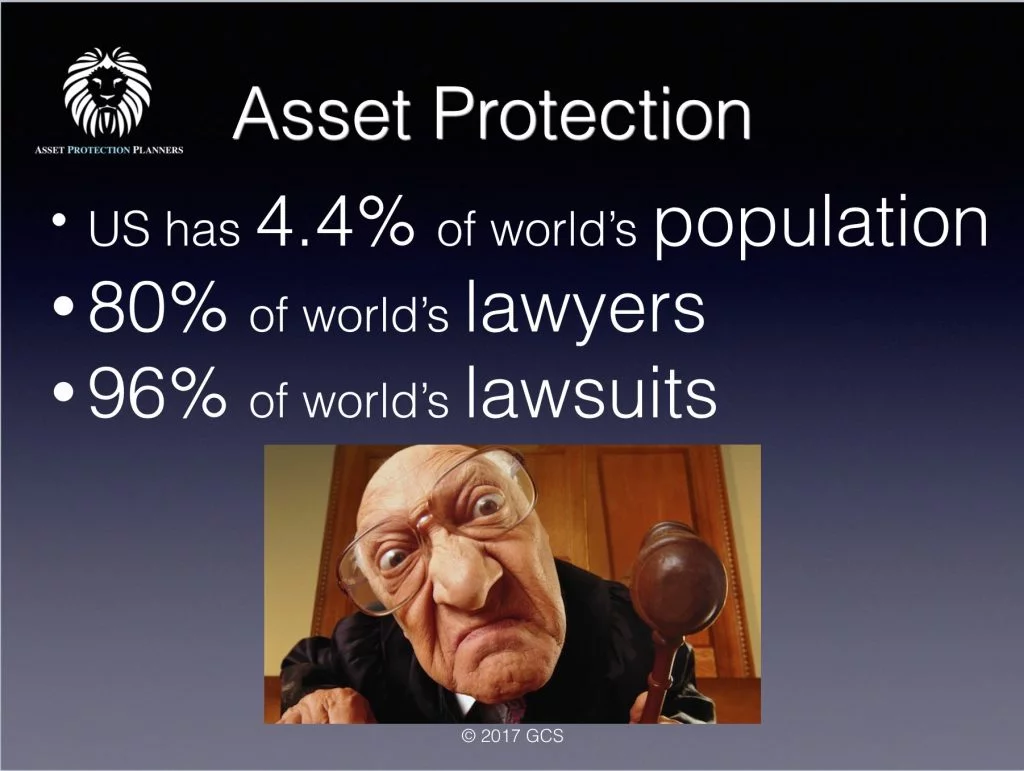

Owning a successful business puts a legal target on your back. If you don’t have asset protection measures in place, your business can lose its assets and equipment in a lawsuit. Fortunately, there are ways to protect your business from lawsuits and personal creditors.

- How Business Lawsuits Start

- Tools Used to Protect Your Business Assets

- How to Use Business Asset Protection Tools

- Business Asset Protection Strategies in Practice

- Protecting Real Estate

- Protecting Cash

How Business Lawsuits Start

Business lawsuits can start for almost any reason. In fact, the cause of the lawsuit doesn’t even have to be associated with your business. For example, if you got into a car crash while on your way to visit a client, the other driver can sue you. If that lawsuit exceeds the protection offered by your insurance policy, the plaintiff can come after your business assets.

Business asset protection prevents the above scenario by using trusts, corporate structures, and other tools to place a barrier between a plaintiff and your assets.

Tools Used to Protect Your Business Assets

To properly protect your business from lawsuits, you need to use tools that separate its assets into distinct buckets. You want your liquid currency to be in one bucket, your equipment in another, and so on. This technique ensures that if your business is sued, and you end up having to pay a judgment, only a portion of what your company owns can be claimed by your creditor.

