What We’ll Discuss

A correctly established offshore trust is one of the most effective tools for wealth protection. Finding a jurisdiction with exceptional benefits for offshore trust settlors is a major part of ensuring these trusts are properly established.

In this article, we’ll compare the most popular offshore trust jurisdictions for asset protection. We’ll walk you through the pros and cons of trusts in the Cook Islands, Nevis, Belize, The Bahamas, The Isle of Man, and The Cayman Islands. With this information, you can make an informed decision regarding which jurisdiction can best protect your hard-earned wealth.

Key Article Sections

- Introduction to Offshore Trusts

- Chart Comparing Offshore Trust Jurisdictions

- Cook Islands Trust

- Nevis Trust

- Belize Trust

- The Bahamas Trust

- Cayman Islands Trust

- Isle of Man Trust

Introduction to Offshore Trusts

Before we dive into specific jurisdictions, let’s discuss what an offshore trust is and how it can benefit you. An offshore trust is a trust established outside of your home country. Typically, offshore trusts are set up in jurisdictions known as tax havens, which have favorable tax and asset protection laws.

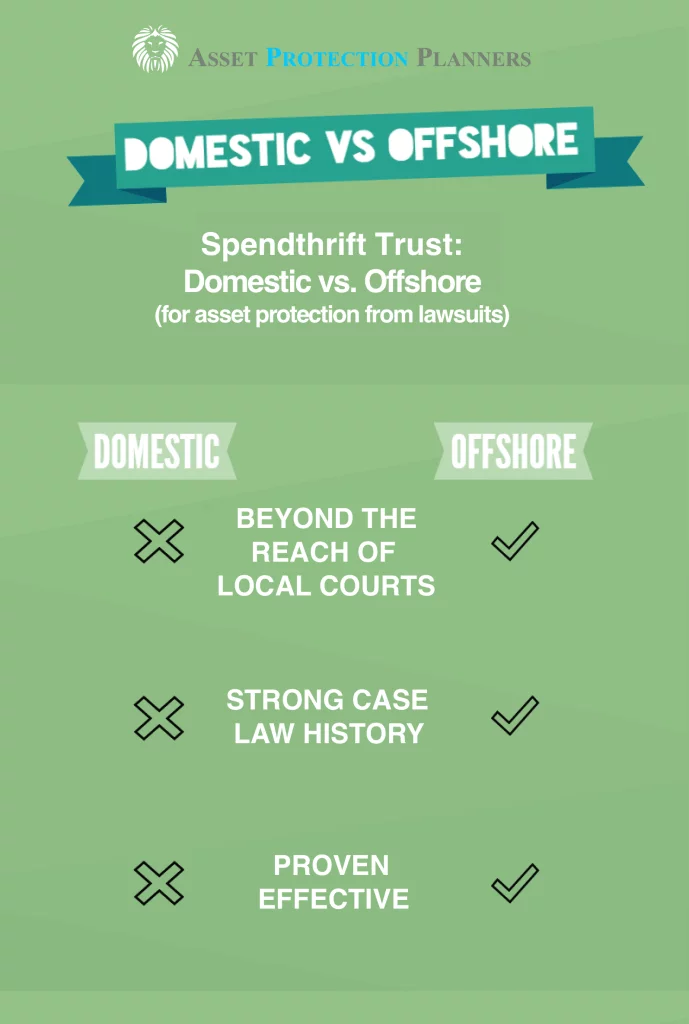

Many high-net-worth individuals choose offshore asset protection trusts (OAPTs) over domestic trusts because OAPTs are not subject to domestic judgments. Put simply, if someone sues you in the United States and wins, they won’t be able to access the money in your offshore trust.

Chart Comparing Offshore Trust Jurisdictions

So, which offshore asset protection trust is best at protecting your assets? The answer will depend on what you want. Nearly every jurisdiction offers potent asset protection benefits, but some are more convenient and trustworthy than others. To simplify the task of comparing offshore trust jurisdictions, we’ve put together this chart:

| Trust Jurisdiction | Strong Asset Protection | Internationally Trusted | Convenient Setup | Long Case History | Prevents Foreign Judgments | Short Statute of Limitations |

| Cook Islands | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Nevis | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ |

| Belize | ✔ | X | ✔ | ✔ | ✔ | ✔ |

| Bahamas | ✔ | X | ✔ | ✔ | X | ✔ |

| Cayman Islands | ✔ | ✔ | ✔ | ✔ | ✔ | X |

| Isle of Man | ✔ | ✔ | X | ✔ | ✔ | ✔ |

Of course, this is just a glimpse of the benefits and drawbacks of each country. Below, we’ve provided a more detailed breakdown of the pros and cons of these popular jurisdictions.

Cook Islands Trust

The Cook Islands is one of the most popular jurisdictions for opening an offshore asset protection trust. This nation has a long history of providing strong asset protection. And since the country is politically stable, the likelihood of these laws changing is low.

Legal experts agree that the Cook Islands has the strongest asset protection case law history in the world. Countless suits have been filed against trust holders here, and virtually all of them have been struck down.

