You’ve probably heard about revocable or living trusts as a tool for avoiding probate. But when it comes to real asset protection and long-term estate planning, irrevocable trusts offer far greater benefits. These trusts are designed to put layers of protection between creditors and your assets by essentially separating you from your assets. And unlike a revocable trust, the terms of an irrevocable trust can’t be altered without the agreement of all beneficiaries. That rigidity, which may sound inconvenient when compared to the more flexible revocable trust, is its greatest strength.

In this article, we’ll provide you with some irrevocable trust examples and explore the pros and cons of irrevocable trusts to help you determine if this trust structure is right for your financial needs:

How Irrevocable Trusts Work

Irrevocable trusts work by transferring the control of your assets away from you and into the hands of a trustee. This trustee must be an independent party—someone who is not a close family member or employee—to maintain the legal separation essential for asset protection.

If you set up the trust shortly before you face a creditor judgment, a court might void the transfer as fraudulent. That’s why the smartest move is to establish and fund irrevocable trusts well before you need them. You can even set up an irrevocable trust offshore to gain greater protections from creditors and domestic court rulings.

Pros and Cons of Irrevocable Trusts

Like most financial tools, irrevocable trusts come with both advantages and disadvantages, including:

Pros:

- Shields assets from lawsuits, creditors, and divorce settlements

- Protects eligibility for government programs like Medicaid

- Creates structured inheritance plans that safeguard wealth for future generations

- Enables philanthropic giving through charitable trusts

Cons:

- Difficult or impossible to alter once created

- Requires giving up ownership and direct control over assets

- May involve significant setup and legal costs

- Can trigger tax implications if not structured properly

- Not a “one-size-fits-all” solution—each trust type must be carefully customized

Ultimately, the pros and cons of irrevocable trusts will depend on your specific situation. By looking over this list and checking out various irrevocable trust examples, you can decide if one is right for you.

Irrevocable Trust Examples

Irrevocable trusts come in several forms and can be used for everything from asset protection to estate planning. Some examples of these trusts include:

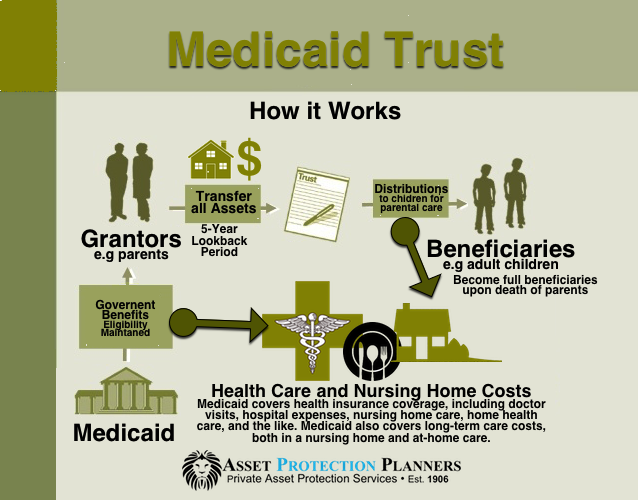

Medicaid Trusts

If you or your spouse spends considerable time in a nursing home, your dream of leaving assets to your heirs can go out the window. People with significant assets are required to cover the cost of everything Medicaid pays for, rapidly draining their life savings. A Medicaid irrevocable trust is designed to prevent that from happening. When used properly, a Medicaid trust will allow you to receive assistance from the Medicaid program, which can cover the cost of nursing homes and end-of-life care.

Advantages

A Medicaid trust does more than protect assets from creditors. It also eliminates your so-called “countable assets” for Medicaid purposes. In essence, these trusts shrink your net worth, allowing you to access Medicaid assistance, when necessary, rather than paying out-of-pocket for medical services.

Disadvantages

With a Medicaid trust, timing is everything. By law, a Medicaid trust must be funded at least five years (60 months) before you or your spouse applies for Medicaid. If either one of you must enter a nursing home before that 60-month time frame, you can pay for nursing home costs with assets outside of the trust until the IRS “look-back” period ends.