Creating these buckets requires the use of various tools, such as:

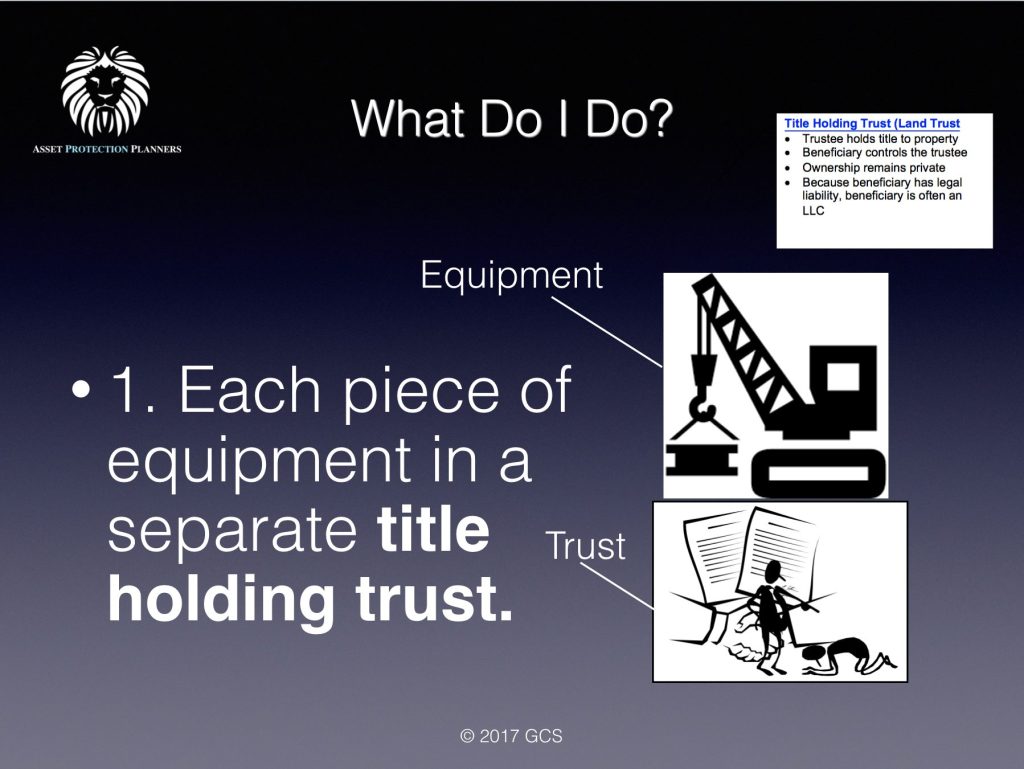

Title Holding Trusts

In a title holding trust, a trustee holds the title of the property under terms defined by the trust’s creator (settlor). The trustee could be a company that you own privately, a trusted friend, or an unrelated representative. Regardless of who or what the trustee is, they must follow the instructions you lay out in the trust deed. Additionally, a title trust also allows the settlor to be the beneficiary. As the beneficiary, you essentially control the actions of the trustee.

Once this type of trust is established, it creates privacy of ownership for any assets within. The property, whether it’s real estate or equipment, is in the trust, but the trust is not publicly recorded. This makes it very difficult for creditors to locate the assets owned by your company, which also makes you a less appealing lawsuit target.

