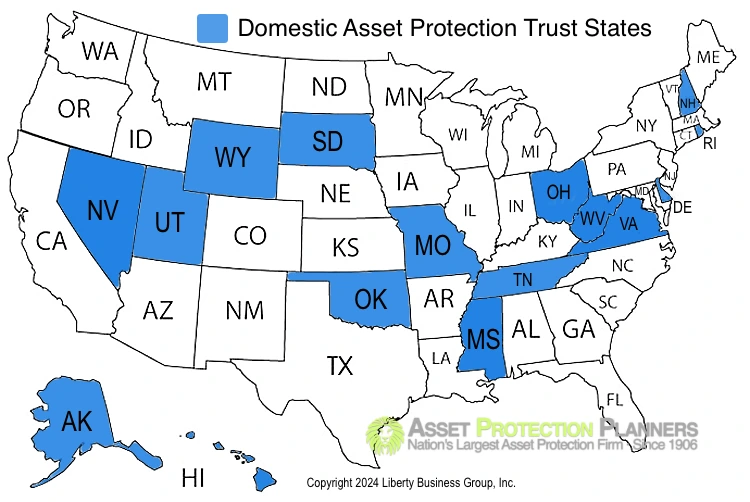

There are currently 17 states in the U.S. that allow the creation of domestic asset protection trusts (DAPTs), where the settlor can also be a beneficiary and receive asset protection:

- Alaska

- Delaware

- Hawaii

- Michigan

- Mississippi

- Missouri

- Nevada

- New Hampshire

- Ohio

- Oklahoma

- Rhode Island

- South Dakota

- Tennessee

- Utah

- Virginia

- West Virginia

- Wyoming

In the past, if you wanted to protect your assets against lawsuits and creditors, you only had one option — offshore asset protection trusts. Today, that’s no longer the case. Domestic asset protection trust have emerged as an alternative for anyone who’s wary about placing their assets with a trustee far from home.

As of this writing, there are 17 domestic asset protection trust states, each with unique protections exemptions, and advantages. We’ll walk you through the basics of each DAPT state to give you a clear picture of which best fits your needs.

- The History of Domestic Asset Protection Trusts in the States

- DAPT Roles and Key Terms

- Domestic Asset Protection Trust Basics

- All 17 Domestic Asset Protection Trust States

- The Best Asset Protection Trust States vs. Offshore Asset Protection Trusts

The History of Domestic Asset Protection Trusts in the States

DAPTs were first created in 1997; Alaska and Delaware were the first two domestic asset protection trust states. Both states based their laws on preexisting offshore asset protection trusts in The Cook Islands and the Isle of Man in an attempt to keep assets within state borders.

Since 1997, 15 other states have adopted DAPT laws. Each state has distinct trust laws impacting the level of asset protection that settlors can expect from their trust. Today, Nevada offers the strongest defenses of all asset protection trust states.

Despite the growing popularity of US-based asset protection trusts, none of the top five most populous states (California, Texas, Florida, New York, and Pennsylvania) have created DAPT laws. Those living in these states must create their trusts elsewhere.

DAPT Roles and Key Terms

In this article, we’ll use various terms to describe certain roles and aspects of domestic asset protection trusts. Below are the most important terms and their definitions:

- Settlor/Grantor: The settlor or grantor creates and funds the trust. Typically, this will be you. There is no material difference between a settlor and a grantor.

- Trustee: A trustee is the person or business entity appointed as the trust’s manager and legal owner. Most states do not allow settlors/grantors to serve as trustees, though some allow them to be co-trustees with limited influence over trust administration. Most states require trustees to be residents of the state where the trust is formed. If the trustee is a business entity, they must be licensed to serve as a trustee within the state.

- Beneficiary: A beneficiary is any entity that will benefit from trust assets, such as a family member of the settlor or a charity of the grantor’s choice. Some states also permit the settlor to be a beneficiary. Common benefits include trust distributions and receiving a portion of the trust value when the settlor passes. Beneficiaries cannot influence how trust assets are used. If distributions are handed out, it’s at the trustee’s discretion.

- Creditor: A creditor is anyone who attempts to claim trust assets for debt collection purposes. Common examples of creditors include lawsuit plaintiffs, bill collectors, and ex-spouses.

- Irrevocable trust: Irrevocable trusts allow settlors to transfer their assets to a trustee, who manages the assets from that point forward. Once formed, irrevocable trusts cannot be altered or dissolved without the beneficiaries’ permission or a court order. All DAPTs are irrevocable trusts.

Domestic Asset Protection Trust Basics

Domestic asset protection trusts work similarly to offshore asset protection trusts. Both are trustee- owned irrevocable trusts that legally separate the assets from the settlor and protect them from creditors. Even if the settlor is ordered by a court to pay a creditor, they typically cannot use trust assets to do so.

There are limitations on how quickly assets can be protected by a trust and excepted creditors who can always pursue trust-held assets. There are also various other factors that can leave these assets open to creditor threats. These weaknesses make it so important to understand the rules of each domestic asset protection trust state.

