Ok, so what are the asset protection trust pros and cons? Maybe you’re asking if an asset protection trust right for you. What are the upsides and the downsides?

The positives and negatives will make the most sense, if we give you a little background. So, keep reading to the end. We’ll we go into detail about how asset protection trusts work to protect your assets from lawsuits.

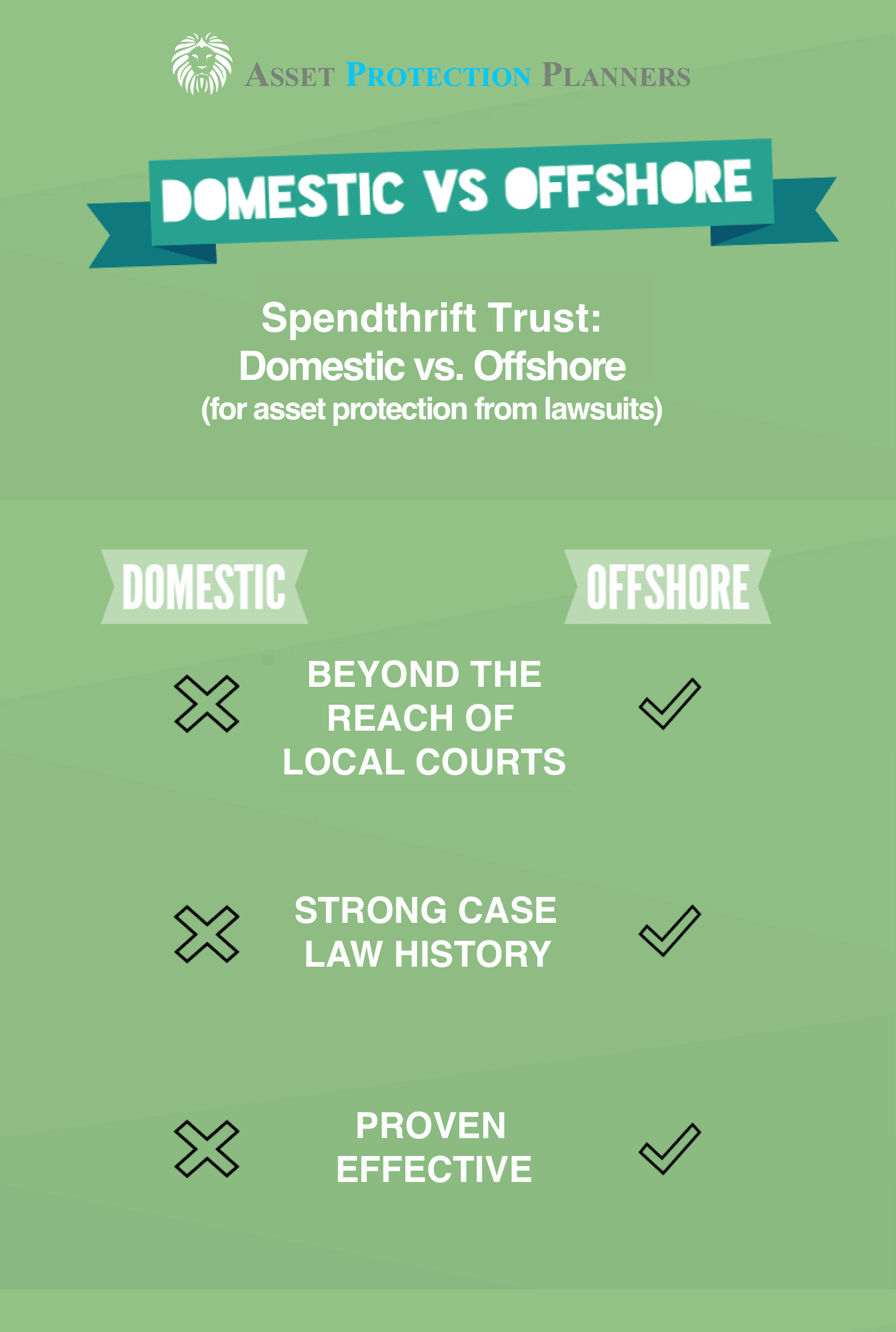

Now, to best help you, we’re going to break down the pros and cons for you even further. That is because there are two types of asset protection trusts: domestic asset protection trusts and offshore asset protection trusts. There’s also a domestic offshore hybrid called a Trigger Trust® that we’ll talk about in the end of this video.

