Asset Protection for Real Estate Investments. Investment properties are important assets to protect from personal debts and liability. In addition, they require a layer of protection from internal liability. There are many ways to protect real property and its equity. So, an investor should develop a strategy based on for the number of properties, amount of equity in each and associated risks. Asset protection vehicles and business entities, such as LLCs can offer excellent protection. Land trusts can provide privacy of ownership. The number of legal tools used should be determined by the types properties and their values.

Lawsuits are the most common methods used to seize property. Nolo Press published an article entitled How to Sue Your Landlord. They sell books informing tenants how to take the landlord to task in the courtroom. The Chicago Tribune recently published an article about a woman who makes her living by moving from home to home suing the landlord each time. One landlord’s attorney reported, “She makes the same accusations. It’s all theft, emotional distress, breach of contract.” The New York Post reports that recently, nearly 60 tenants joined together and sued a major Manhattan landlord.

Government Seizure Without Due Process

But that is not all. A recent report by the Institute for Justice discussed city property seizures for minor violations…without a trial. Cities and law enforcement departments that were short on case are seizing properties to make up for budget shortfalls. Again, many seizures were for minor violations and taken without due process. The article called this Civil Asset Forfeiture With a Profit Motive. This is a widespread epidemic. As the article states, “Only three states—Maine, North Dakota and Vermont—receive a combined grade of B or higher. The other 47 states all receive Cs or Ds.” And it is not only local governments. The article goes on to say that, “Eighty percent of persons whose property was seized by the federal government for forfeiture were never even charged with a crime.”

Privacy of Ownership

You never know when a contingent-fee lawyer will start sniffing around for your assets. Thus, privacy of ownership provides a protective layer around real estate assets. What tool should you use? Land Trusts. Land trusts are excellent tools in order to own real property privately. Titling property to a trust keeps an individual’s name from public title records. As a result, it enhances lawsuit deterrence for real estate owners and investors. Predatory potential legal opponents often search for deep pockets prior to taking legal action.

Furthermore, the Garn St. Germain Depository Institutions act of 1982 protects you from banks invoking the due-on-sale clause. When you transfer a mortgaged property to a land trust, a bank cannot call the loan due. That applies to properties of one two four dwelling units. Therefore, through the use of land trusts one can own multiple properties without a public display of wealth.

Real Estate Investment Asset Protection

In order to protect an asset from personal liability the investor must be legally separate it from himself or herself. You can help achieve this by owning the property using a limited liability company (LLC). A business entity is a separate legal person that can own property, open a bank account and pay taxes among other things. This separate legal person comes with limited liability for members, or owners of the business. The LLC is one of the ways to hold title that can protect from the liability and debts of the business. Legal separation also protects business assets from personal liability of the business owners.

Additionally, there are legal provisions that help prevent judgment creditor from seizing LLC membership interest to satisfy a judgment. This is unlike shares of corporate stock, which a creditor can seize. Moreover, a single-member or multi-member LLC is granted flow-through taxation by default. That means, that tax deductions flow through the company to its members. Plus, rental real estate is not generally subject to the 12.4% Social Security tax or the 2.9% Medicare tax. As a result, these tax benefits also flow through the company.

How an LLC Works

So, the LLC acts like bulletproof glass. It let’s the good things in and keeps the bad things out. Like the sun shining through glass, the tax benefits shine through the LLC. On the other hand, LLCs help stop the bullets, i.e. lawsuits, from penetrating the owners and managers. All of these benefits make LLCs the preferred business entity for protecting real estate.

The real estate investor can use multiple legal tools to provide maximum privacy and legal protection. The land trust holds title to the property. Then the land trust, in turn, owns the land trust. Technically speaking, the LLC is the land trust beneficiary.

Divide and Conquer

When protecting real estate using LLCs, separating properties from one another is an important asset protection strategy. When owning multiple properties through a single entity, liability from one property could jeopardize the other(s) held in the same company. If a property has more than a quarter million dollars of equity (depending on an individual’s own comfort level), it warrants its own business entity. This limits the amount of equity at risk at any given time. On can own several properties with low equity value with a single LLC. However, a property with greater equity; especially one that creates positive passive income, should be encumbered in its own business entity.

The investor should split up properties on a cost/benefit basis. You are best served to funded and manage each legal vehicle separately. This will strengthen the legal separation of the entity from your personal effects. This includes accounting as well as operating formalities. With a large portfolio of properties it is advisable to encumber them in a much stronger asset protection strategy as described below.

Ultimate Real Estate Asset Protection

The final step in protecting real estate investment assets from lawsuits to protect the equity. The way we do this is to record home equity line of credit types of mortgages against each property. (We are using mortgage and deed of trust interchangeably.) This is payable to a separate LLC that you own privately. We typically establish such an LLC internationally for maximum privacy and protection. The most common example is the Nevis LLC. In turn, we establish an asset protection trust that owns the LLC. So, the LLC holds mortgages against the property. If you have liquid assets the LLC also protects them. You can hold bank accounts and stock market investments in the LLC.

We typically establish the asset protection trust in the Cook Islands because of its sound case law history. Domestic trusts are under the jurisdiction of domestic judges. So, if the trustee company resides offshore it is not subject to US court orders. When the “bad thing” happens, we have an international company that will buy the mortgages against your property. They place the cash into a “you can’t touch it” account in your offshore trust.

Naturally, they are not going to risk you running off with the cash so you wouldn’t be able to scoop the cash and run. It is really of little relevance, since without refinancing or selling you would not be able to touch the cash anyway. Once you do sell or refi you create liquid cash that is deposited into your offshore trust that you can touch. Alternatively, when the “bad thing” goes away, you can ask the trustee to release the mortgage.

