The first thing a lawyer will do when considering a case against you on a contingent fee basis is to do an asset search. It’s the same thing an experienced litigant will do before handing over a hefty retainer. When he or she is attempting to discover the amount of money you possess, you need to remember that real estate deed copies and taxes paid on your property are available for public consumption. Anyone can access them. Average income in your neighborhood – easily accessible. The car you hold title to in your name – easy to find. Where you work – a simple Internet search will usually do.

How much you make and how much you’ve saved – this organization has repeatedly seen private investigators find out without much effort. The secret for how to protect your assets? Secure your wealth and prevent your asset information from going public by using the proper legal tools.

Land Trusts

With a land trust, you can hold title to your property in the name of the trust/trustee instead of your own name. This keeps your name out of the public records. So, if someone unknown to you attempts to find out where you live, what property you own or what your real estate holdings are worth, finding that information becomes more difficult. The land trust provides the cloaking, which keeps your real property holdings private.

If you plan to establish land trusts for your personal residence or other real estate holdings, the good news is that they are available for use in all states, through common law, whether or not their statutes specifically address them. Remember, not every possible human act has been codified into law. Just like there are no known laws specifically authorizing the wearing of red shoes, what you will eat tonight, and who dates your daughter, not all state statutes specifically address the use of land trusts. They don’t need to. Unless there are laws to the contrary (of which there are we have found in in the United States), common law permits their use. This organization has established land trusts for use in all U.S. States.

Privacy vs. Asset Protection

Whereas the land trust is not an asset protection device, it is a privacy tool. Consider making the beneficiary of each land trust a separate limited liability company. For your personal residence, it usually makes most sense to name yourself as the beneficiary from a tax perspective. That way you can take advantage of the interest deduction, the allowable tax-free profits upon the sale of the home, etc.

A mortgage lender cannot forbid the transfer of a home into a land trust if the property is between one and four dwelling units and the owner remains as beneficiary of the trust (Garn St. Germain Depository Institutions Act of 1982). It would be wise to inform the insurance company that your properties are in land trusts.

Title Holding Trusts

Title holding trusts are similar to land trust in that they provide privacy of ownership of non-real estate assets. You can use a title holding trust to own vehicles privately. Since automobile ownership is a matter of public record, why own them in your name? If you own a newer 500 series Mercedes-Benz, a 600 series BMW, high-end Tesla or the like, a potential plaintiff or contingent fee attorney can easily find out. That could get his or her juices flowing that you are a deep-pocket.

Filing a lawsuit or taking a case on a contingent fee basis is a business decision. When they look for what you have and find no real estate and no cars, they’ll think twice about proceeding with case. Like land trusts, title holding trusts are not asset protection tools, they are privacy tools. This organization has seen hundreds of people keep cars that they would have otherwise lost by merely disguising their ownership in title holding trusts.

Living Trusts

For estate planning, there are few tools as good as the living trust. When you form a living trust, the trustee can be you or someone else. A living trust can act as the serving tray that serves your assets to your heirs up on your death. Your estate can avoid probate fees – the legal process of transferring assets from the deceased to the living. There are no such fees because the title to the property doesn’t need to change. It’s still in the trust. Your heirs simply become the new beneficiaries.

Instead of hearing, “First I’ll need a $10,000 retainer,” from an estate lawyer your heirs simply take the trust and a death certificate down to the bank and the money is theirs. Alternatively, you may have the trust drafted such that a trustee or trust company steps in and provides specified amounts at specified ages, regular support payments, payments for education, living expenses, etc. You can require your heirs to accomplish specified goals, such as certain levels of educational attainment in order to receive specified amounts. Your trust, your choice. This gives you control of the distribution of your assets long after your death.

Just like there are different motor vehicles for different uses, there are different trusts for different uses. There are powerful asset protection trusts that are available. However, a living trust is not an asset protection tool. It is an estate planning tool. Its main purpose is to give your assets to your heirs when your days are done.

Corporations for Asset Protection

Corporations are useful for legally protecting yourself from business lawsuits. The law calls a corporation a separate person. When someone sues that person, the lawsuit is directed at it, not you. Thus, the corporation can act as a wall between you and your business to help protect your personal assets.

