In today’s lawsuit-prone world, your wealth is rarely safe. Even if you hire the best legal team, there’s not a lawyer on Earth who can promise a 100% win rate. So, when a judgment goes the wrong way and your wealth is on the line, you need something to stand between you and your creditor. Quite often, you need an asset protection trust

We’ll explain everything you need to know about asset protection trusts and provide real-life examples of how they can keep your wealth safe:

- Asset Protection Trusts vs. Bankruptcy

- Asset Protection Trust Basics

- Assets Protected by APTs

- Domestic Asset Protection Trusts

- Offshore Asset Protection Trusts

- How to Establish an Asset Protection Trust

- Domestic Trusts vs. Offshore Trusts

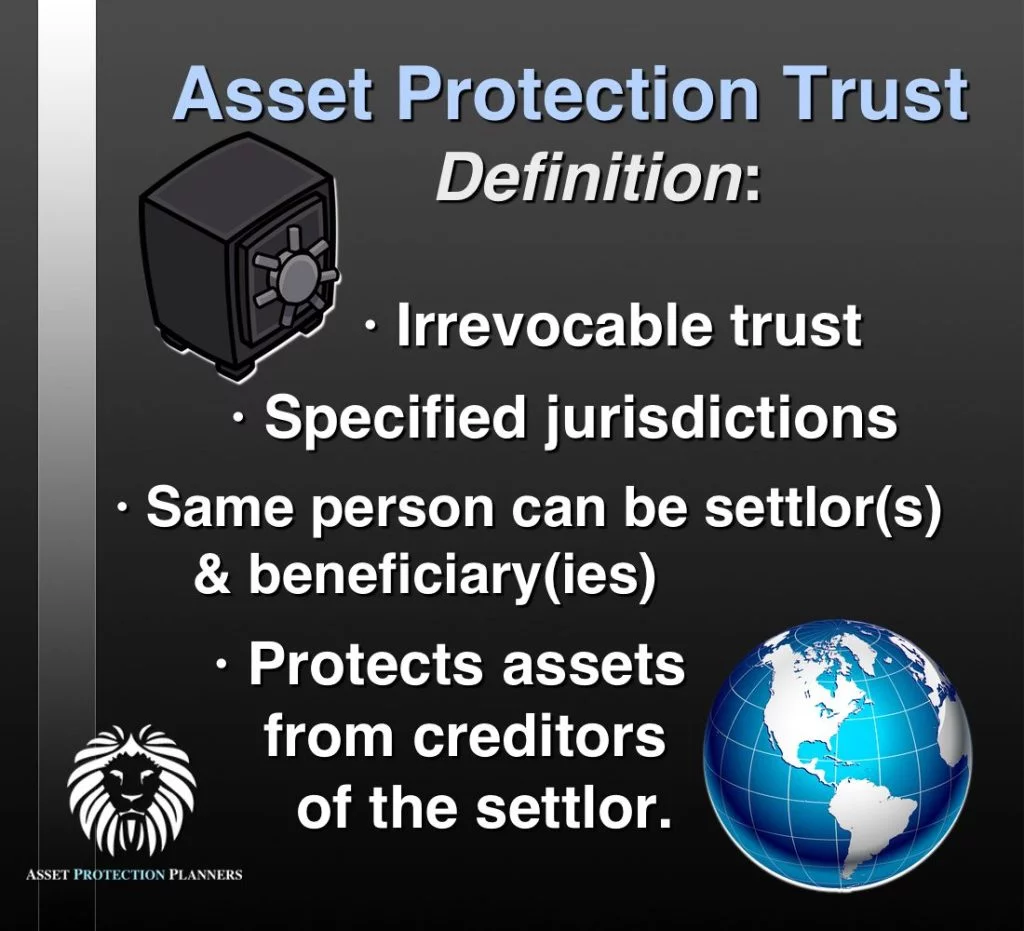

An asset protection trust is a financial structure that legally separates you from your assets. Doing so protects them from judgment creditors and other threats. To accomplish this separation, an asset protection planner creates a trust in your chosen jurisdiction. Next, they place your assets under the control of a trustee. This individual manages your assets on behalf of beneficiaries, whom you name when creating the trust.

Asset protection trusts are governed by documents known as trust agreements or trust deeds. This agreement dictates the terms of the trust, identifies who serves in each key role, and limits the powers of a trustee.