Irrevocable Trust for College Savings – 2503(c) Minor’s Trusts

If you want to ensure your child or grandchild can afford a good higher education without drowning in debt, a 2503(c) minor’s trust, also known as an irrevocable children’s trust, fits the bill. Such an irrevocable trust is not the best choice for every potential grantor, but it does serve as a tax-efficient instrument for higher education savings.

Disadvantages

The trust is intended for college expenses, but the intended recipient does not need to go to college to access the trust funds. Once they reach the age of 21, they receive the property and income in the trust. At that point, they can spend the money however they please, which may not be ideal.

Advantages

On the plus side, you can have your asset protection planner convert a 2503 (c) trust to a Crummey trust, which permits annual gifts to keep benefiting from the gift tax exclusion even after the beneficiary turns 21. Just know that neither you nor your spouse should act as the trustee of a Crummey trust. That’s because if the trust exists when you die, it becomes part of your taxable estate. Have a trusted relative not directly up or down the family tree (e.g., not your children, parents, or grandparents) or a professional fiduciary serve as trustee.

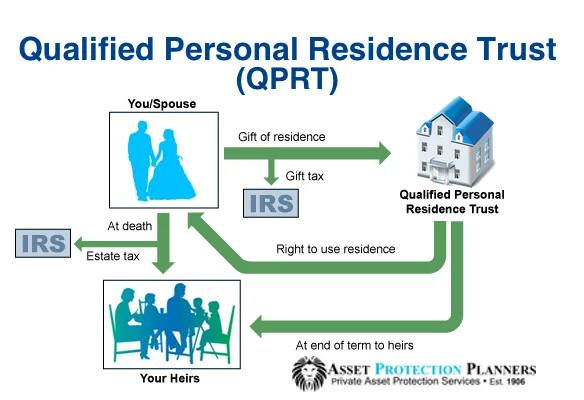

Qualified Personal Residence Trusts

A qualified personal residence trust (QPRT) allows you to place your primary or secondary residence into a trust, greatly reducing your estate tax liability. You can continue to live in the dwelling rent-free for the length of the trust term. After that, the home passes on to your heirs, or can remain in the QPRT for their benefit.

Advantages

There are tremendous asset protection advantages for this type of irrevocable trust. Once a piece of real estate is titled to a properly structured QPRT, your legal opponent generally cannot take it from you. This is especially useful in states that have no homestead protection, such as New Jersey and Pennsylvania. QRPTs also provide a tremendous advantage to those states with high real estate prices, such as California and New York, where home values can far exceed the amount protected by homestead exemptions.

Homeowners are eligible for more than one QPRT. A single person may have two QPRTs, while a married couple may include as many as three personal residences. You can still deduct property taxes and mortgage interest on your tax returns during the QPRT term.

Disadvantages

QPRT law is complex, and making a mistake during the trust setup and management can undo its protections. For instance, if you continue to live in the home after placing it in a QRPT without paying rent, the property can become part of your taxable estate. To understand all the potential pitfalls of this useful asset protection tool, we recommend working with financial professionals who understand trust structures, like the team at Asset Protection Planners.

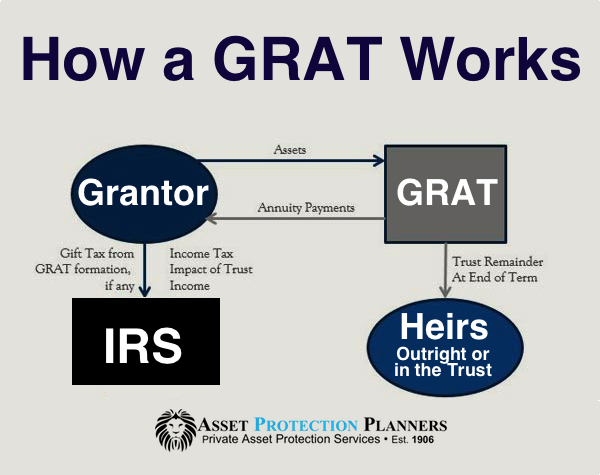

Grantor Retained Annuity Trusts

Grantor retained annuity trusts (GRAT) allow you to minimize tax liability when passing on assets to children or grandchildren.