When you operate your business as a privately held corporation, then you can generally sell stock in your company free from public disclosure, protecting both the price paid and the name of the buyer. Just make sure you comply with the state and federal securities statutes. If it becomes a publicly traded company, the law requires more disclosures.

Privacy

Most states require corporations to release the names of officers and directors. If you wish, you may elect to have nominee officers and directors who show up in “name only,” but you, as the voting shareholder, have the ultimate control. The names of stockholders typically stay out of the public records.

Corporations also allow for creative maneuvering of assets. For instance, let’s suppose you are in the process of purchasing expensive equipment or vehicles. The corporation already owns them. You can have the owner leave the property in the corporation, or place it in a new one. Then the seller can transfer the stock in the corporation to you. Make sure to get advice from a CPA on how you best handle a transaction of this nature from a tax perspective.

LLCs and Limited Partnerships (LPs)

For real estate assets, both limited liability companies (LLCs) and Limited Partnerships (LPs) work well for protection. LLC owners do not generally have liability for business debts or actions of employees. The benefit of an LLC is that it shields the one(s) in charge, the managers, business liability. With a limited partnership, on the other hand, the general partner (GP) is vulnerable. So, people now use LLCs almost exclusively instead of LPs.

Furthermore, as long as your LLC has been properly established, when someone sues you in your personal life, there are legal provisions that can protect you from losing your membership in your LLC. They may get a judgment against you. But there are laws preventing them from taking your LLC or anything inside of it.

Passive Investments

LLCs are also great tools to own passive investments. Unlike a corporation, which doesn’t usually work well from a tax perspective for owning a stock brokerage account, an LLCs default tax flow-through status allows you to take deductions and report gains as if you held the investments in your own name. However, unlike holding them in your own name the LLC offers favorable asset protection advantages. We discuss these advantages below.

It is usually a fast process to form an LLC in most states. Have it set up professionally because there is quite a bit to it, including drafting the articles, operating agreement, membership certificates, etc. You want to make sure that when you need it to protect you that you had it set up right. If you missed something, you can believe that your opponent’s attorney will make a major issue of it in court and drive a truck right through it. So don’t scrimp. Have it set up by someone who does it every workday.

LP and LLC Background

Before the invention of LLCs, limited partnership were one of the most common tools people used to own real estate. With either structure, you can protect your properties when someone sues you, personally. Why can someone not take your LP or LLC if they sue you? There is a reasoning behind this; mostly, fairness. To make sure the actions of one partner or member do not affect the actions of others, judgment creditors generally cannot take these entities, nor can they seize the property inside.

Business people typically structure an LP that for asset protection purposes as a family limited partnership, or FLP. An FLP is simply a limited partnership where the only partners are members of a family. (The same is true for members of a family LLC or FLLC.) Professionals establish both an FLP and LP with written agreements between at least two individuals. There are at least two types of partners, a general partner and a limited partner.

The Dangers of Limited Partnerships

The general partner runs the business and is liable for debts of and lawsuits against the partnership. That is why we usually place a corporation or LLC in that position. It absorbs the liability.

The limited partner is a passive investor and does perform actions within the business. The limited partner is also not liable when the LP is sued. If a limited partner does start to manage the LP, however, he will be legally considered to be a general partner with all of the associated liabilities. So, if a limited partner wants to perform services for the LP, he or she will want to perform those services as an agent of the corporation or LLC that serves as the general partner. Contracts will be signed, for example, “Pat Smith, Manager of XYZ LLC, as general partner of ABC, LP.”

LLC & LP Owners

Whereas a one-person LLC is quite common, an LP requires at least two partners. A one-human LP, however, is possible where one partner is a natural person and the other is a legal person, such as a corporation or LLC. A man named John can hold, for example, a 95% interest as a limited partner, and the LLC he owns can hold a 5% interest as a general partner.

Profit sharing can occur between or among partners depending on their percentage of ownership. If the written limited partnership agreement allows it, the general partner can receive income over and above his, her or its proportional ownership interest.

