Let’s talk about transferring real estate privately so it doesn’t appear in the public records. That means nobody knows about the transfer but you. There are two main ways hide property title transfers. We will discuss our favorite, what has worked best for thousands of our clients.

So, we’re going to talk about the different types of deeds and what each one does. We’ll talk about how to hide a property transfer from the public and we’ll talk about how to save thousands of dollars in transfer tax when you sell or transfer a property.

Okay, so if you’ve purchased property previously, you likely know generally what a deed is and how it works. People use deeds to transfer property to another party, to another person, to multiple people, to companies such as LLC, to living trusts, etc.

When you BUY a property, the deed goes to you.

Types of Real Estate Deeds

What are the different types of deeds? The most common are as follows:

- Grant Deed

- Warranty Deed

- Quitclaim Deed.

What’s the difference among these three types of deeds?

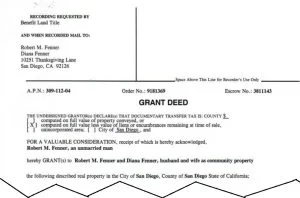

Grant Deeds

Well, grant deeds contain two guarantees. First, the grantor states that the property has not been sold to anybody else. Secondly, it states the property is not burdened by encumbrances—apart from those the seller has already disclosed to the buyer.

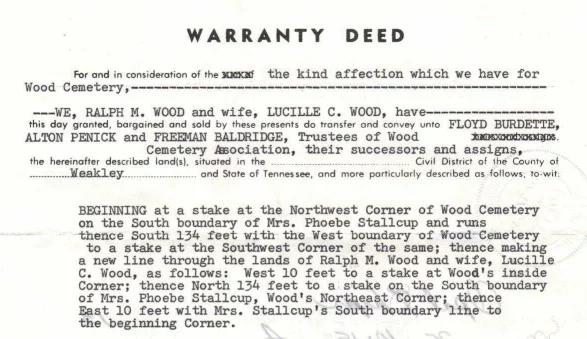

Warranty Deeds

Warranty deeds are used all over the United States, but they’re most common in the Midwest and Eastern states. They’re very similar to grant deeds, with one exception. Instead of two guarantees like the grant deeds we just covered, warranty deeds contain three.

With a warranty deed, grantor states that the property has not been sold to anybody else. Next, that they will warrant and defend the title against the claims of all persons. And third, the grantor declares that the property is not burdened by any encumbrances; apart from those issues about which the seller has already told the buyer.

In essence, the grantor guarantees the grantee that the title is free of any defects that may affect the title—even if the defect was caused by a previous owner.

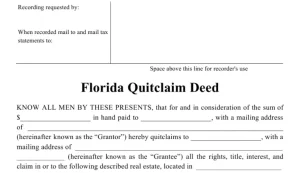

Quitclaim Deeds

And finally, Quitclaim deeds are used to convey any interest that the grantor MIGHT possess in the property. The grantor might be a legal owner—or not. The deed makes no promises in that regard.

So in essence, a quitclaim deed is says, “I’m not saying I have any ownership interest in the property. But whatever interest I do have I give to you.”

People often use Quitclaims in divorce situations to deed a marital property from one spouse to another. Let’s say a married person holds the title to a property and is sole and separate owner. Say, they acquired the property before marriage. The spouse who is not on title might be asked to sign a quitclaim deed to ensure that they don’t later try to lay claim to the property.

So, when we say the word “deed” we are referring to one of those three types of deeds that people use to transfer properties from one party to another.

How Deeds Work

A deed is typically delivered to the county recorder’s office in the county where the property is located. The seller signs the deed in front of a notary public. Then the document is recorded either physically on a piece of paper or in many counties, the document is submitted electronically.

Doing so shows the world that you are the legal owner of the property.

Once the deed is recorded, there are two ways we will discuss here to transfer ownership of the property privately.

How to Keep Real Estate Transactions Private

Land Trusts

First, you can put the property into a land trust. That’s our favorite way to transfer property privately. In fact, a land trust is a document that we draft that our clients use to own real estate privately. We have set up thousands of land trusts over the 30 years our management has been in this business. Our research has shown us that land trusts are legal in all 50 states.

Some states specifically name land trusts in their statutes. Some don’t. But there are also no laws that we know of that say you can or cannot wear red shoes either. So, not everything we can or cannot do is written in law books. Simple common law on which most of our laws are based allows for the use of trusts and has for centuries. Moreover, we have set up land trusts which have been successfully used in all 50 states and many foreign countries.

The great thing is this. Most lenders will only lend to you if you hold title to the property in your own name. However, once you get your mortgage, the Garn St. Germain Depository Institutions Act allows you to put your property into a land trust at will. You can put it into the land trust without the lender calling your loan due. The property needs to be one to four residential units and you are the beneficiary of the trust.

Steps to Using a Land Trust

So, step one, call us and have us set up a land trust and transfer deed.

Step two, is to have all relevant parties sign the land trust and transfer deed in front of a notary public.

Step three is to store the land trust in a safe place that you can access. You don’t typically record the land trust. You keep that in a safe place at home.

Step four is to record the transfer deed. This creates a public record that the trust / trustee now holds the title to the property.

We also provide you with an additional document called the “Assignment of Beneficial Interest.” Cutting through the technicalities, a beneficiary of a land trust essentially owns the property. Simply put, the beneficiary holds the rights to the benefits of the property that the trust holds.

So, if you are the beneficiary of the trust, you can assign your beneficial interest in the trust to someone else such as your LLC so that you have protection from lawsuits that originate from that property. Now, your personal residence and your investment properties fall into two separate tax categories. We would not assign your beneficial interest in a land trust to an LLC. If that land trust owns your personal residence, assigning your beneficial interest in the trust could affect tax benefits that you enjoy in your primary dwelling. But with rental property, we routinely assign beneficial interest to LLCs as the tax benefits remain.

