What’s an asset protection trust? How does it work? What kind will best protect your assets? When it comes to asset protection trusts, there are two types: domestic trusts vs. offshore trusts. What’s better?

Domestic Trust

A Domestic asset protection trust (DAPT) is a trust formed in the US, under US laws that has one or more US trustees. It is drafted to shield items of value from being seized in lawsuits. Fairly recently, some states such as Nevada, Delaware and Alaska have adopted statutes allowing one or more people to form a trust (called a settlor) with spendthrift provisions (that are intended to keep assets from creditors). Unlike traditional statutes, the settlor can also be a beneficiary of the trust. That is, the settlor can enjoy its proceeds while, at the same time, keeping trust assets from his legal enemies. So, in this article we discuss these instruments and provide you with tips, information and hints to improve your chances of surviving a full frontal attack by an aggressive litigant.

First came Alaska in 1997, which adopted asset protection trusts that help make assets creditor-remote. Other states have followed suit, including Nevada, Delaware, Missouri, Rhode Island, Utah, South Dakota, Wyoming, Tennessee, New Hampshire, Hawaii and Oklahoma. As of this writing,Virginia is the most recent. Virginia enacted legislation addressing this type of trust, going into effect on July 1, 2012. The Alaska Trust, Nevada Trust and Delaware trust remain the most popular.

Offshore Trust

An offshore asset protection trust (OAPT) is formed under the laws of a country foreign to the trust settlor. Again, the settlor is the one who creates the trust. The settlor then transfers property into the trust. The trustee manages the trust. In our case, the trustee is our offshore law firm.