We Love Charging Order Protection

When a litigant sues a partner, a creditor can only obtain a “charging order” against that partner’s interest in the LP. It is the same for one’s membership interest in an LLC when someone sues an LLC member. A charging order acts as a lien against that person’s interest in the LP or LLC. It can allow the creditor to have access to profits that are distributed to the partner. However, if an FLP is utilized, the general partner (or LLC manager) can step in and simply stop the profits from being distributed.

How Charging Orders Work

There is a big bear trap for the creditor who sues you and then receives a charging order against your LP or LLC. Whoever has the right to receive profit distributions from an LP or an LLC must pay taxes on that proportion of the profits whether or not those profits are actually distributed. So, if a charging order lien is granted and the general partner decides to leave the profits inside of the LP, the creditor is still liable for the tax bill. You read that right; person who sued you receives no money but now has to pay your taxes. (Revenue Ruling 77-137.)

The charging order protection is available to both LPs and LLCs when established properly. In most states only multi-member LLCs receive charging order protection, not single-member ones. As of this writing, only Nevada, Wyoming and Delaware offer charging order protection for single-member LLCs.

Offshore LLC – Strong Asset Protection Tool

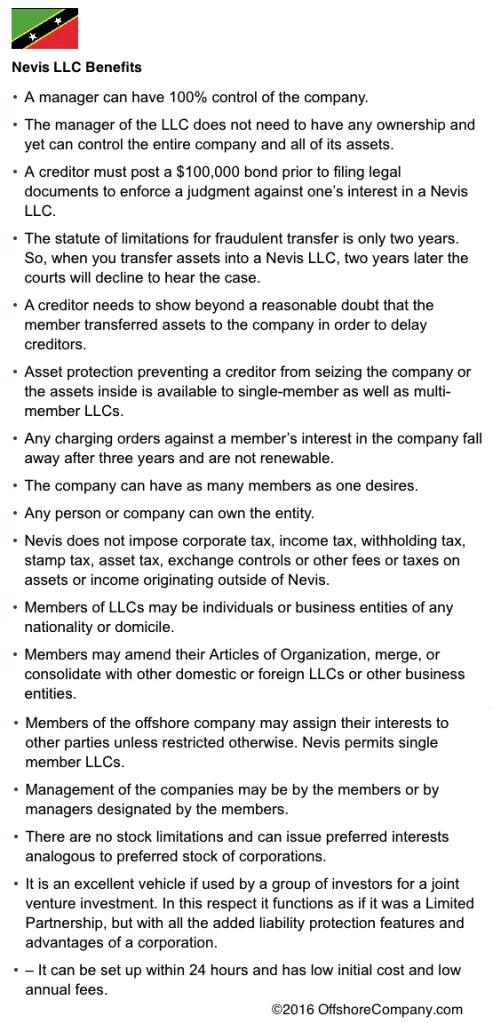

Want even greater protection? Establish an offshore LLC. The one with the most favorable asset protection laws? Nevis. Below are many of the reasons why.

Asset Protection Trusts – Strongest Asset Protection Tool

Let’s get straight to the point. Many experts agree that the offshore asset protection trust is the strongest legal tool for protecting liquid assets. The most favorable asset protection trust laws, history and character are found in the Cook Islands, followed by Nevis with Belize in a distant third.

Frankly, we have not seen US-based a.k.a. domestic asset protection trusts fare as well as offshore. Sure, this organization establishes domestic asset protection trusts, too. But with the ever-increasing theories of legal liability and the blunt reality that the assets are still under the jurisdiction of local judges, we have seen too many domestic trusts penetrated.

Domestic vs. Offshore Trust

Of the domestic trusts, currently Nevada is most favorable. Will it work if you live in California, New York or Florida? Maybe. Maybe not. We have seen both results. If a judge in California tells a Nevada trustee or a banker in New York to hand over the money or go to jail, what do you think they are going to do? The judge doesn’t have that weapon at his or her disposal offshore.

With the offshore trust in the Cook Islands, the trust jurisdiction and the trustee are both beyond the reach of the local courts. The local judge says, “hand over the money,” and the foreign trustee says, “sorry, not going to.” The funds in the trust should be in an international bank that does not have corresponding local branches.