Land Trust Plus LLC

Plus, you get the tremendous legal protection that the LLC offers. Someone slips and falls or dies on the property and you have $500,000 of insurance. Somebody could sue you for $3-4 million. The LLC can protect you from that lawsuit. So, by assigning your interest in the property to an LLC, you do so privately with your assignment of beneficial interest.

So, you can show the trust, with yourself as the beneficiary. Then when a lawsuit comes knocking, you can ALSO show your assignment of beneficial interest document. This document shows that you assigned your beneficial interest in the trust to an LLC. So, you have liability protection. It is best that you have this notarized as third-party proof that you assigned it on a certain date.

Save Money on Doc Stamps and Real Estate Transfer Fees

In addition to privately transferring the property to a company or another person, a land trust can also help protect you from paying expensive property transfer fees. For example, we just came across an article about the Florida Department of Revenue. A high court ruling enabled sellers to avoid the documentary stamp taxes. They do this by structuring real estate deals in company mergers and foreign land trusts. The strategy is often used to conceal the identity of buyers in high-end real estate deals. Naturally, this is to be used for legal, ethical purposes only.

So, not only can a land trust help you transfer property privately. It can also save you tons of money in transfer taxes by simply assigning the beneficial interest in the trust — instead of recording the transfer in the public records.

So, if you want to transfer a $3 million property to another party in Miami-Dade county as of this writing, the county would charge you $18,010 for a single family home. And $31,510 in fees for any other type of property, such as a duplex or commercial building. By using a land trust instead, the cost is absolutely zero.

So, the first way to transfer title privately is with a land trust.

Pocket Deed

A second way to transfer title privately is with what we call a “pocket deed.” We don’t like doing it this way but here is how it’s done. Most people would think that in order for the deed to be legally enforceable that you actually have to record it. When you notarize a deed to transfer a property, you can show evidence of the intent to transfer. How do we do that? The deed needs to be in writing and preferably notarized so that you have third party proof that you didn’t just do this yesterday. You’ll typically have on the deed the tax parcel number. We like to write the street address on the deed so a normal human can read it. You can also write or attach a copy of the property legal description of the property.

In addition to that you also have what is called delivery and acceptance. That is, the one to which the property is being transferred has received a copy of the deed. Now, keep in mind, the only one who signs the deed is the person who is transferring the property. The recipient doesn’t need to sign anything in order to receive the property.

Pocket Deed Example

So, it’ll say John Smith hereby conveys the following described property to the 123 Main Street Trust with XYZ LLC as the trustee. The manager of XYZ LLC, the property title recipient in this case, does’t sign it. Just the grantor. That is, the one giving the property away or selling the property signs signs it. So, if it was your property before the transfer, that would be you. Thus, when someone records the deed, it lets the world know that the property is held by the trust / trustee and not John Smith anymore.

Let’s say John Smith sold the property to Blue Sky LLC. If someone doesn’t record the deed, then the public records still show John Smith as the owner of the property. So John Smith could then sell the property to Green Tree LLC.

Say they pay for title insurance, and it still shows John Smith as the owner of the property. Meanwhile, John Smith moved to Costa Rica with all the money from both buyers. And then the manager of Blue Sky LLC would have to fight like heck and spend tens of thousands of dollars in court to get the property. That is why we have a public recorder’s office. It is to prevent this type of shenanigans from happening. We had legal case in the State of Washington. In that state, the unrecorded deed took precedent. We have seen other cases in California, which they call a “race” state. This means whoever races down to the county recorder and records the deed first, win.

When to Use the Pocket Deed

So, that’s the second way to do it and you can see why I like the land trust more than I like the pocket deed. But say you live in a state like Pennsylvania that charges you out the nose for transferring property into a land trust. By the way, that is the only state that we know that does. Paying an extra $5000 or $10,000 or $15,000 more after the fact and recording a deed that you notarized five years ago might make sense. And then a few states charge you for transferring a property directly into an LLC and many don’t if you owned the property before, and you are also the owner of the LLC.

So, some terrible lawsuit could strike that originated on the property that could wipe you out, and you didn’t want to record the transfer deed because you wanted to save money on the transfer tax. Delaying paying $10,000 might possibly make sense in a case like this. And then you can record it later. This is because it’s a heck of a lot better to pay 10 grand than to face a lawsuit that could take half a million dollars out of your pocket. You’d be happy to pay 10K. And instead of wishing you’d transferred it way back when, you have the notarized deed that you can record quickly.

Say you get into a lawsuit. You hurry up and record that pocket deed before the lawsuit freezes the title the property.

Fraudulent Conveyance Questions

Someone might ask, isn’t that a fraudulent conveyance or fraudulent transfer to record the deed after you’re sued? The answer is no. Keep in mind you notarized the deed five years ago. You have evidence that the property was transferred five years back. So, we are talking about those scenarios where you are transferring real estate to an entity you control. In addition, you want to avoid the transfer tax. You can still have a real estate asset protection device that you can deploy when you need it. Just keep in mind you not only need to have notarized the deed, but you also must have kept your LLC in good standing. You need to pay the annual government and registered agent fees and whatever else is needed.

Legal Advice

Keep in mind there are 3006 counties in the United States. They all have their little quirks and we don’t know all of them. So, before doing any of this, get legal advice for your specific situation from an attorney. We do have attorneys on our full time staff here that you can talk to if you want to set up a land trust or LLC. Call us for details.