Yes, certain types of trusts can protect your assets from lawsuits. An asset protection trust, for example, can shield your wealth from legal threats. However, most living trusts offer no such protection. If your goal is asset protection, opt for a trust that is specifically designed for that purpose, drafted properly, based in the right jurisdiction, and managed by an independent trustee.

Here is an analogous question: Can vehicles drive fast? Yes, certain kinds can. Properly built race cars are fast, but farm tractors aren’t. In short, if you want to go fast, choose the right vehicle. Likewise, if asset protection is your goal, choose the right kind of trust.

In this article, we’ll explain which kind of trust protects assets from lawsuits:

- The Lawsuit Threat

- Who Needs Lawsuit Protection?

- Insurance Won’t Protect Your Assets

- How Irrevocable Trusts Protect Assets from Lawsuits

- Asset Protection Trusts

- Domestic Asset Protection Trusts

- Offshore Asset Protection Trusts and Their Benefits

- Asset Protection Trusts Defend Against Lawsuits After Death

- Can a Trust Be Sued?

The Lawsuit Threat

It’s no secret that the U.S. is the most litigious country on the planet; it’s home to more than 1.3 million attorneys. Of course, not every lawyer is prosecuting or defending criminals. Most are filing civil lawsuits that could put your wealth at risk.

Think about it – how many TV commercials have you seen where lawyers hawk their ability to file lawsuits and obtain “compensation” for minor injuries? We’re guessing you’ve seen quite a few. As silly as these ads can seem, there are real threats behind them. If you don’t have asset protection in place when these lawyers come knocking, you could lose everything.

Keep in mind that these contingent fee attorneys have as much sympathy for you as a pack of lions has for a baby gazelle. You are just the next meal, and these lawyers will find any reason to pounce. An acrimonious divorce, a car accident, or even a business dispute can open the door to litigation.

Who Needs Lawsuit Protection?

When you ask people, “Who needs lawsuit protection?” you get a few common answers. The ones we hear most frequently are:

- Physicians who are worried about a malpractice lawsuit

- Real estate developers concerned about legal issues

- High net-worth individuals working in lawsuit-prone careers

Though all those people should have an asset protection plan in place, the truth is that anyone can be sued. Even worse, a person’s litigation risk rises with every dollar they earn. Lawyers regularly go after the individual or entity with the deepest pockets, even if they have little to do with the lawsuit circumstances. In short, anyone can be sued, so everyone of means needs asset protection.

Insurance Won’t Protect Your Assets

Many people believe purchasing sufficient insurance eliminates the need for an asset protection trust. In some instances, that may not prove true, like during a divorce.

You also don’t know what “sufficient” might mean. Under ordinary circumstances, perhaps a couple of million dollars in insurance might protect you. But if the circumstances are extraordinary—perhaps a devastating car wreck—you can be hit with a massive lawsuit that exceeds your policy limits. In this scenario, the insurance you thought would protect your assets, including your family home, turns out to be nothing more than a false sense of security.

Lastly, insurance companies write policies with the primary aim of protecting themselves – not you. Unsuspecting policyholders may think they have protection, only to be hit with, “Your policy doesn’t cover that.” There’s a better way to protect your assets – setting up an asset protection trust.

How Irrevocable Trusts Protect Assets from Lawsuits

Although trusts can protect assets from a lawsuit, not all trust types offer lawsuit protection. For example, revocable trusts are vulnerable to creditor action. This is because creditors can use the power of revocation to step into your shoes and drain the trust. However, creditors can’t easily touch a properly established irrevocable trust.

When a trust is irrevocable, it does not readily permit alteration. The settlor – the party funding the trust – and beneficiaries cannot make changes without going through the trustee. The trustee’s responsibilities include trust oversight and account management. In a revocable trust, the settlor commonly also serves as the trustee. That is not the case with most irrevocable trusts that provide asset protection.

Because the settlor doesn’t serve as the trustee in an irrevocable asset protection trust, it limits a creditor’s power to step into your shoes and take your assets. For instance, if you just kept your money in a bank account under your name, a creditor could easily take it. The structure of an irrevocable trust forces the creditor to ask the trustee for your assets. When asked, your trustee can, and will, typically refuse.