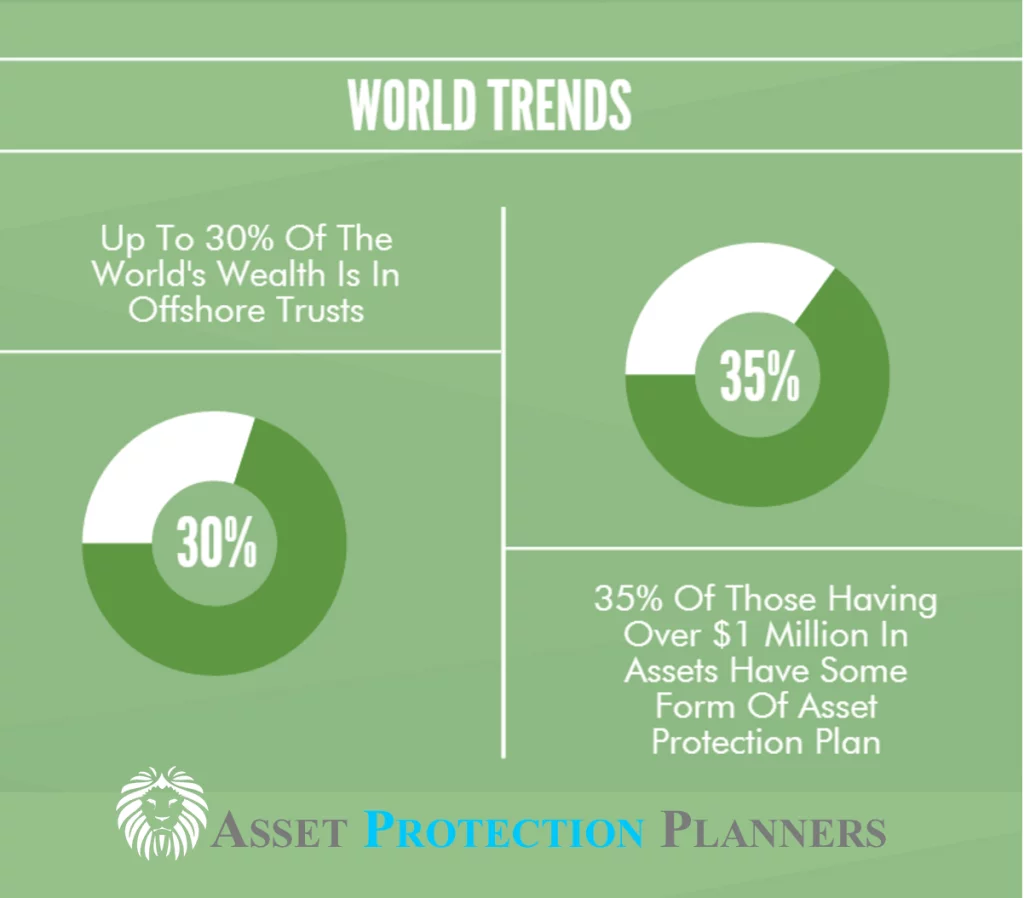

Offshore trusts came into existence in the early 1900s. High net worth individuals used offshore trusts for asset protection from lawsuits and tax efficiency. Such trusts for United States persons are tax neutral under current statutes. However, they still provide powerful asset protection. People in the UK utilized trusts in the Channel Islands. People in the US utilized the Bahamas.

Today, more people use offshore trusts than ever before. Jurisdictions with the strongest asset protection include the Cook Islands, St. Kitts & Nevis. The main benefit people seek is asset protection from lawsuits.

Local courts have jurisdiction over local assets. However, with offshore trusts, our trustee/law firm is at the helm. Thus, courts in the US, UK, Australia, Canada, etc. do not have jurisdiction over the Cook Islands or Nevis. So, court orders to turn over your money that your trust holds fall on deaf ears.

Asset Protection Trust Features

Here is the bottom line. We see the following features in the trust laws of the above states:

- Asset Protection. You can settle the trust (have it created and put money and property into it), can be the beneficiary of the trust. At the same time, it can keep trust assets away from creditors. Thus, we call it a “self-settled trust” because you create it and can benefit from it. It has spendthrift provisions. This means that there are provisions to keep trust assets out of the hands of your creditors. The states without these special laws do not allow this type of trust to shield your assets from creditors.

- Shorter Time for Creditor Challenge. The creditors don’t have much time to challenge the transfer of assets into the trust compared to other states. So, there is a relatively short statute of limitations on fraudulent transfer. In Nevada, for example, you can form a trust, put assets into it. Two years later those asset are theoretically safe from lawsuits. If you transfer assets into such a Nevada asset protection trust and properly publish the event, you can reduce the time frame to six months. In many other states you have six to fifteen years to file a claim.

- Higher Barriers to Creditors. Laws make it more difficult for a creditor to try to convince a courtroom that you put the money into the trust to keep it from creditors.