Advantages

By using a GRAT, you avoid paying gift taxes. There are various types of grantor-retained trusts available, and your attorney will advise you on the best type for your needs.

Disadvantages

There are pitfalls with a GRAT. First of all, you must outlive the trust terms. If you don’t, the trust assets revert to your estate, along with applicable taxes. Secondly, because it is an irrevocable trust, you can’t change the beneficiary. That means if your child or grandchild develops a gambling habit, substance abuse issue, or other serious problem, they will still receive the assets when the trust term expires.ust terms, which obviously raises uncertainty. If you die while the QPRT is in effect, the home goes back into your estate for tax purposes.

Special Needs Trusts

If you have a child or other relative with special needs receiving government benefits, such as Medicaid or Supplemental Security Income, leaving assets to that individual outright could make them ineligible for those benefits. A special needs trust, also known as a supplemental care trust, permits funds in the trust to purchase items not provided by government benefits.

Advantages

A supplemental care trust can help anyone with special needs pay for essential services and items without forfeiting their government benefits.

Disadvantages

Special needs trusts can only be used to pay for certain items and services, such as:

- Home health aide salaries

- Transportation – including wheelchair-accessible vans

- Computers and related equipment

- Tuition for educational programs and classes

Funds from the special needs trust cannot supply everyday basics such as food, shelter, and utilities.

Set Up an Irrevocable Trust With Help From Asset Protection Planners

Setting up an irrevocable trust is one of the best ways to protect assets. And now that you’ve learned about the pros and cons, and seen various irrevocable trust examples, you can determine if one is right for you. Should you choose to set one up, Asset Protection Planners is here to help! Our team of experts has set up thousands of trusts and will help you choose one that will protect your assets for yourself and future generations.

Schedule a free consultation now to start protecting your wealth today.

Irrevocable Trust FAQ

How Do You Set Up an Irrevocable Trust?

People often think setting up a trust is only for the very wealthy, but that’s not true. An irrevocable trust can benefit anyone who wants structure, privacy, control, and protection over how their assets are used in the future. Whether your goal is to guard your children’s inheritance, prepare for long-term care costs, or donate to charity in a tax-efficient way, this type of trust offers a legally sound foundation.

Building an irrevocable trust is both a strategic and emotional process. You need to weigh the cost of giving up some control over your assets against long-term stability. For many, the safety offered by these trusts is more than worth the trade-off in control.

Keep in mind that once you create an irrevocable trust, you can’t modify it at will. To that end, it’s important to set it up correctly the first time. Every single item in the formation document, from trustee appointment terms and beneficiary definitions to tax provisions and jurisdiction choices, affects how it functions.

Timing is vital, too. You can’t move assets into a trust after a lawsuit begins or when a financial crisis is looming. That’s why it’s best to treat irrevocable trusts as a proactive, not reactive, defense.

Setting up one of these trusts takes careful consideration and professional help. You should always work with a financial or legal professional, like the team at Asset Protection Planners, when you start to establish an irrevocable trust. When you do, the setup process will usually involve the following steps.

Step-by-Step Guide

- Identify your goals (tax reduction, Medicaid eligibility, asset protection, etc.).

- Choose an independent trustee who can act impartially.

- Consult with an experienced estate planning attorney.

- Draft clear, comprehensive documents tailored to your objectives.

- Select the trust type—Medicaid, CRT, QPRT, GRAT, or others.

- Gather the assets you plan to transfer into the trust.

- Execute legal documents transferring ownership to the trust.

- Appoint beneficiaries and specify how distributions should occur.

- Understand any federal or state tax implications.

- File required tax forms or gift tax returns.

- Keep full records of transfers and funding dates.

- Ensure your trustee understands fiduciary duties.

- Review compliance with Medicaid and creditor protection rules.

- Educate beneficiaries about the trust’s terms and timing.

- Maintain communication with your attorney and trustee.

- Revisit goals annually to confirm the trust still aligns with your future plans.

- Avoid conflicts of interest by keeping roles clearly divided.