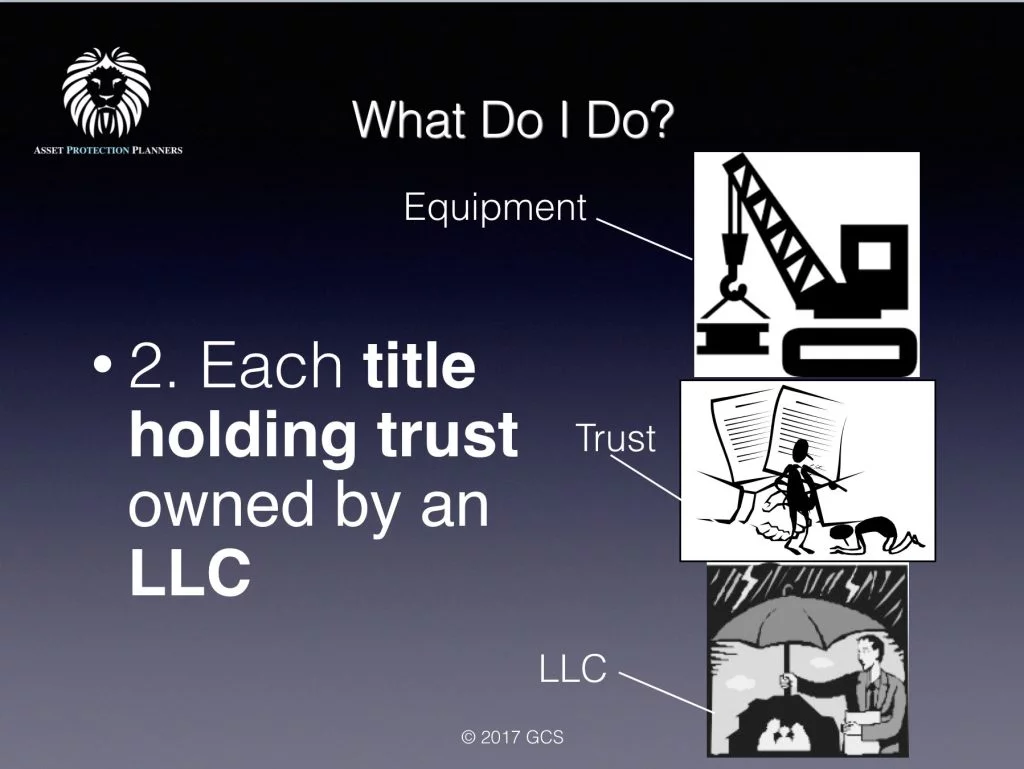

Limited Liability Companies (LLCs)

To enhance the efficacy of a title holding trust, we establish an LLC to serve as the beneficiary. This way, the company shields the settlor by adding more privacy and limiting their liability. Here’s how this works in practice.

When someone sues your business, the LLC acts as a brick wall. On one side of the brick wall are your business’s assets. On the other side of the wall are your personal assets. The LLC structure essentially prevents a lawsuit against one party from affecting the other.

How to Use Business Asset Protection Tools

Now that you know about LLCs and title holding trusts, here’s an explanation of how to protect your business from a lawsuit using these tools:

- Place assets into a title holding trust: Each piece of valuable business equipment, whatever that is, is placed in a separate title holding trust. Placing them in a trust keeps your ownership of those business assets private. People cannot look in the public records and find out who owns it and who is on the title. So, you have privacy of ownership.

- List an LLC as the beneficiary of the title trust: Setting up an LLC to serve as the beneficiary of each title trust limits the potential impacts of a lawsuit. If your business gets sued, this greatly reduces the chances of the lawsuit reaching your personal assets, and vice versa. Additionally, setting up an LLC to serve as the beneficiary creates another degree of separation between you and the assets held within the title holding trust.