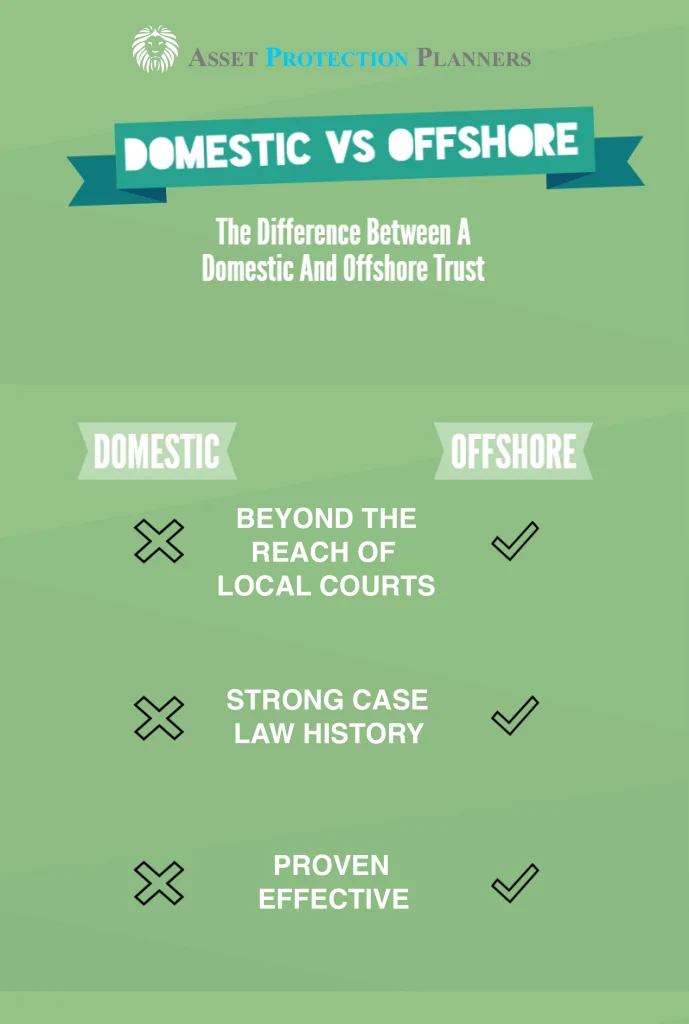

Compare Domestic to Offshore Trust

For asset protection purposes, how do domestic and offshore trusts compare and what are the advantages and disadvantages of each? We establish both domestic and offshore trusts as well as corporations, LLCs, both local and foreign. So, we do not have an ax to grind. Though the following may seem like editorializing, the facts are so compelling that we have just cause to state a strong opinion. The offshore asset protection trust wins, hands down. Here is why.

Top 10 Benefits of Offshore Trusts

The Top 10 Reasons why Offshore Trusts Beat Domestic Trusts

Here are the top 10 reasons why the international structure wins the Domestic Vs. Offshore asset protection trust battle.

- Offshore trusts are not subject to domestic court orders. In a civil lawsuit, suppose a judge orders a US trustee to release the funds or be thrown in jail for contempt of court. Can you can guess what the trustee is going to do? The offshore trustee, however, can simply ignore US court orders because he is not bound by them.

- The domestic trustee’s assets are at risk. We have seen US plaintiffs sue domestic trustees in civil lawsuits. When the trustee has the choice of coughing up your assets or his own, you already know which one he will choose.

- The domestic trustee is subject to scare tactics. Suppose, on the other hand, the plaintiff’s attorney implies threats of, or actually succeeds in, getting the government involved. Such treats terrify the trustee with racketeering or money laundering charges for failure to release funds. In that instance, the domestic trust is worthless. This drawback, in itself, is enough to kill the asset protection of a domestic trust. There may be a statute of limitations on fraudulent transfer. But there is no statute of limitations on trustee terror.

- Offshore trust jurisdictions can ignore US judgments. In the Cook Islands, Belize and Nevis, to name a few, the courts do not acknowledge US judgments. So, the creditor would have to start afresh and file whole new lawsuit from the very beginning. This tremendously high expense and time-consuming undertaking is about enough to deter even the most resolute of plaintiffs from pursuing an offshore trust. To top it off, even after a die-hard attacker has been exhausted from the foreign battle, you can redomicile the trust and change it from a Cook Islands Trust to a Belize Trust, and then to a Nevis Trust. In each case, your opponent would have to start from scratch.

- US states fully recognize out-of-state judgments. In contrast to the above, suppose your enemy gets a judgment against you any US state. The law requires every other US state to recognize it. That means that a creditor can move his judgment to any state and start seizing assets without having to file another lawsuit. This is very easy and inexpensive for the creditor. In fact, collection agents will often do it for free to get a piece of the action when they collect from you.

- US judges consistently rule according to their own state’s laws. You get a judgment against yourself in California, but have assets in a Nevada trust. Do you honestly think the California judge is going to apply Nevada law to property located in California? Good luck. The creditor gets your assets and liquidates them. Then it’s up to you to file an appeal to get them back. Ironically, we have seen plaintiffs protect seized and liquidated assets from appeal by using offshore trusts, something that you could have done to keep them out of his hands in the first place.

- Federal courts can ignore state law. Federal courts are not essentially bound by state law. This is even more concerning when you take into account that the big hairy cases are usually federal lawsuits.

- Asset seizure without due process. It is even more daunting when a federal agency gets involved. Often, the policy is, “Seize now, ask questions later.” You may be surprised how many times we have seen this happen. Time and time again an administrative agency suddenly strips a would-be client bare and defenseless by before they even file a lawsuit.

- Privacy is thrown out the window. US trustees are drug into depositions on a routine basis. The local trustee of a DAPT is subject to subpoena and must cough up documents that may be used against you. Each state applies its own laws, the federal courts apply their own laws, and your trustee must comply regardless of the state in which he resides. The state in which one forms the trust doesn’t matter. The trustee of an offshore asset protection trust, on the other hand, can simply discard and ignore deposition and subpoena requests.

- Offshore bank accounts. People often shelter offshore bank accounts inside of offshore trust, outside the reach of US courts. Even if a DAPT had assets in a foreign bank, the courts could compel the domestic trustee to bring them back. Not so with a foreign trustee.

