Imagine having a shield so strong that it protects your wealth from lawsuits, creditors, or unexpected financial challenges. An irrevocable trust can offer precisely that level of security.

But what exactly is an irrevocable trust, and how can it secure your financial future? In this guide, we’ll unravel the mystery, break down the advantages, and show you how these powerful legal tools work. Whether you’re looking to safeguard your family’s legacy or fortify your assets against unforeseen threats, understanding irrevocable trusts could be the financial game-changer you’ve been searching for.

Let’s dive in and discover if this is the key to your peace of mind and financial freedom.

- Key Terms Used

- What Is an Irrevocable Trust?

- The Basics of Setting Up an Irrevocable Trust

- Common Benefits of Irrevocable Trusts

- Typical Uses for Irrevocable Trusts

- Revocable vs. Irrevocable Trusts

- Why Irrevocable Trusts Work Best for Asset Protection

- Irrevocable Trusts Aren’t Necessarily Unchangeable

- Which Works Better? Domestic Irrevocable Trusts vs Offshore Irrevocable Trusts?

Key Terms Used

Before getting into the fine details of irrevocable trusts, you need to know a few key terms, including:

- Beneficiary – The beneficiary is any party who can benefit from the trust’s assets, whether it be the trust creator’s family member, a charity, a business, or even the trust creator themselves. Beneficiaries typically receive trust distributions at set intervals determined by the trustee or grantor, though trust benefits come in many different forms.

- Grantor/Settlor – The grantor (also known as the settlor) is the person who created and funded the trust. During the trust creation process, they deposit assets into the trust and then cede control of those assets to the trustee.

- Trustee – A trustee is the person or entity in charge of managing the trust. They are to follow the terms of the trust that determine when to distribute benefits to the listed beneficiaries. Trustees, as clarified in the trust document, also legally hold the trust’s assets, which protects those assets when the settlor is sued or pursued by creditors.

What Is an Irrevocable Trust?

An irrevocable trust is a type of trust that cannot be easily revoked or altered once it’s created. Establishing such a trust requires the settlor to relinquish significant control over the assets to the trustee. While this might initially seem like a drawback, it’s actually a powerful advantage. By legally distancing the settlor from the assets, the trust makes it far more challenging for creditors to lay claim to them.

Consider this: If you, as the settlor, retained direct control over the trust’s assets, a court could compel you to use that control to satisfy a legal judgment. In other words, retaining control could ultimately leave you defenseless, as it effectively places power in the hands of the court. By contrast, a trustee serves as a crucial buffer, protecting your assets and ensuring they remain out of reach of legal adversaries.

The Basics of Setting Up an Irrevocable Trust

Irrevocable trusts require three parties—the settlor, the trustee, and the beneficiary. When forming the trust, the settlor “grants” assets into it. Once deposited, those assets are officially a gift and cannot be returned independent of the trustee.

Though the grantor does not retain direct control of deposited assets, they can set usage conditions for those assets beforehand. The grantor establishes the trust asset’s original rules, terms, and intended uses. Both the trustee and beneficiary must abide by the grantor’s wishes. For example, the grantor may specify that the money placed in an irrevocable trust should only be used for a specific purpose, such as for college tuition or wedding expenses.

When the settlor transfers assets into an irrevocable trust, they transfer ownership to the trustee. Still, the trustee cannot do whatever they want with the assets. Many states and offshore jurisdictions have strict rules limiting trustee powers; they prevent trustees from conflicts of interest. Ultimately, the trustee cannot inadvertently use trust assets for their benefit unless the trust conditions allow it.

Common Benefits of Irrevocable Trusts

Irrevocable trusts have many advantages for those looking for a good asset protection and estate planning tool. They include the following:

- Protecting assets from judgments and creditors.

- Removing taxable assets from the estate so that the grantor can take advantage of estate tax exemptions.

- Allowing appreciating assets to gain value without severe tax implications for beneficiaries.

- Gifting a home to children with fewer tax implications.

- Gifting assets while being able to retain income generated from them.

- Preventing misuse by beneficiaries via grantor wishes.

Typical Uses for Irrevocable Trusts

Irrevocable trusts’ benefits make them effective for various use cases. Here are just a few ways you could use an irrevocable trust to improve your financial situation:

Asset Protection

Irrevocable trusts, when properly drafted, established in the right jurisdiction, and managed by an independent third-party trustee, are exceptionally effective tools for protecting assets from judgments and creditors. These trusts create a complete legal separation between the settlor and their assets. If a settlor with a well-structured irrevocable trust loses a trial and is ordered to pay the plaintiff, the trust’s assets remain shielded from legal claims.

This protection becomes even stronger with offshore trusts. In such cases, U.S. courts lack the authority to compel a trustee in a foreign jurisdiction to release trust assets, which adds a layer of security.

Estate Planning

Many people use irrevocable trusts to pass along assets after their death.

Here is a typical scenario concerning using an irrevocable trust for estate planning purposes:

A couple sets up an irrevocable trust. They make their children the beneficiaries. When they pass, their children receive payments from the trust. These payments can help them achieve financial security earlier in life.