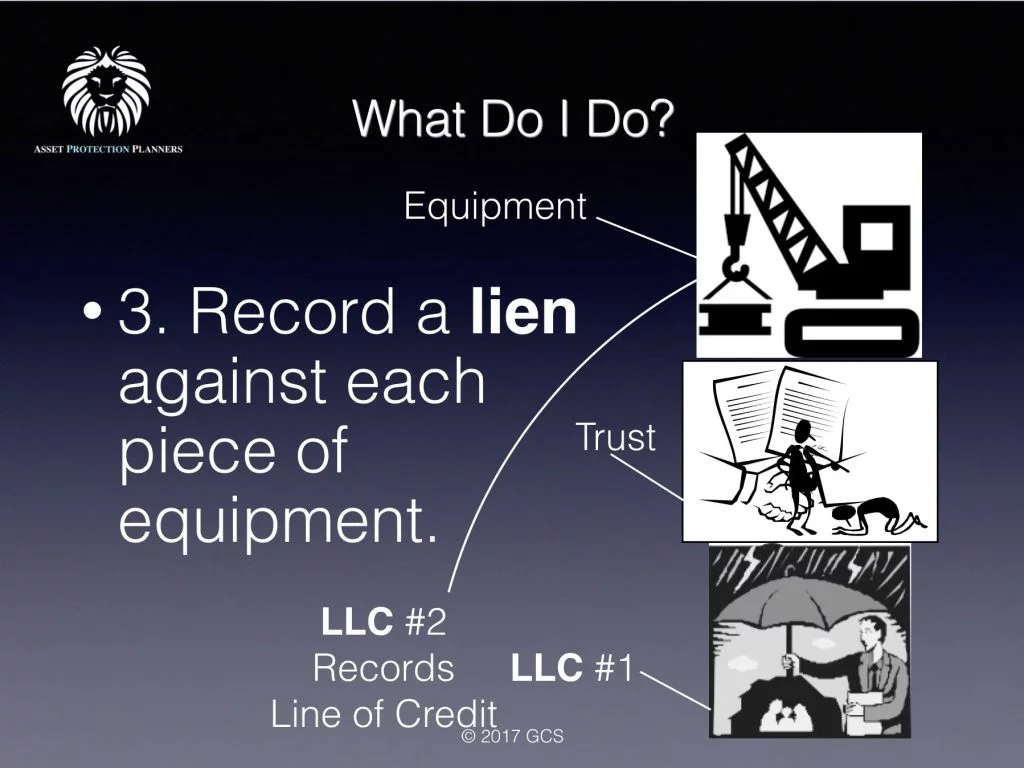

- Record a lien against any business property: The next step of business asset protection is to record a lien against each valuable piece of property. To do this, we establish an LLC that acts as a lender to your main company. This strips your assets of their value, ensuring that even if you are sued, your creditor has nothing to go after.

- If needed, get a third-party lender to buy the lien: Finally, if the lien is questioned in a legal procedure, we arrange for third-party lenders to purchase the lien. You place the proceeds into an asset protection trust. This legitimized the lien in the eyes of the court.