These trusts can be established domestically (within the United States) or offshore. Both offshore and domestic trusts have a similar setup, key parties, and provisions. However, they vary greatly in terms of the protections offered.

Before we explore the details of how APTs are used, let’s take a look at the key parties involved in an asset protection trust:

Asset Protection Trusts: Key Parties

Asset protection trusts are generally comprised of four roles. The names of these roles may vary based on the jurisdiction where the trust is established.

- Settlor – The settlor of a trust is the person who first establishes the trust. Settlors are also known as grantors in certain jurisdictions.

- Trustee(s) – The trustee holds the title to the assets in the trust. They are responsible for administering the trust as dictated by the trust agreement. A trustee does not have to be an individual, though they often are. Companies can also serve as trustees if they meet the licensing requirements of the jurisdiction where the trust is established.

- Beneficiary – A trust beneficiary is any person who benefits from the trust. These benefits can include everything from regularly scheduled distributions to inheritance rights. Most often, beneficiaries of a trust include the settlor’s family members. In the case of asset protection trusts, the settlor can also be a beneficiary

Protector – Trust protectors are optional positions in most jurisdictions. They limit the power of a trustee. Protectors can veto decisions made by a trustee and even appoint new trustees if needed. Generally, it is best if the protector resides outside of your country of residence as to be outside the control of your local courts. There are corporate professional protectors that serve in this capacity.

Asset Protection Trust Traits

Asset protection trusts have a few key traits that set them apart from other trust structures, including:

- Irrevocability – Irrevocable trusts require effort to change. This is essential for asset protection, as judgment creditors can legally step into your shoes and do what you could do. For example, if you can directly withdraw money from a bank account, a judgment creditor could also take money from that account. However, an irrevocable trust does not allow settlors to withdraw assets without trustee approval; therefore, creditors cannot remove assets from them.

- Independent Trustees – While many trusts are managed by friends, family members, or employees, that’s not the case for asset protection trusts. These trusts must be managed by an independent trustee (not a blood relative, controlled employee, or agent of yours). This stipulation creates a greater degree of legal separation between you and your assets, protecting them from creditors.

- No Distribution Requirements – APTs do not require regular distributions of income or principal to beneficiaries. Instead, these items are subject to the trustee’s judgment.

- A Spendthrift Clause – Spendthrift clauses essentially allow trustees to regulate distributions to a beneficiary. This clause is important for asset protection so that a court cannot seize regular distributions of liquid assets. Without that guarantee, a creditor cannot claim anything within the trust.

Next, we’ll look at different types of asset protection trusts.

Assets Protected by APTs

Asset protection trusts (APTs) can be used to hold a variety of assets, such as:

- Liquid assets (cash and currency)

- Real estate

- Life insurance policies

- Investment accounts

- Stocks

- Bonds

- Intellectual property

It’s worth noting that real estate is still subject to local laws. If you place domestic real estate in an offshore trust, it may still be affected by domestic judgments. To prevent this outcome, we record an equity line of credit mortgage against trust-held properties. A third-party lender acquires the mortgage when needed. This process, known as equity stripping, pulls the value out of the property and puts it in an account owned by your trust. If you ever lose a judgment, your house will be safe, as its value has been hollowed out by the mortgage. Equity stripping is even more effective than other common real estate protection strategies, such as a land trust.

Assets can be transferred to the trust or an LLC held by the trust at almost any time. However, the earlier you put your assets in the trust, the better. Placing your wealth into an APT before a judgment is handed down, or better yet, before a lawsuit starts, is the easiest way to avoid claims of fraudulent conveyance.

Divorce creates even greater urgency. Once you’re served with divorce papers, a financial restraining order typically kicks in—legally blocking you from moving assets into an asset protection trust.

Learn about the pros & cons of asset protection trusts.

Domestic Asset Protection Trusts

Domestic asset protection trusts (DAPTs) are created and managed within the United States. These trusts were first allowed in Alaska in 1997, and were intended to slow the outflow of funds to offshore trusts.

Today, South Dakota and Nevada offer the strongest asset protection trust statutes. Most notably, with proper publication, South Dakota and Nevada protect assets six months after a transfer, much faster than other states. Both of these states, along with Alaska and Delaware, have also done away with the rule against perpetuity (in the case of Alaska, 1,000 years). That is, once a trust is created in any of these jurisdictions, it can be maintained indefinitely or extended significantly.