All 17 Domestic Asset Protection Trust States

Since the first DAPT was allowed in Alaska, dozens of states have created their own DAPT laws. Most tend to have similar rules, like requiring a local trustee. However, despite their many similarities, some states offer far stronger protection than others.

To help you find your ideal trust, we’ve outlined the basics of all 17 domestic asset protection trust states:

Alaska

- Overview: Alaska was the first state to introduce DAPTs in 1997 with the passage of the Alaska Trust Act. The act states that any trust must be irrevocable and contain a spendthrift provision, which is standard for most DAPTs. Alaska does not require the DAPT trustee to be a state resident, though trusts with local trustees provide better protection. Similarly, Alaska recommends, but does not require, trust-held assets to be located within the state.

- Statute of Limitations: Four years

- Protection exceptions: Alaskan DAPTs do not protect against child support or divorce claims if the settlor was in default for 30 days or more when the assets were placed in the trust.

Delaware

- Overview: Delaware was the second state to establish DAPT laws – just months behind Alaska. DAPTs in Delaware are governed by Delaware Code Title 12, § 3570 – 3576. Like most states, Delaware requires trustees to be based in Delaware, though settlors can be located anywhere. Some or all trust assets must be located within Delaware, and the trustee must have trust administration authority.

- Statute of Limitations: Four years

- Protection exceptions: Delaware DAPTs do not defend assets against certain tort claims and all alimony, divorce, and child support claims.

Hawaii

- Overview: Hawaii has allowed DAPTs since 2010, when it passed an early iteration of the Hawaii Revised Statutes, Chapter 554D. Like in most states, DAPTs in Hawaii require at least one trustee to be located within the state. The settlor cannot select themselves as a trustee.

- Statute of Limitations: Two years

- Protection exceptions: Hawaii DAPTs do not offer protection from certain tort claims or any child support, alimony, or divorce claims.

Michigan

- Overview: Michigan first allowed DAPTs in 2017, when it amended the Michigan Qualified Dispositions in Trust Act. Trustees of Michigan DAPTs must be state-based, and banks/trust companies can serve as trustees.

- Statute of Limitations: Two Years

- Protection exceptions: DAPTs in Michigan do not protect assets against certain tax liabilities or child support claims. Additionally, there are no divorce protections for assets placed into a trust during a marriage or 31 days before a marriage.

Mississippi

- Overview: Mississippi began allowing DAPTs in 2017 when it passed the Mississippi Qualified Disposition in Trust Act. This act requires a trust to be irrevocable and managed by a local trustee who actively participates in its management.

- Statute of Limitations: Two years

- Protection exceptions: Mississippi DAPTs do not protect against child support claims and some tax liabilities. Alimony claims and divorce asset divisions can also undermine protections if the trust was formed during the marriage.

Missouri

- Overview: In 2004, Missouri passed the Missouri Revised Statute, Title 31, to outline the process for creating DAPTs within the state. Like most states, Missouri requires trusts to be irrevocable and managed by a local trustee.

- Statute of Limitations: Four years

- Protection exceptions: A DAPT in Missouri does not protect against alimony or child support claims.

Nevada

- Overview: Nevada DAPTs are governed by Chapter 166 of the Nevada revised statutes, which were passed in 1996. Thanks to its strong protections and minimal restrictions, Nevada is regarded as the best asset protection trust state. The only notable requirements are that the trustee must be based in Nevada and remain in charge of the trust’s administration.

- Statute of Limitations: Two years (or six months if deposits are publicly announced).

- Protection exceptions: Nevada is one of the only states where DAPTs can protect against alimony and divorce. The state has no exception creditors. Provided the statute of limitations has passed, assets within a Nevada DAPT are secure against most legal and financial threats.

New Hampshire

- Overview: New Hampshire first allowed DAPT creation in 2017, when it passed the New Hampshire Trust Code. This code is notable for its lack of restrictions on trustees, who can be based anywhere in the United States rather than just in New Hampshire.

- Statute of Limitations: Four years

- Protection exceptions: New Hampshire’s DAPTs do not protect against child support and basic alimony claims. Divorce claims may break through DAPT defenses if the trust was formed during or within 30 days of the marriage.

Ohio

- Overview: In 2013, Ohio passed the Ohio Legacy Trust Act, which permitted the creation of legacy trusts (AKA DAPTs). Trustees for Ohio-based trusts must live in Ohio, though banks or family trust companies based in the state can also serve in this role. The trustee must participate in acts of trust administration.

- Statute of Limitations: 18 months to 3 ½ years

- Protection exceptions: DAPTs in Ohio do not defend against certain tax liabilities, divorce claims, child support, and alimony cases.

Oklahoma

- Overview: Oklahoma DAPTs are governed by the Oklahoma Family Wealth Preservation Act, established in 2004. Trusts in Oklahoma are only permitted to have certain beneficiaries, such as family members and charities. They are widely used as an estate planning tool rather than an asset protection method.

- Statute of Limitations: Four years

- Protection exceptions: DAPTs in Oklahoma don’t protect against child support claims or most tax liabilities.