Asset Protection Trusts

So, what is an asset protection trust? An asset protection trust (APT) is a type of irrevocable trust specifically created to keep assets safe. APTs are run by a trustee and include spendthrift clauses. These clauses prevent creditors from accessing assets until they have been given to a beneficiary.

Asset protection trusts can be used to protect almost anything. Some common items placed into APTs include:

- Cash

- Bank accounts

- Art

- Jewelry

- Antiques

- Precious metals

- Real estate

This level of flexibility has made APTs the go-to option for people looking to protect assets from lawsuits.

Domestic Asset Protection Trusts

Though many asset protection trusts are located offshore, Domestic Asset Protection Trusts (DAPTs) can also provide some protection from creditors. However, DAPTs are not available to all U.S. residents. Only the following 17 states permit DAPTs:

- Alaska

- Delaware

- Hawaii

- Michigan

- Mississippi

- Missouri

- Nevada

- New Hampshire

- Ohio

- Oklahoma

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Wyoming

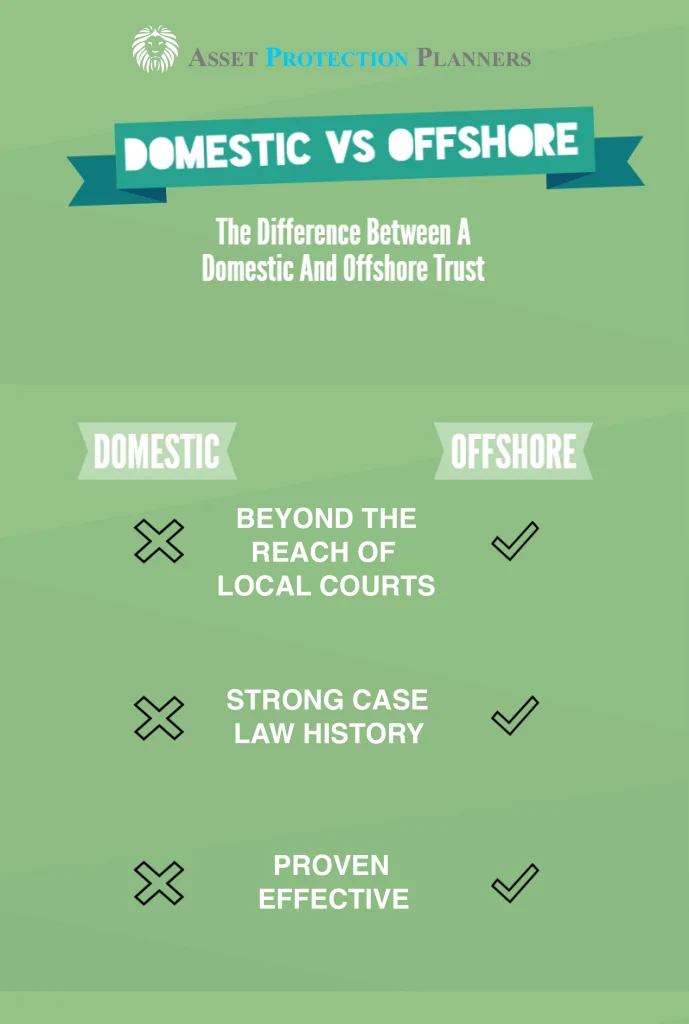

Even if you live in one of these states, you may want to consider an offshore option instead. DAPT protections vary greatly from state to state. For example, in one state, former spouses may be able to access your assets. In other states, tort creditors might have special claims to trust held assets.

Worst of all, if you are sued in another state, that state’s laws will apply to your trust, too. Far too often people will set up a DAPT in a trust-friendly state like Nevada, only to be undone by a lawsuit in a creditor-friendly state like California.

Some people prefer domestic asset protection trusts because they seem more convenient than offshore asset protection trusts. However, the decision to pursue convenience leaves gaping holes in these people’s strategies to protect their assets from lawsuits. Ultimately, if you’re spending the time and money needed to establish an APT, make sure it’s the strongest trust type, not just the easiest.