South Dakota Trust

Among all U.S. jurisdictions that permit Domestic Asset Protection Trusts (DAPTs), South Dakota is consistently ranked as one of the top—often first—for its legal strength, flexibility, and trustee-friendly statutes. Here are some of the key benefits of a South Dakota Asset Protection Trust:

A. No State Income Tax

South Dakota imposes no personal or corporate income tax, making it a tax-efficient jurisdiction for trusts.

B. No Rule Against Perpetuities

South Dakota allows dynasty trusts that can last indefinitely, making it ideal for multi-generational wealth preservation and legacy planning.

C. Strong Privacy Laws

South Dakota has some of the strongest privacy protections in the country, with sealed trust court records and no public disclosure requirements.

D. Modern and Protective Legislation

South Dakota’s trust statutes are frequently updated to favor asset protection, and courts there are known for consistently upholding trust law that favors settlors and beneficiaries.

E. Discretionary Trust Distributions

Trustees can make discretionary distributions, which strengthen protection from creditors because beneficiaries have no enforceable right to trust distributions.

F. Flexible Trust Management

Trusts in South Dakota can be managed by out-of-state trustees or trust companies, offering flexibility while still maintaining protection under South Dakota law.

G. Limited Exceptions for Creditors

Unlike some other states, South Dakota’s statutes allow very few exceptions for creditors to pierce a trust, making them particularly appealing to high-net-worth individuals.

Disadvantage of South Dakota Asset Protection Trusts

While South Dakota offers some of the strongest domestic asset protection laws available, there is still one key limitation: you’re still within U.S. jurisdiction.

Because U.S. law requires full faith and credit between states, a judge in a more creditor-friendly state (like California or New York) could still undermine your trust’s protections. For example, if you live outside of South Dakota and lose a lawsuit in your home state, that court may not honor South Dakota’s favorable trust laws—especially if your trust was not set up early or properly funded.

For this reason, while domestic asset protection trusts are excellent for many situations, those with significant exposure or higher risk profiles often turn to offshore trusts (such as in the Cook Islands or Belize), which lie outside of U.S. court jurisdiction and provide even stronger barriers against creditor attacks. So, to fully inoculate yourself against the threat of domestic lawsuits, you need an offshore asset protection trust.

Offshore Asset Protection Trusts

Offshore asset protection trusts (OAPTs) are created and managed outside the United States. They are governed by foreign laws and managed by a trustee in your chosen jurisdiction. They are, on average, better at defending wealth against lawsuits than DAPTs are, as they can refuse foreign judgments.

There is no residency requirement to use an offshore trust. The only person in the entire trust structure who needs to be a resident of the offshore jurisdiction is the trustee. Settlors are welcome to live anywhere in the world and still enjoy the protections of an OAPT.

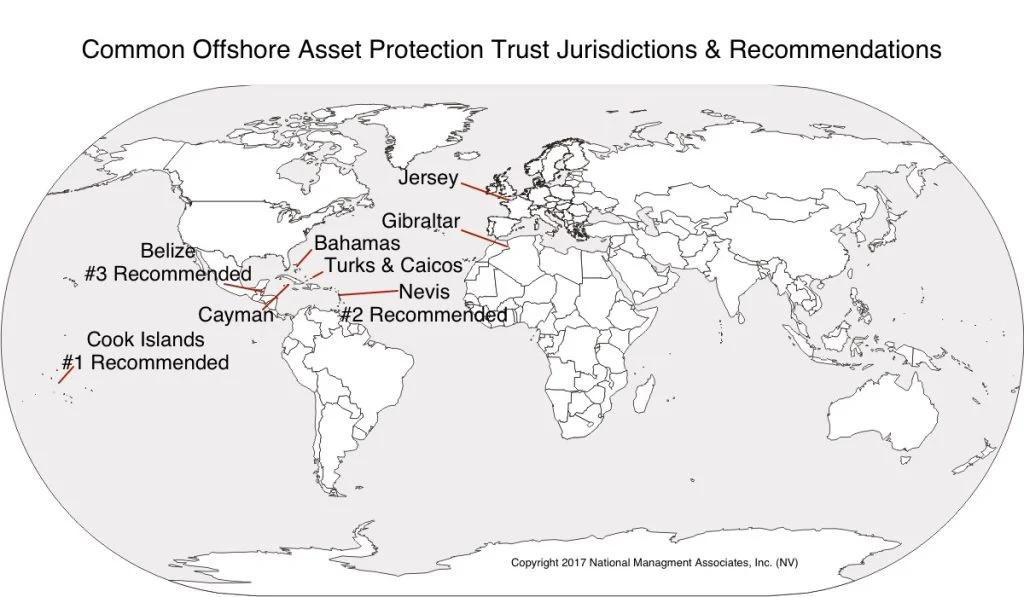

Dozens of jurisdictions allow for the creation of offshore asset protection trusts. However, we’ll focus on three jurisdictions, the Cook Islands, Nevis, and Belize, when discussing OAPTs in this article.