Trust Structure

Most often the offshore trust strategies [1] come with three elements: (1) The offshore asset protection trust (in the Cook Islands, for example), (2) an offshore LLC (such as one in Nevis) wholly owned by the trust, and (3) one or more bank and/or brokerage accounts (such as one in Switzerland or Luxembourg). You are the manager of the LLC and signature on the bank account. When the lawsuit gets too hot, the trustee can step in as LLC manager and protect you.

Worried about a Cook Islands trustee running off with your money? There are safeguards in place for this. First, the trustee is bonded by an insurance company, so your funds are insured. Second, the trustee must undergo intense background checks to even be considered for a trustee license. Third, this organization has established well over a thousand trusts since 1995 and has only witnessed integrity with Cook Islands trustees. Fourth, the region depends on the financial services sector to support its economy so regulators oversee trustees like drill sergeants.

Asset Protection Trust & Estate Planning

Offshore asset protection trusts can also be drafted with living trust-like estate planning provisions. So, the equivalent of “when I die everything goes to my spouse and when we both die everything goes to the kids,” or your desired alternative, can be incorporated into an offshore asset protection trust deed.

Want to know more? The offshore asset protection trust is discussed in great detail on this website.

Annuities for Asset Protection – Well, Maybe

Annuities are occasionally touted as asset protection vehicles. However, there are several challenges. First, they only work in some states. Second, if placed in an annuity when a potential defendant knows a lawsuit is on the horizon, the judge will likely disallow transaction as a fraudulent transfer. Third, the annuitant loses full access to the money.

In an annuity, an individual merely receives a regular payment installment over a certain amount of years. With a fixed annuity, that amount usually remains the same from beginning to end. Then, in a variable annuity, the amount paid out depends on the investment return.

Annuities – Too Restrictive For Most

Transferring cash into an annuity is considered permanent. Getting a three-percent return on an annuity and want to move the cash into a real estate investment that could double your money? Forget about it. The money is stuck inside the annuity. With an international trust, when the legal problems go away you are free to do with your cash what you want. All of it.

If someone decides to set up an annuity, they can pay one large sum or make payments on the annuity. As mentioned, annuities are creditor exempt in some states. However, the amount of the exemption from state to state can vary from just a few hundred dollars or to an unlimited amount of money. Some states exempt all annuities, and some others only allow annuities to be exempt if they are paid out to a spouse, children, or other dependent.

Good for Them, Not You

Why do financial institutions offer such tools? Because they invest your money in high yielding investments, such as the stock market and receive a respectable long-term return and give the annuitant a low yielding long-term return. The institution keeps the difference. So, in many cases, the annuity tends to work out better for the annuity salesperson than the annuitant. Since there are other asset protection vehicles that offer you more flexibility and control, consider the alternatives.

Asset Protection Tool Summary

In summary, there are a variety of tools to use for asset protection and lawsuit deterrence. The following is a summary of options and strategies discussed here.

- Land trusts for privacy of ownership of real estate.

- Title holding trusts for privacy of ownership of vehicles.

- Living trusts for estate planning.

- Corporations to operate a business or transfer assets privately.

- LLCs (and LPs) to own real estate and passive investments such as stock brokerage accounts. For greater protection consider an offshore LLC.

- Asset protection trusts for protecting liquid assets. Experts consider the offshore asset protection trusts, especially ones in the Cook Islands, the strongest asset protection tool for this purpose. Use in combination with an offshore LLC and international bank and/or brokerage account.

- Annuities can provide asset protection in some states. But with their low yield and permanent loss of control, there are other alternatives that may be more favorable. As an annuity salesperson once said, “They are for selling not buying.”

- Finally, if you are going to establish asset protection tools, do it right and have it done professionally. You wouldn’t do medical surgery on yourself. Don’t do financial surgery on yourself. There are too many variables and there is too much at stake. Leave it to the professionals.

- Want to know more? There are numbers and forms on this page that can get you in touch with experienced professionals who can help you design a plan for yourself.