Protecting Private Notes, Deeds of Trust and Mortgages

Some people, instead of selling properties for cash, sell properties and hold back a mortgages on the properties. That is, the seller transfers the title to the new buyer. The buyer signs a promissory note payable to the seller. The seller, in turn, secures the promissory note with mortgage or deed of trust recorded against the property. Some states use mortgages and some use deeds of trust to secure the note. In either case, the new buyer makes monthly payments to the seller.

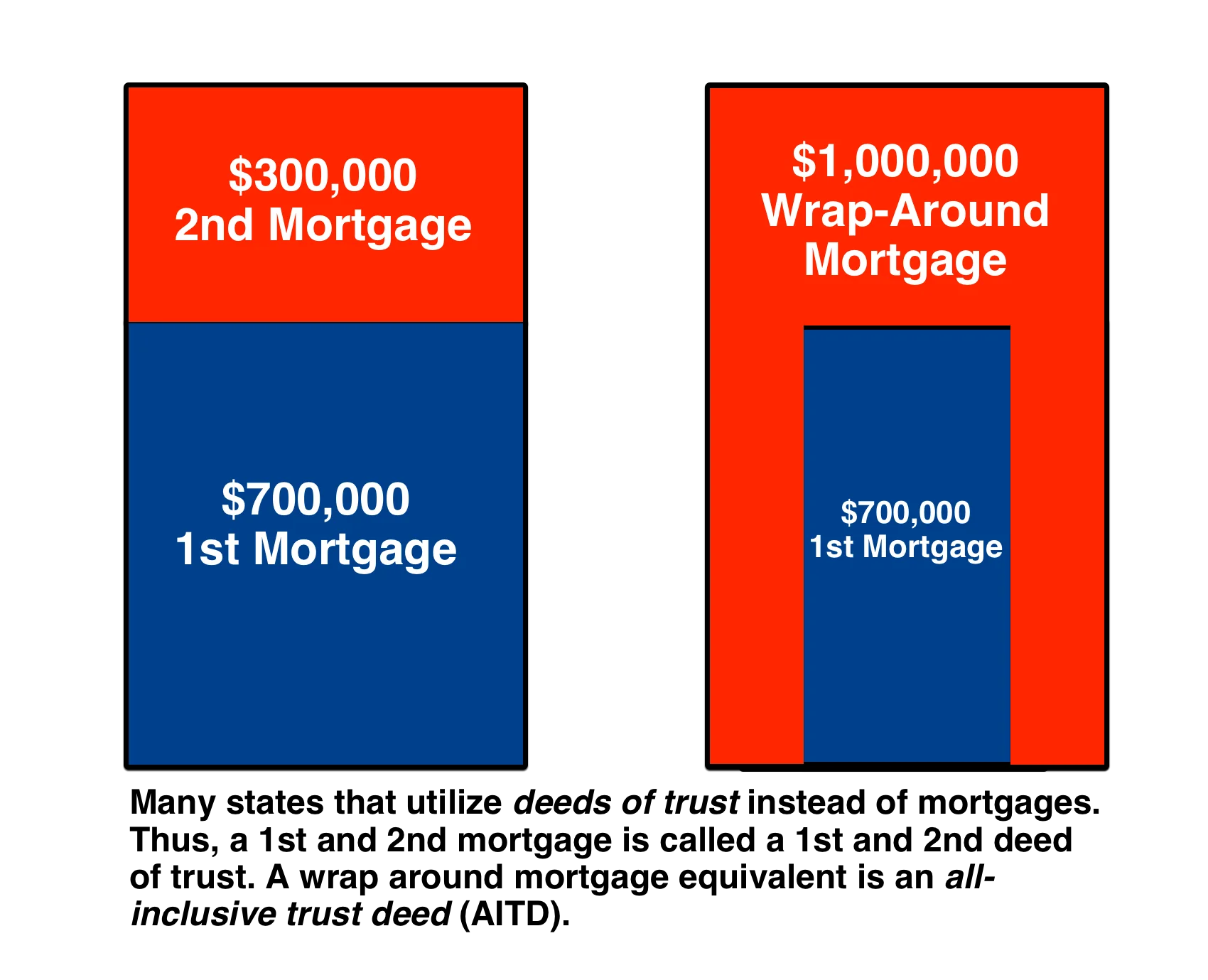

So, how do you protect private mortgages and deeds of trusts? We do so by recording a wrap around mortgage or all-inclusive trust deed (AITD) against the property. You record such a document in the county recorder’s office (or its equivalent) in the country where the property is located. Such an instrument wraps around and is in place in addition to any other mortgages pre-existing on the property. Therefore, the wrap around mortgage or all inclusive trust deed consumes some or all of the remaining equity in the property, including the underlying mortgage.

Income Property Protection Conclusion

In summary, for protection against lawsuits and liability you employ a personal asset protection strategy. A separate land trust holds the title to each property for privacy of ownership. A separate LLC owns each land trust. (You can group low value properties into one LLC if you like.) The LLC provides lawsuit protection for the owners if a tenant sues. It also provides asset protection for the properties if the owner is sued personally. Then you encumber the equity in each property with a mortgage or deed of trust. Engage your offshore trust to hold the resultant cash. If you sold property and held back a note, a wrap-around mortgage or AITD can protect such an arrangement. Encumbering your real estate assets using the strongest legal tools gives you negotiating power when a lawsuit strikes.

Investment properties can provide a great source of wealth. To an attorney, unprotected real estate is like shooting geese in a pond. There are strategies you can employ to protect your assets.

Now that you know the information, the next step is to take action. There are telephone numbers and an inquiry form on this page so you can take the next step in protecting your investment real estate from lawsuits.