Benefits of Offshore Asset Protection Trusts

Most asset protection professionals consider OAPTs the gold standard of wealth defense. But why? Here are some of the key benefits of offshore asset protection trusts that make them so effective at keeping your money safe:

Foreign Judgments Are Not Recognized

The most notable benefit of settling a trust offshore is the ability to refuse foreign judgments. In the United States, a domestic trustee who refuses to release their assets to a creditor can be held in contempt of court. An offshore trustee, however, is not bound by U.S. court orders. To pursue a judgment against the settlor of an offshore trust, the creditor must have their case re-adjudicated. This is because the trustee is only bound by the law of the jurisdiction where the trust was established.

Some jurisdictions, such as the Cook Islands, Belize, and Nevis, provide additional barriers to keep creditors from attacking trusts. These barriers include plaintiff travel requirements and significant case-opening fees.

Even if a case is filed, it is unlikely that a creditor will be able to touch the assets held within an offshore trust. In many jurisdictions, creditors can only claim assets after proving a fraudulent conveyance claim. Luckily for trust settlors, the burden of proof for these cases is “beyond a reasonable doubt,” the same standard used for criminal cases in the United States. Virtually every creditor fails to meet this burden of proof. In fact, it’s so difficult that we have yet to see a single Cook Islands trust be breached.

Ability to Wholly Own an LLC

One of the best ways to utilize a trust for asset protection is to form the trust in conjunction with a limited liability company (LLC). Certain jurisdictions, such as the Cook Islands and Nevis, offer the option for an LLC to be wholly owned by a trust. The settlor of the trust can transfer their assets to the LLC, then serve as the LLC manager and control their assets. In the event of legal duress, the trustee company can step in as LLC manager and can refuse to comply with foreign judgments.

Multi-Generational Estate Planning

Popular asset protection trust jurisdictions like the Cook Islands and Nevis have no rule against perpetuities. The Cook Islands and Nevis lack this rule, so trusts established in these jurisdictions can operate indefinitely. This ensures that your assets can continue to benefit future generations for decades or even centuries.

Access to Assets Under Legal Duress

If properly established, asset protection trusts allow settlors to access assets while under legal duress. While a settlor is under legal duress, the trustee shields the assets held within the LLC in the trust. The trustee is not allowed to comply with foreign court orders. They may, however, pay bills for the settlor or pay a trusted friend or relative for the settlor.

Financial Privacy

Trustees of domestic trusts are routinely deposed or compelled by subpoena because they are subject to the judgments of U.S. courts. U.S. laws often require trustees to disclose sensitive financial documents during legal proceedings. In contrast, many offshore jurisdictions consider settling a trust a private matter. The Cook Islands, for example, does not even require trusts to register the names of their settlors. Only the name of the trust, trustees, and the date of the trust deed need to be registered.

Learn about the pros & cons of asset protection trusts.

Domestic Trusts vs. Offshore Trusts

To get straight to the point, when you compare how well each shields you from lawsuits, offshore wins hands down. That is because your local judge has the right to issue court orders to domestic trustees. The law does not grant that privilege to members of the local judiciary for offshore trusts. In short, losing a lawsuit in the United States has little impact on the assets in your offshore trust.

Offshore vs. Domestic: Real Life Example

The best way to show how much stronger an offshore trust is than a domestic trust is through a real-life case. Here’s a quick overview of the 2012 California Court of Appeals case, Kilker v. Stillman, 2012 WL 5902348 (Cal.App. 4 Dist., Unpublished, Nov. 26, 2012).[1]

In 2000, Stillman, a soil engineer, provided services through a pool company to Kilker. Four years after providing these services, Stillman set up numerous domestic asset protection trusts in Nevada. Then, in 2008, the pool on Kilker’s property cracked and began to leak.

Kilker filed a lawsuit against Stillman, alleging that he was responsible for any property damage caused by the cracked pool. Kilker won the suit, and Stillman was ordered to pay $92,000.

