keep in mind the primary purpose of placing the LLC within the trust is to provide a means for you to control your money as the manager of the LLC. Additionally, it makes for an easy transition when you need the trustee firm to step in to secure your funds.

The purpose of establishing a Cook Islands Trust is not to conceal your assets from the government; it is to protect them. Any personal or business taxes due on the income that your assets generate are still your responsibility, making the structure tax neutral.

Who Should Consider a Cook Islands Trust?

Cook Islands Trusts are ideal for a wide range of individuals and entities, including:

- High Net Worth Individuals: Those with significant assets who want to protect their wealth from legal threats

- Business Owners: Entrepreneurs looking to safeguard their business assets from potential lawsuits and creditors

- Those in High-Risk Professions: Doctors, lawyers, and other professionals who face a high risk of being sued

- Estate Planners: Individuals seeking to ensure a smooth transfer of wealth to future generations while minimizing estate taxes

Who Should Not Consider a Cook Islands Trust?

Cook Islands Trusts are not for everybody. Here are examples of those who should not consider setting up such a trust:

- Tax Evaders: Tax evasion is illegal. We are legally forbidden from accepting clients who clearly intend to use a trust for tax evasion purposes.

- Criminal Defendants: Cook Islands regulators forbid the establishment of trusts intended to hide assets during a criminal case.

- Government Civil Defendants: FTC regulators will not allow defendants involved in a lawsuit with a government agency, such as the SEC or FDA, to establish a trust.

- Insufficient Asset Value: For those with less than $250,000 in assets, we offer more economic options to protect wealth.

Common Uses of Cook Islands Trusts

Cook Islands Trusts are primarily used to protect assets against external threats. However, that’s not their only purpose. Here are additional examples of how one would use an asset protection trust in the Cook Islands:

- Pre-divorce or pre-marital planning

- Leverage to negotiate a legal settlement

- Estate planning

- Wealth preservation

- Family legacy planning (Cook Islands Trusts can last indefinitely)

- Avoidance of forced heirship laws (so you can choose who inherits your assets)

- Protection from lawsuits

- Stock market portfolio management

- Retirement planning

- Intellectual property protection (e.g., patents, copyrights, trademarks)

- Real estate asset retention

How to Set Up a Cook Islands Trust

To ensure you receive the maximum amount of asset protection afforded by a Cook Islands Trust, you must set it up properly. Follow these five steps to ensure that your trust is compliant with local regulations:

1. Seek Professional Guidance

The first step in creating a Cook Islands Trust is to consult with a seasoned asset protection firm. If needed, Asset Protection Planners has attorneys and consultants on staff who can discuss your needs. Working with professionals will help you remain compliant with legal requirements, ensuring your assets are properly guarded against creditors and lawsuits.

2. Identify Key Trust Parties

Working alongside your professional partner, you will have individuals serve in the following roles:

- Settlor: The individual establishing the trust (such as you)

- Trustee: Our licensed trust company in the Cook Islands responsible for managing the trust

- Beneficiaries: Individuals or entities who will benefit from the trust

- Protector (optional): An entity or person, outside of your local court jurisdiction, with oversight powers over the trustee

3. Draft the Trust Deed

This legal document will be drafted by our in-house professionals. It outlines the terms, conditions, and parties involved in the trust. It serves as the foundation of your Cook Islands Trust, detailing the roles and responsibilities of the settlor, trustee, protector, and any beneficiaries.

4. Complete Necessary Documentation

To establish a Cook Islands Trust, you will need to prepare and submit several key documents, including:

- A certified copy of the settlor’s passport or driver’s license

- Proof of address (utility bill or bank statement)

- Evidence of funds (bank reference letter)

- Solvency affidavit or solvency certificate

- A signed Money Laundering Control Act document

- A deed of indemnity (protects trustee from acts made in good faith)

These documents are essential for the trust company to perform due diligence and ensure compliance with international regulations.

5. Transfer Assets to the Trust

The final step in setting up your Cook Islands Trust is to transfer your assets into the trust. Once the assets are transferred, they are legally owned by the trust, and are protected against legal claims and creditors.

Looking for a more detailed guide on setting up a trust in the Cook Islands? Check out our article on How to Establish a Cook Islands Trust.

Cook Island Trust Costs and Maintenance

Setting up and maintaining a Cook Islands Trust involves several expenses, including:

- Setup Costs: Varies

- Annual Maintenance Fees: $5,000 – $10,000

- Additional Entities: The LLC that goes inside of the trust and real estate asset protection structures cost extra

- Additional Costs: Reporting compliance, tax preparation, and trustee fees

While Cook Islands Trust costs may seem significant to some people, they are usually far smaller than the cost of having your assets taken during a lawsuit. Additionally, the cost of creating a trust through

Asset Protection Planners is far lower than the average cost of trust establishment, which typically ranges from $35,000 to $60,000.

Please keep in mind that the above costs are an estimate and not a guaranteed price range. Since our organization sets up trusts for many attorneys in the Cook Islands, we cannot publish concrete prices online.

Once established, you must continually manage your trust. The key activities involved in trust maintenance are:

- Annual Fees: You’ll need to pay the required annual maintenance fees to keep the trust active and compliant.