Business Asset Protection Strategies in Practice

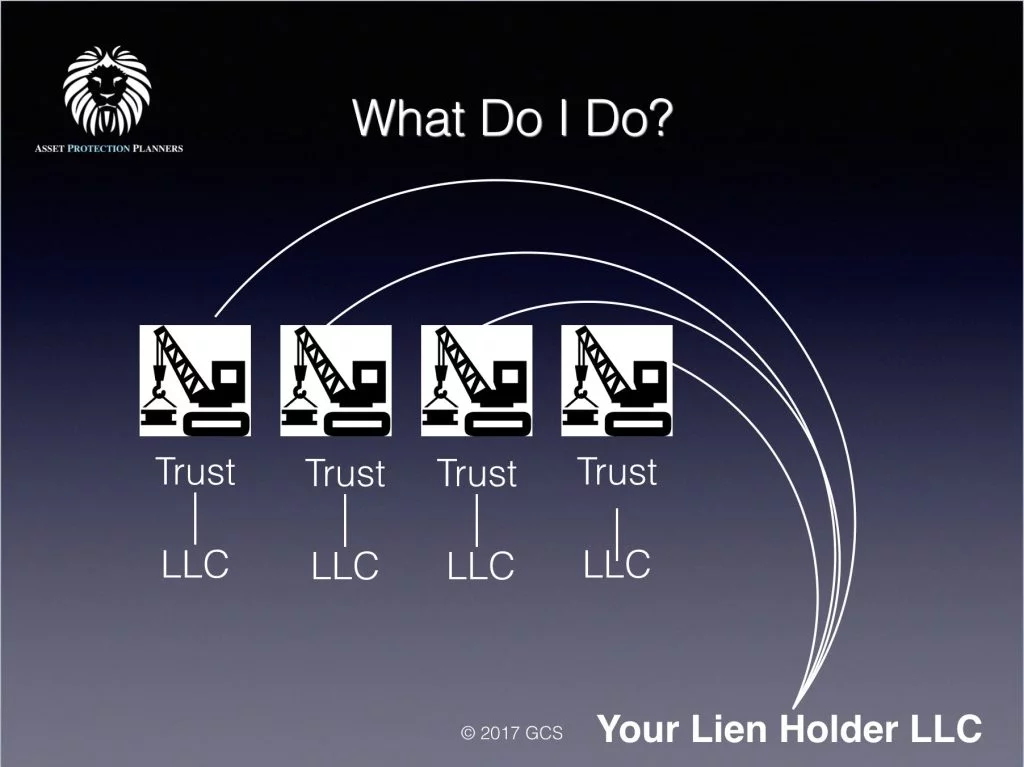

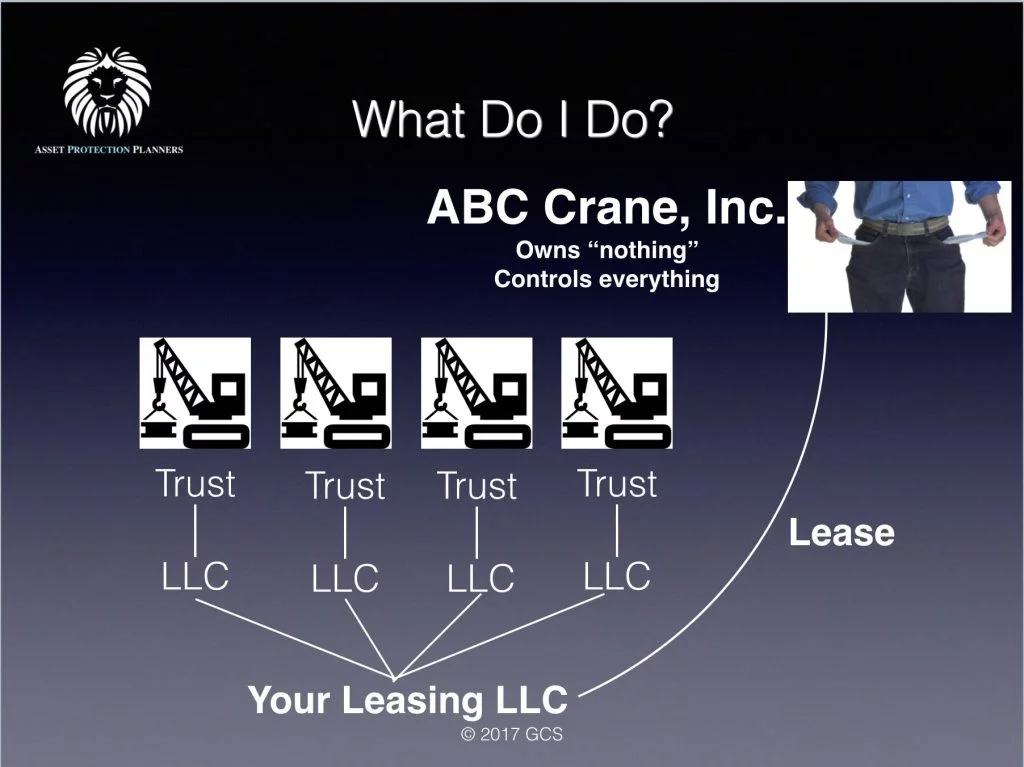

Imagine you run a company called ABC Crane Inc. You’ve taken all of the above steps to create a strong business asset protection strategy. You own nothing and control everything. Your main company leases from one central leasing company (that you also own), and one main company handles the leases on the equipment for your other companies.

In the above situation, your primary company holds no assets. It simply makes a lease payment to the central leasing company you formed to oversee the LLCs that own your equipment. These LLCs, in turn, act as the beneficiary of a US-based title holding trust. Using this format, you can control the LLCs with your primary company, which keeps your business assets at a distance, protecting them from lawsuits.

Learn more about asset protection strategies for small businesses.