Are offshore banks safe?

Every year the well-respected publication Global Finance rates the world’s 50 safest banks. In most recent rankings, as of this writing, 40% of the safest banks are in Europe. The majority of the rest are in Asia and Australia. Only four were located in the United States. The highest ranked US bank was only number 35 on the list. In other words, there are 34 banks in the world that are safer than the very safest US bank. The other US banks that made the list were only 44th, 46th and 47th.

So, those who ask, “Are offshore banks safe?” should be asking, “Are US banks safe?” A whopping 547 US banks have failed in the past 15 years. A Forbes article questions whether or not the FDIC (a private corporation) was on the brink of bankruptcy. How much comfort should it give us that the FDIC is backed by the full faith and credit of the most in-debt country in the world?

When to Use a DAPT

So, are DAPTs all that bad? We are not saying they are bad. We are just saying that there is a much better choice, especially for liquid assets.

So, when would you use a DAPT? You stand a fair chance when you meet all of the following criterion at once:

- You live in Alaska, Nevada, Delaware, Missouri, Rhode Island, Utah, South Dakota, Wyoming, Tennessee, New Hampshire, Hawaii, Oklahoma or, Virginia, as of this writing. These states all recognize self-settled DAPTs. (Incidentally, if you live in one of these states, we would choose a Nevada trust since it has one of the smallest windows of time for creditors to challenge transfers into the trust. Then pray that the judge uses Nevada statutes.)

- You have all of your assets in one or more of the above states.

- You think you can avoid federal lawsuits.

- The potentially at-risk assets have been placed into the trust before problems arise. In Nevada, for example, the creditor must file a claim within two years after someone transfers assets into the trust or six months before your creditor knew or should have known that you transferred assets into the trust.

If you don’t meet all of the above at the same time, use an offshore trust, because the DAPT probably isn’t going to do the trick.

Getting Comfortable with Offshore

Alternatively, there are some who have not yet busted out of the US cocoon. They have the isolationist notion that “US = safe” and “everywhere else = scary” despite overwhelming evidence to the contrary. For those people stuck in that mode, a DAPT is far better than nothing. Again, we are not saying not to ever use the domestic option, but are making you aware that there are much stronger choices.

For what it’s worth, this ain’t yo’ momma’s America anymore. Things have changed. There have been more US bank failures during the great recession than there have been in our entire lifetimes. The Euro is stronger than the dollar. There is a great big hole in our financial dike and the great China sea is located downstream. Things aren’t safe here anymore.

Hype vs Results

Keep in mind that different promoters will tout their magic formulae. They will search long and hard to find instances where the alternatives got caught in the thickets. Fortunately, we don’t have that issue because we have the ability to offer a full banquet of various legal tools. So, for us it’s “Just the facts ma’am.” We have literally formed thousands of domestic and foreign asset protection trusts, living trusts, children’s trust, land trusts, corporations, LLCs and many more, thus have no self-serving bias.

Plain vanilla living trusts, title-holding trusts, and land trusts do not provide asset protection. Domestic asset protection trusts can help shield assets in certain circumstances, especially if established in one of the aforementioned states that have recently put some muscle into their laws. Nothing we have seen bests the offshore asset protection trust. It simply works. We have more information about specific countries in an article entitled Best Offshore Trust Jurisdictions.

By the way, we might as well mention this. As a responsible company, it is our policy not to intentionally set up trusts to protect assets from government actions. We do not tout trusts for tax avoidance. These trusts are generally tax neutral.

Conclusion

So, what’s the bottom line? It is that the offshore trust simply provides better asset protection than the domestic alternative. When you are climbing the ladder to asset protection success, going from nothing to a DAPT takes you several steps up the ladder. Something is better than nothing. Properly using the OAPT takes you straight to the top rung.

The advent of the DAPT is a testament to how well the OAPT has fared. US states are jumping on the bandwagon. Buyer beware. If you are about to leap into a one of two lifeboats, we would suggest you not choose the one with 10 holes in it.

Though the OAPT has had rare instances where rogue judges have tried to brew up a storm, we know of no cases in modern trust case law where a properly structured Cook Islands trust has not protected trust assets. For years it has proven to be the most waterproof option we have seen.

You can use the number at the top of this page to get more information and details from a specialist.