Rhode Island

- Overview: In 1999, Rhode Island was one of the first states to establish DAPT laws, namely the Qualified Disposition in Trust Act. DAPTs in Rhode Island must include a spendthrift clause and be managed by a person or organization within the state. Also, at least a portion of the assets must be held in Rhode Island.

- Statute of Limitations: Four years

- Protection exceptions: Rhode Island DAPTs do not protect against claims related to alimony, child support, or divorce.

South Dakota

- Overview: South Dakota passed the South Dakota Qualified Distributions in Trust Act in 2005 to allow for the creation of DAPTs. Trusts in this state are best known for their strict privacy rules, which make it difficult for creditors in the state to identify which assets are in a given trust. Like most other DAPTs, South Dakota requires a South Dakotan trustee to manage all local trusts.

- Statute of Limitations: Two years

- Protection exceptions: South Dakota DAPTs do not protect against child support claims if a child support order existed at the time of trust creation. Alimony and divorce claims are also exempt from trust protection if the trust was created during the marriage.

Tennessee

- Overview: Tennessee authorized DAPT creation when it passed the Tennessee Investment Services Act of 2007. Tennessee DAPT laws require settlors to name a local trustee and retain at least a portion of the trust-held assets within state borders.

- Statute of Limitations: 18 months

- Protection exceptions: Tennessee DAPTs do not protect against child support claims. The trust assets may be protected from divorce and alimony claims if the trust was founded before the marriage.

Utah

- Overview: Utah passed the Utah Code Annotated Section 25-6-501-502 in 2003 to allow the creation of DAPTs. Like most other states, settlors must name a Utah-based trustee and give them administrative power over the trust. Settlors are allowed to be co-trustees but cannot make distribution decisions.

- Statute of Limitations: Two years

- Protection exceptions: DAPTs in Utah are designed in a way that offers little protection against child support or alimony claims. The trustee must provide 30 days’ notice to any party with an unmet divorce, child support, or alimony claim before making any distributions to the settlor.

Virginia

- Overview: Virginia permitted trust creation in 2012 when it amended the Virginia Uniform Trust Code. This code requires grantors to appoint a trustee within the state and to keep a portion of the assets within the state.

- Statute of Limitations: Five years

- Protection exceptions: A DAPT in Virginia offers no protection from child support claims or liabilities owed to any government agency.

West Virginia

- Overview: West Virginia only began allowing DAPTs in 2016 when it passed Chapter 44 of the West Virginia Code. Though the state’s laws are similar to those of other states, there is an additional requirement for the grantor to file a “qualified affidavit” when the trust is created. This document certifies that the grantor will not be rendered insolvent by creating the trust and will not attempt to defraud any existing creditors.

- Statute of Limitations: Four years

- Protection exceptions: A DAPT in West Virginia does not defend against child support claims or certain creditors named in a “qualified affidavit” document by the settlor/grantor.

Wyoming

- Overview: When Wyoming passed the Wyoming Uniform Trust Code, Spendthrift and Discretionary Trusts Act in 2007, it quickly became one of the best domestic asset trust protection states. Wyoming requires settlors to list a Wyoming resident or other authorized individual to serve as a trustee. DAPTs in Wyoming must also provide trust income distributions to the settlor. This allows the settlor to enjoy asset protection and financial benefits from the trust.

- Statute of Limitations: Two years

- Protection exceptions: Wyoming trusts do not protect against child support claims. There are also exceptions for financial institutions claiming that a transfer was fraudulent, though the institution will have to prove fraudulence.

The Best Asset Protection Trust States vs. Offshore Asset Protection Trusts

After reviewing the list of domestic asset protection trust states, you probably realize that DAPTs have clear asset security benefits. However, they are not bulletproof. Many DAPTs are vulnerable against certain creditor categories and susceptible to US court rulings. Each state is beholden to the judgments of another state, even if the ruling disagrees with its own statutes. This reveals significant gaps in trust protection, especially for people who hold an out-of-state trust.

An offshore asset protection trust has none of these weaknesses. These trusts are governed by separate jurisdictions that don’t have to play by the rules of the United States government. Offshore asset protection trust jurisdictions will outright ignore the rulings of US courts, protecting your assets against even the most adverse rulings.

All told, domestic asset protection trusts offer moderate protection against creditors and are more than enough for those who are beginning the estate planning process or have a low risk of being sued. However, those who need ironclad protection should rely on offshore asset protection trusts.

Learn more about the differences between domestic and offshore asset protection trusts.

Schedule a Free Consultation to Find the Right Asset Protection Trust State

Just because offshore trusts are stronger than all the best asset protection trust states doesn’t mean that a DAPT isn’t right for you. A DAPT may provide the protection you need, and the convenience can outweigh the disadvantages.

Schedule a free consultation with a team member from Asset Protection Planners to determine which option works for your situation. We’ll help you choose between domestic and offshore options and even help you pick the proper domestic asset protection trust state if a DAPT fits your needs.