- Compliance: It’s important to ensure that the trust complies with all relevant legal and regulatory requirements. We assist with this step by staying updated on regulatory changes.

- Audits and Reviews: You should conduct regular audits and reviews to verify that the trust is being managed according to its terms and in compliance with international standards. Our team constantly monitors your trust to ensure it is being managed according to your preference.

- Updates: You should make any necessary updates to the trust deed and other documents to reflect changes in your financial situation or estate planning goals.

To assist with maintenance processes, we provide a registered office and can help remind you about the filing to renew your trust annually.

What Role Do Trustees Play in Cook Islands Trusts?

A trustee’s sole purpose is to protect the assets of the LLC within the trust. Let’s say a court issues a judgment against you that could threaten the assets included in your Cook Islands LLC. At that point, your trustee steps in to temporarily take over the reins of the LLC.

If you were in full control of the trust and were ordered by a court to turn over your assets, you would have to comply. Likewise, the trustee of a domestic trust, that is, a trust in your home county, must comply. For that reason, even popular domestic trusts, like those in Nevada, Wyoming, and Delaware, lack the efficacy of an offshore asset protection trust. However, with a Cook Islands Trust, the trustee is not under the jurisdiction of your home court, so the orders fall on deaf ears.

As a lawful citizen of your country, you are obliged to instruct the trustee to obey the court’s ruling. So, if you had control, you would have to surrender your assets to the court. The court, in turn, would grant them to the person or entity who has won the lawsuit against you. However, the verbiage we place in the trust prevents trustees from releasing funds within the trust to the courts. When the person requesting this action is under duress from a legal opponent, the trustee will refuse to comply. This is the case if a judge was compelling you against your will with a court order.

Impossibility to Act

The aforementioned scenario places you in a legal situation known as an “impossibility to act.” You have fully complied with the court ruling, but your legal enemy still cannot access your assets. This is because the trustee, acting in accordance with the asset protection laws of the Cook Islands, will not release them. In other words, it’s out of your hands. This is not mere legalese nor an example of sleight-of-hand. This is a legitimate countermeasure that you can employ (through your trustee) to preserve the assets you placed in a Cook Islands Trust.

The Trustee is Your Ally

Given that trustees are often someone you don’t know and are in charge of a significant amount of your assets, it’s normal to be wary of the power they wield. However, they are always on your side. The laws in Cook Islands regarding the licensing of trustees are clear, comprehensive, and strictly enforced. Moreover, the government thoroughly vets the trustees, and makes them hold surety bonds (insurance that protects you, the client). Plus, regulators thoroughly research trustees’ backgrounds prior to issuing them licenses.

A licensed trustee is, therefore, eligible to take over as a manager of an LLC within the trust when needed. Even in the highly unlikely event that a trustee misappropriates your assets, the surety bonds they hold make them liable for failure to properly manage the trust, and force them to pay you back completely.

Surrendering control of your assets might make you nervous. However, we invite you to look into the history of Cook Islands trustees. You will find a heavily regulated industry with a longstanding track record of proper fiduciary responsibility. Ultimately, the risk of a trustee acting against your interests is far lower than the risk of your assets being taken as part of a lawsuit. So, when legal troubles arise, having the trustee step in as the LLC manager is a temporary and prudent step that averts the possibility of losing your assets altogether. When the legal crisis passes, the trustee will cede control and management of all your assets back to you.

Moreover, our organization has had relationships with Cook Islands trustees for nearly 30 years. We follow the “we believe what you do, not what you say” philosophy. Thus, we have observed and vetted the trustee companies over a period of decades.

If needed, you can use a portion of the funds in your LLC to cover certain financial obligations. This may include living, business, and legal expenses. Your trustee can cover these financial obligations for you. We recommend this course of action in any event where courts prevent you from directly accessing your assets. We automatically draft the trust with this contingency plan ahead of time.

What to Keep in Mind When Creating a Cook Islands Trust

While Cook Islands Trusts are incredible tools for asset protection, there are a few factors to keep in mind. Most notably, creating one of these trusts requires you to use a foreign trustee whom you may not know. Fortunately, trustees are beholden to strict rules that dictate what they can and cannot do with the trust while it is in their possession.

Additionally, if you are a US person, once you establish a trust, you will need to adhere to certain Internal Revenue Service (IRS) and Financial Crimes Enforcement Network (FinCEN) reporting requirements. You will need to complete these reports every year. Failing to do so can lead to civil or criminal penalties.

On the whole, this fear of the unknown pales in comparison to the risk of leaving your assets unguarded. Additionally, working with a respectable trust establishment group, like Asset Protection Planners, can render the potential negatives moot, as they have connections with reputable trustees and can assist with reporting requirements.

Set Up a Cook Islands Trust with Help from Asset Protection Planners

When properly set up, your Cook Islands Trust can effectively protect your assets from frivolous lawsuits. In addition, it can help secure your future, and ensure that your assets are used only for the purpose that you envisioned.

If you work in a field that has a high risk of litigation, such as the legal or medical fields, are a wealthy individual, or simply want to prepare for the possibility of a lawsuit, consider setting up a Cook Islands Trust to protect your assets. Doing so will give you the most precious and priceless commodity of all: peace of mind.

Contact us today by filling out the form below to start your trust formation process.