In addition, a trust can provide substantial flexibility regarding how assets are doled out after the settlor’s death. Trusts may be drafted so that the beneficiary receives a single lump sum or a certain amount at set intervals. You can even set up your trust to cover certain expenses, like housing, education, and wedding costs, and exclude more frivolous expenses.

Additionally, a trust is often better than standard gifts from a tax standpoint. When assets are passed along via a trust, it can help reduce tax obligations.

Charity and Tax Benefits

Irrevocable trusts offer several tax benefits, primarily by removing assets from the grantor’s taxable estate. Thus, it can reduce estate taxes upon the grantor’s death.

Income generated by trust assets may be taxed differently depending on the type of trust and how income is distributed. For irrevocable trusts, income distributed to beneficiaries is typically taxed at the beneficiaries’ individual tax rates, which can sometimes be lower than the trust’s tax rate. Additionally, irrevocable trusts established for charitable purposes can offer significant tax benefits. Contributions to a properly structured charitable trust may qualify for a tax deduction in the year the assets are transferred, subject to certain IRS rules and limitations.

By transferring assets into an irrevocable trust, the grantor removes those assets from their taxable estate, potentially avoiding capital gains taxes on future appreciation if the assets are sold by the trust. However, the trust itself may still owe taxes on income it retains, such as interest, dividends, or capital gains, which are generally taxed at compressed trust tax rates. Proper planning is essential to maximize these tax benefits while complying with U.S. tax laws.

Life Insurance

One can even place insurance policies into a trust. An irrevocable life insurance trust (ILIT) can hold and control a term or permanent life insurance policy. Then, it distributes the proceeds when the insured dies.

Upon the policyholder’s death, the ILIT is excluded from the insured’s estate. Therefore, beneficiaries can increase the amount of money they receive without paying estate taxes. In addition, the life insurance trust can pay the decedent’s taxes, debts, and expenses. It can also ensure receipt of government benefits like Social Security or Medicaid since the trust assets are separate from those of the beneficiary.

In the same vein, an ILIT can protect insurance proceeds from lawsuits against the trust beneficiary. The irrevocable life insurance trust can also help avoid the generation-skipping tax (GST). This enables you to give proceeds to grandchildren and others without having to pay the 40% tax on distribution to those more than one generation removed.

Revocable vs. Irrevocable Trusts

A revocable trust, commonly called a revocable living trust, is an estate planning tool that a settlor can change from revocable to irrevocable at any time. So, if your needs change, you can make amendments freely without third-party interaction.

So, why doesn’t everybody set up a revocable trust instead of an irrevocable one? There are several reasons.

- A revocable living trust is part of your own estate for asset protection purposes. As such, it offers no asset protection from creditors or those who seek to sue you.

- It offers no segregation of assets. This can push your wealth levels above the maximum required to qualify for government benefits such as Medicaid or disability assistance.

- Upon your death, assets in the trust are yours for state and federal estate tax purposes.

Learn more about revocable vs. irrevocable trusts.

Why Irrevocable Trusts Work Best for Asset Protection

The primary reason people use irrevocable trusts is to protect assets from lawsuits. Legal theory commonly allows a creditor to step into the debtor’s shoes. In practice, this means that whatever the debtor could theoretically do to pay the creditor off, the creditor can force them to do so.

For example, let’s say the settlor of a trust could freely change the beneficiary. In this case, the one who sued the settlor could step into the settlor’s shoes and change the beneficiary to himself. If the trust allowed the settlor to independently spend trust assets on himself, the creditor could do the same.

A secondary asset protection benefit of irrevocable trusts is how they allow settlors to list out trust usage conditions. This ensures that the assets will not be used irresponsibly or in a manner that goes against the settlor’s wishes, even after their death. This is common in second marriages, where a spouse wants to ensure that children from the first marriage receive at least a portion of the assets.

Finally, irrevocable trusts contain spendthrift clauses. These clauses keep the assets in a trust separate from the beneficiary and the settlor. This ensures that a beneficiary’s creditor cannot seize trust assets until they are completely distributed to the beneficiary through previously established channels.