Because Stillman had placed his money in domestic asset protection trusts, he was initially protected from paying this sum. However, Kilker filed a fraudulent conveyance claim against Stillman. Unfortunately for the engineer, the trial court determined that he had fraudulently transferred his assets into the trust, despite doing so years before any flaw was found in Kilker’s pool.

This outcome lays bare the failings of a domestic asset protection strategy. Even if you create your trust in the best jurisdiction, long before a lawsuit, with the help of a professional, your assets are still vulnerable. Had Stillman placed his assets in an offshore trust, he would likely have avoided draining his trust to pay the judgment.

Learn more about offshore vs domestic trusts.

How to Establish an Asset Protection Trust

To establish an asset protection trust, follow these steps:

- Consult with a professional: Asset protection trusts are complex legal structures. It’s always best to work with a professional, such as those at Asset Protection Planners, to establish one. Without professional assistance, you could create a trust that doesn’t protect your assets.

- Select your trust jurisdiction: Where you establish your trust has a profound impact on the protection it provides. Offshore trusts are much stronger than domestic trusts and are recommended by most professionals.

- Choose a trustee: Your trustee must be an unaffiliated party. If you work with a professional, they likely have a network of vetted trustees who can serve in this role.

- Draft a trust agreement: The trust agreement dictates everything from trustee powers to beneficiary distributions and beyond. Never work on this document without help from an asset protection attorney. Making an error on your trust agreement can render your trust ineffective.

- Set up an LLC (optional but recommended): Offshore asset protection trusts can be combined with an LLC to improve its functionality. In short, placing an LLC within a trust gives the settlor greater control over their assets without undoing the protection of the trust.

- Transfer your assets to the trust: Once the structure is fully established, it’s time to transfer your assets. Work with your asset protection planner and your financial advisor to determine which assets require protection and which don’t.

- Keep the trust updated: Trusts are not “set it and forget it” structures. They must be regularly updated to remain compliant with changing laws. Fortunately, your asset protection planner can help you make any necessary updates, and can inform you if any major changes are required.

Learn more about how to set up an asset protection trust.

Adding an LLC to an Asset Protection Trust

Asset protection trusts are often combined with limited liability companies (LLCs). In this situation, assets are transferred to the LLC. The settlor of the trust is typically the initial LLC manager. In turn, the settlor will transfer 100% of the LLC membership interest to the trust. As manager, the settlor can make decisions regarding the use of assets held within the LLC. Should a lawsuit arise, the settlor can completely turn over the LLC manager position to their trustee company, who will hold it until the legal threat passes.

Asset Protection Trusts vs. Bankruptcy

If you’ve lost a lawsuit, or think you’re going to, it may be tempting to consider bankruptcy. While it is a last resort, this measure can prevent debts from following you for decades. However, we don’t recommend this course of action.

For those with a medium to large asset base, bankruptcy is usually a big mistake. It’s a knee-jerk panic reaction to alleviate immediate pain. Unfortunately, it usually causes long-term agony. After bankruptcy, you’re left with minimal assets and a horrible credit score, making it far more difficult to build back to where you once were.

So, if filing for bankruptcy isn’t a worthwhile solution, what is? The answer: setting up an offshore asset protection trust. An OAPT will make it improbable for a creditor to get their hands on your wealth. Even if you lose a lawsuit in the United States (or other country), your creditor will have to re-try the case in a trust-friendly jurisdiction.

Offshore Vs. Domestic Trust in Bankruptcy

Don’t set up a domestic asset protection trust to protect yourself from bankruptcy. If you try this, your judgment creditor is certain to argue against you in court. They’re likely to win these arguments thanks to creditor-friendly laws in the United States. As a consequence, the courts will deny the bankruptcy discharge.

Using an offshore asset protection trust prevents this unfortunate outcome. Foreign trustees can ignore U.S. judgments, so there’s little your creditor can do to take your assets. While they may be able to claim your domestically held wealth, you’ll have something in the trust that can keep you liquid and prevent the need for a bankruptcy filing.

Need Help Establishing an Asset Protection Trust? Call Asset Protection Planners

ost experts consider offshore asset protection trusts to be the strongest means of securing wealth from creditors. If you’re looking for an ironclad method of keeping your wealth safe, a professionally established OAPT is your best bet.

Don’t leave your asset unprotected against lawsuits and creditors. Contact Asset Protection Planners today to set up your offshore asset protection trust!