Protecting Real Estate

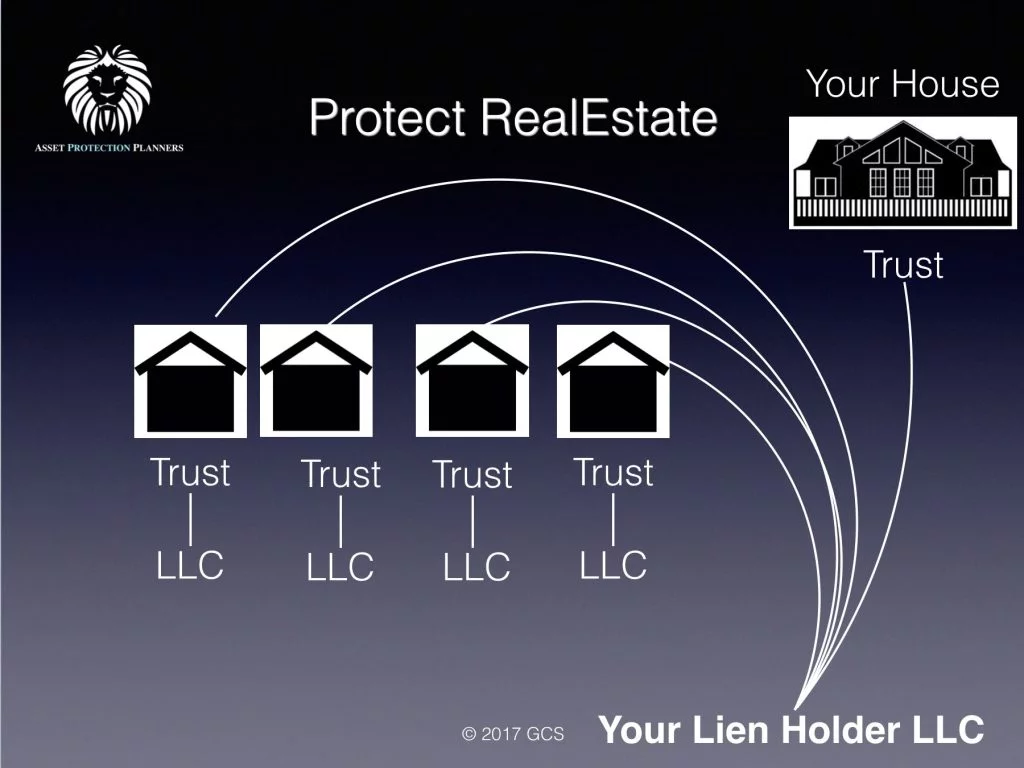

You can use the above process to protect real estate as well. Each piece of real estate is in a separate land trust, in this case, which operates similarly to a title holding trust. The beneficiary of your land trusts, in turn, are LLCs. That is, a separate LLC is the beneficiary of each trust.

Implementing the above structure ensures that you have privacy of ownership through the trust. You also have the lawsuit protection if any of your properties incur liability. That way, you’re not piling all your liability into the same entities that own your real estate.

So, if you’re sued personally, the LLC protects you from losing your stake in the company or anything inside of it. Your lien strips all the equity by recording mortgages or deeds of trust against all the properties. Your personal residence, however, should not be placed in an LLC because that will affect the tax benefits of home ownership. Thus, you own your home in a trust only.

With this structure in place, a contingency-fee attorney can run a search and see that you own nothing. This is because there is nothing in your name, personally. Moreover, if the attorney does decide to file a lawsuit, you have the proper protective measures in place.

The liens recorded against your equipment are simply lines of credit. So, if you need to sell a property to protect its value, you can. You can have an international third-party entity acquire these liens and deposit the proceeds in your offshore trust that we will establish for you. Once that process is complete, you’ll have a deposit statement to show that you have distributed the proceeds from the lines of credit. You can use this statement to demonstrate to a judge that the loan is legitimate.

Protecting Cash

Cash is likely one of your business’s most valuable assets. We protect cash using offshore asset protection trusts. Put in simple terms, these tools exist outside of the jurisdiction of U.S. courts. So, if you lose a lawsuit in the United States, the trustee of an offshore trust can refuse to hand over your assets on the grounds that U.S. rulings have no power in other jurisdictions.

Let Asset Protection Planners Keep Your Business Safe from Lawsuits

If you’re ready to ensure that your business is protected against lawsuits and other threats, give us a call. We’ve spent decades establishing trusts, LLCs, and other business asset protection strategies for countless clients.

For more information on our business asset protection strategies, fill out the form on this page to schedule a free consultation.