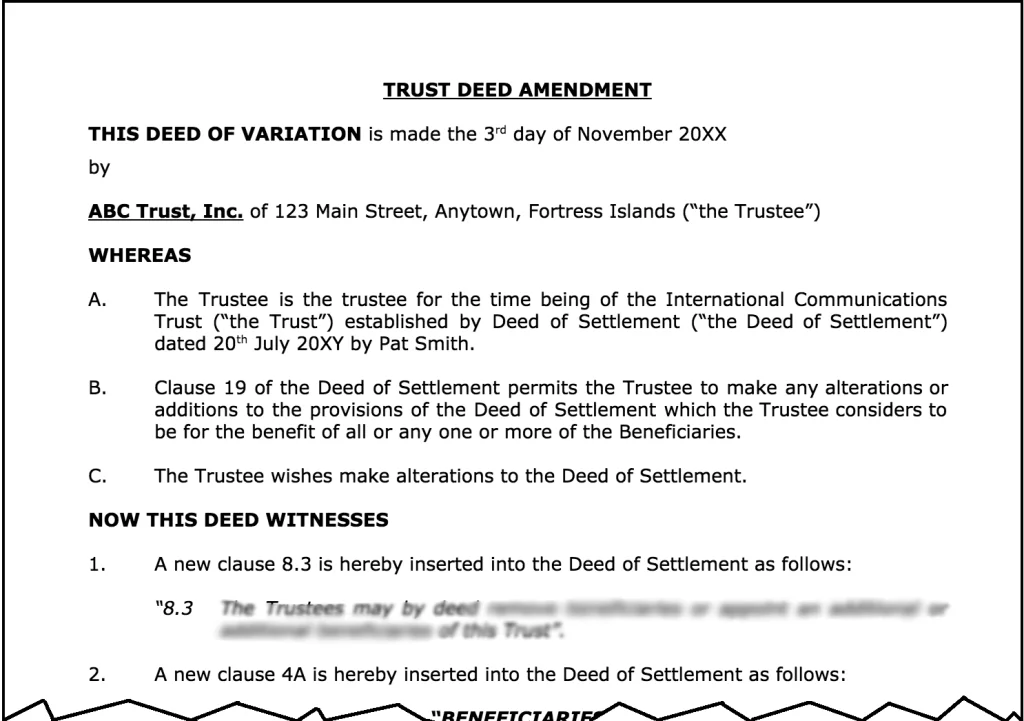

Irrevocable Trusts Aren’t Necessarily Unchangeable

One of the biggest concerns cited about irrevocable trusts is their inalterability. However, that concern is often overblown. There are ways to make changes to these trusts, and most can be made without reducing your asset protection abilities.

Here are a few ways irrevocable trusts can be changed without impacting their usefulness:

Changing the Trustee of an Irrevocable Trust

Don’t like the trustee? That’s okay. Simply fire them and hire another. Want to retain your asset protection? Here’s how: You can change the trustee to anyone but yourself, a family member, an agent of yours, or a controlled employee. This is because courts consider these people your alter ego.

Allowances for the Unforeseen

Properly drafted trusts allow for a wide range of future possibilities. Certain circumstances may allow for a change to the beneficiaries or trustees. For example, if one beneficiary tragically passes or develops an issue that drastically alters their behavior, the agreement can be altered. A well-drafted trust addresses all of these circumstances.

Learn more about the advantages and disadvantages of irrevocable trusts.

Which Works Better? Domestic Irrevocable Trusts vs. Offshore Irrevocable Trusts

Choosing between a revocable and irrevocable trust isn’t the only decision to make when setting up your asset protection strategy. You also need to decide whether your trust will be based in the United States or offshore.

Here’s a quick breakdown of domestic and offshore irrevocable trusts:

Domestic Trust for Asset Protection

A domestic asset protection trust is an excellent choice for people looking to maintain moderate asset protection benefits without relying on foreign trustees. These trusts are not quite as reliable as offshore trusts, as even the strongest domestic asset protection trust states are beholden to other states’ judgments. Additionally, the trust protections afforded by US law are not nearly as powerful as those in many offshore jurisdictions.

That being said, placing your assets in an irrevocable domestic asset protection trust still makes it harder for creditors to reach your assets. Additionally, these trusts might provide several tax benefits and are well-suited for estate planning.

As of this writing, several states offer irrevocable asset protection trusts. They include:

- Alaska

- Delaware

- Hawaii

- Nevada

- New Hampshire

- Mississippi

- Missouri

- Ohio

- Oklahoma

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Wyoming

Offshore Trust for Asset Protection

Offshore irrevocable trusts, commonly called Offshore Asset Protection Trusts (OAPT), take asset protection to the next level. With trusts in the Cook Islands (near New Zealand) or Nevis (in the Caribbean Sea), you can be the settlor and the beneficiary. These jurisdictions have special laws, so you can still maintain some control over the trust in cooperation with the licensed, bonded trustee.

The greatest advantage of an offshore irrevocable trust is that trustees residing in foreign jurisdictions are not obligated to comply with U.S. court judgments. When presented with a U.S. court order, these trustees are legally and ethically bound to reject it, as compliance would undermine their duty to protect your assets.

For a creditor to access assets in an offshore irrevocable trust, they must successfully prove to a foreign court that a fraudulent conveyance occurred—and this must be within the strict time limits set by that jurisdiction’s laws. Leading offshore trust jurisdictions, known for their robust asset protection statutes, make such legal challenges extraordinarily difficult.

Create an Effective Irrevocable Trust with Help from Asset Protection Planners

If you need more protection for your assets, a proper irrevocable trust is often the way to go. However, these trusts only work effectively if they’re drafted by an experienced asset protection professional. Luckily, you’ve come to the right place!

At Asset Protection Planners, we’ve set up effective domestic and offshore irrevocable trusts for decades. We’ll help you design a trust that meets your needs and keeps your wealth out of the hands of creditors and plaintiffs.

Get the protection you need. Contact us today for a consultation!