Political stability and a strong case law history aren’t the only benefits of a trust in the Cook Islands. This jurisdiction is one of the most trusted in the world. This is thanks to an immaculate rating on the Global Corruption Perceptions Index. New Zealand, which has a free association with the Cook Islands, routinely ranks as the least corrupt nation in the world. This positive perception translates to an implicit belief from other nations that trusts established here are valid and ethically sound.

Thanks to these benefits, the Cook Islands is one of the best locations to create offshore asset protection trusts. We strongly believe in this trust type; our CEO has a Cook Islands trust for himself and his family.

Nevis Trust

The Caribbean Island Nation of Nevis is another popular location for offshore trusts. It has strong asset protection laws and is known for being debtor-friendly. The laws here are almost identical to those in the Cook Islands.

To compete with Cook Islands trusts, Nevis trusts include a few beneficial statutes that the Cook Islands variety lacks. First, to file a case against a Nevis trust, a creditor must post a cash bond deemed feasible by the Nevis High Court. A cash bond of about $100,000 is required. Secondly, Nevis International Trust statutes have abolished the Mareva Injunction. This is similar to a temporary restraining order in the US. It’s a ruling that allows foreign creditors to freeze trust assets, effectively tying the trustee’s hands.

In other jurisdictions, a judgment creditor will often request a Mareva Injunction ruling when a creditor files a lawsuit against a trust. Since Nevis has abolished this option, your opponent cannot freeze your trust assets this way. With the Mareva Injunction out of the picture, your trustee can continue to move funds within the trust during a lawsuit. They can use the trust account to pay your legal bills and even make changes to the trust during litigation. These statutes are so beneficial that our clients often convert their Cook Islands trusts into Nevis trusts if someone attempts to file a Mareva Injunction against them.

Belize Trust

Yet another preferred location for offshore trusts is Belize. It has robust asset protection laws just like the Cook Islands and Nevis. Belize trusts do not recognize foreign judgments from any country, even the United States. Your legal opponent must initiate litigation against your trust within Belize. Though other jurisdictions boast some of these same benefits, the real draw of a Belize trust is its nonexistent statute of limitations. Most nations allow fraudulent conveyance claims to be filed within two or more years, but it is impossible to do so against a Belize trust.

However, when you compare offshore trusts, Belize does come up short in one key category — trustworthiness. The nation has a poor ranking in the Global Corruption Perceptions Index, which opens up other avenues for creditors to deem your trust fraudulent. Even when trustees act with honesty and integrity, as they routinely do, corrupt government officials have tarnished the company’s reputation.

In addition to corruption issues, the crime rate in Belize is very high. Armed robberies are commonplace in Belize City, and the nation has a high number of homicides per capita. These issues with crime and corruption keep us from setting up trusts in Belize.

The Bahamas Trust

The Bahamas is a hotspot for offshore trusts due to its political stability and strong asset protection laws. Trusts in the Bahamas are also known for being a flexible, cost-effective option for asset protection. These trusts also have a short two-year statute of limitations on fraudulent conveyance into the trust.

One of the biggest draws of The Bahamas is that trusts can last indefinitely. Many other jurisdictions impose trust statutes that have a “Rule Against Perpetuities.” This rule states that a trust cannot exist after a certain number of years have passed since the death of the last beneficiary. A trust can last forever in The Bahamas.

Unfortunately, foreign judgments can be enforced in The Bahamas. Once the foreign judgment has been recognized or domesticated by the Order of the Supreme Court of the Commonwealth of The Bahamas, it will be enforced. In other top offshore trust jurisdictions, a plaintiff must file a whole new court case and start from square one.

Cayman Islands Trust

The Cayman Islands is another renowned offshore asset protection trust destination. This jurisdiction provides extensive protection to trusts and requires creditors to prove that the person who settled their trust in the Cayman Islands acted in bad faith.

The problem with Cayman Islands trusts is that the assets must be in the trust for six years before they’re protected from fraudulent conveyance challenges. For that reason alone, we don’t recommend Cayman Islands trusts.

Isle of Man Trust

The Isle of Man was one of the first nations to offer offshore asset protection trusts. Unfortunately, its legislation has not kept pace with other jurisdictions. Today, this jurisdiction makes it needlessly difficult to establish a trust. Even then, when one is set up, it doesn’t provide the quality of protection other jurisdictions provide.

Learn more about How to Select The Right Offshore Trust Jurisdiction and the best countries for asset protection.

Comparing Offshore Trusts: Key Takeaways

Each of the above jurisdictions offers far better asset protection than any domestic trust. However, if asked which jurisdiction is the best, we’ll always say that it’s the Cook Islands, with Nevis as a close second. These two jurisdictions have rich case histories, favorable laws, and a respectable international reputation. To date, none of the trusts we’ve established in the Cook Islands has ever been breached.

If you want to protect your wealth from creditors, lawsuits, and even divorce, an offshore trust in the Cook Islands is the way to go. Click the button below to learn how we can set yours up today!