Offshore Asset Protection Trusts and Their Benefits

Offshore asset protection trusts (OAPTs) are structurally similar to DAPTs. OAPTs are irrevocable spendthrift trusts, and they are managed by a trustee. The biggest difference between OAPTs and DAPTs is where they are located. That small difference has a huge impact on the level of protection an offshore trust provides.

The biggest advantage of an offshore trust is that they aren’t subject to domestic judgments. Put simply, if you lose a lawsuit in the U.S., your trustee does not have to comply with that judgment. For a creditor to get their hands on your assets, they will have to win a court case in your OAPT’s jurisdiction. In a moment, you’ll see just how difficult that is.

Benefit 1: Creditors Must Travel to You to Re-Try a Case

Many offshore trusts require creditors to travel overseas and adjudicate their cases under that nation’s laws. If your asset protection trust is located in the Cook Islands, any creditor trying to obtain your assets must travel to the Cook Islands – a 14-hour trip from New York.

Once they land, the creditor must hire a Cook Island lawyer. These lawyers won’t take the case for free, unlike a lawyer in the United States. On top of all that, the laws of The Cook Islands are designed to benefit trust settlors. The chances of your creditor winning are slim to none, even if they go through the effort of re-trying the case.

As an aside, our firm has established more Cook Islands trusts than any firm worldwide. We have been doing so since 1996. That experience gives us a deep understanding of what works—and what doesn’t—when it comes to effective asset protection.

Benefit 2: Short Statute of Limitations on Fraudulent Conveyance

In the United States, if you transfer your assets to a trust after losing a lawsuit, your creditor will probably file a fraudulent conveyance claim. When they do this, they are saying to the court, “This person put the money they owe me in a place where I can’t access it.” U.S. courts will usually side with your creditor, and forcibly remove your recently transferred assets from the trust.

One way that offshore asset protection trusts defend against fraudulent conveyance claims is with a short statute of limitations. This means that once you make the transfer, your creditor doesn’t have long to file a claim. If they wait too long, they can’t do anything about the transfer.

The Cook Islands and Nevis only allow creditors to file these claims within one to two years of the event that triggered the lawsuit. So, if you got into a car accident with someone two years ago, and they just won the domestic lawsuit, the statute of limitations will already have expired for your offshore trust. Some jurisdictions, like Belize, take this a step further by banning fraudulent conveyance claims outright.

Benefit 3: Extreme Burden of Proof

Finally, if your creditor does choose to hop on a plane and file a fraudulent conveyance claim in time, their battle is just beginning. The Cook Islands and Nevis use a “beyond a reasonable doubt” standard for deciding fraudulent conveyance cases. This is the same standard used in United States criminal trials. Often, this level of evidence is nearly impossible to obtain, as transfers to a trust can be made for countless reasons.

To make things even more difficult for your creditor, there’s a penalty for losing the case, too. Some jurisdictions, like the Cook Islands and Nevis, require the loser to cover the victor’s court costs.

Asset Protection Trusts Defend Against Lawsuits After Death

Death is a certainty, but your estate can still be sued after you’re gone. An asset protection trust allows you to leave your assets to those you choose. It also helps prevent the wrong people from getting to your assets.

Suppose there is a close relative from whom you are estranged. Naturally, they will not be a beneficiary of your trust. If you live in a country with forced heirship laws or are a Louisiana resident, you cannot disinherit kin via a will or trust. However, if you have a trust that doesn’t recognize forced heirship, your relative cannot sue to become a beneficiary.

Can a Trust Be Sued?

Generally, a trust cannot be sued because it’s not a legal entity like a corporation or LLC. Instead, any legal action must be directed at the parties involved—typically the trustee, settlor, or beneficiaries. When a trust is properly structured and established in a strong offshore jurisdiction, such as the Cook Islands or Nevis, its assets can be effectively shielded from U.S. court judgments—even if you personally get sued.

Protect Your Assets from Lawsuits Using the Right Trust

So, does a trust protect assets from lawsuits? Yes, when you choose the right kind of trust and set it up properly.

Luckily, if you’re looking for a way to keep your assets safe from lawyers and creditors, we can help. At Asset Protection Planners, we’ve been setting up offshore asset protection trusts for decades. We’ve seen our trusts protect assets from lawsuits time and time again.

For more information on setting up an asset protection trust, click the button below to schedule a free consultation.