Now, we set up both types of trusts (and own the trademark for the hybrid type). But if you study the case law you’ll clearly see most powerful by far to protect your assets is when you put your assets into an offshore asset protection trust. And we’ll tell you why.

Domestic Asset Protection Trust Pros and Cons

A domestic asset protection trust can be established in a U.S. state that has laws permitting this type of trust. Now, not all states provide for asset protection trusts. As of this article there are 17 states that do and 33 states that don’t.

Domestic Asset Protection Trust Pros

First let’s cover domestic asset protection trust benefits.

- The states that do have asset protection laws on their books allow you to set up the trust as the trust settlor and also be a beneficiary of the trust.

- Those people with this type of trust typically keep their assets in the US.

- If you live in a state that has asset protection trust laws, they will give you a fairly good to mid-level of asset protection from lawsuits in some cases.

So, those are the three main benefits.

Domestic Asset Protection Trust Cons

Now the disadvantages of domestic asset protection trusts.

- US courts have jurisdiction over domestic trusts and trustees. So, we have repeatedly seen results-oriented US judges cast the law aside and order the forfeiture of trust assets.

- The second big disadvantage of domestic trusts? They only tend to work when you both live in and have your assets in the state that has asset protection trust law. For, example, we have not seen Nevada trusts protect assets of California, Florida, Texas, New York, Illinois residents. In other words, suppose you live outside of the state that has asset protection laws. We have seen the courts apply the laws of your home state, not the state that has asset protection trust laws in place. So the judge says, “You’re here. Your assets are here. I demand you turn them over.” When the trustee is a US resident and the assets are in a US bank, they don’t really have a reasonable choice but to follow the court order and hand over your assets.

- The final big disadvantage of domestic trusts is that they are fairly new and do not have a well-established case law history. As such, we have seen judges blaze new trails. Say you have a judgment against you; especially when it’s issued by the judge attempting to reach your assets. What we have seen is that the judge tends to want to keep the momentum going. That is, they want to see to it that your opponent gets the assets he has ordered you to turn over. Many judges will go to greath lengths to do so; even if it means ignoring the letter of the law. So, that’s one reason why we see domestic trusts penetrated over and over again.

Offshore Asset Protection Trust Pros and Cons

Okay. Now let’s switch gears and talk about the pros cons of offshore asset protection trusts. Again, we set up both types. So we really don’t have an incentive to promote one over. That is, we have little incentive other than what we have seen work and not work for our clients in the 31 years our management has been in this profession. Now, the offshore asset protection trust from our experience, is the most powerful asset protection trust of all.

Offshore Asset Protection Trust Pros

- Benefit number one: They work. The main benefit of the offshore or foreign asset protection trust comes from studying the case law. It has proven itself extremely effective at protecting assets from lawsuits, creditors, divorce, judgments and other financial threats. In other words, it protects your assets….and we’ll tell you why.

- Assets are out of reach of the local courts. When threatened, the trust generally holds assets in an international institution outside of the reach of the local courts. Whereas, a domestic court order could instantly freeze a domestic bank account.

- Likewise, our trustee / law firm is not subject to your local court orders. So, this is a great contrast to domestic trustees. Domestic trustees must comply with domestic court orders. However, orders to our foreign law firm to turn over your trust assets fall on deaf ears. They don’t have to comply because our offshore law firm is not under your local judge’s jurisdiction.

- The duress clause. We place a duress clause in your offshore trust. Thus, you can comply with the judge’s orders and ask the trustee to return the funds. But what if you are asking under duress (because somebody made you ask)? If so, the trust legally binds the trustee to protect you and not let your opponent reach touch your money. So, you keep yourself safe by complying with the judge’s order. But our offshore law firm that services as your trustee will not cooperate.

- You can access the funds for yourself. Just ask the trustee under your own free will. In other words, you have access to your money, but your legal enemy does not.

- If you don’t like what the trustee is doing, you simply fire him and hire another.

- More control. The offshore trust gives you more control with better protection.

- The offshore trust jurisdictions we use don’t recognize foreign judgments. That is, your creditor can’t just go over there and start taking your money away like they can in most other countries.

Another item worth mentioning is that our offshore asset protection trusts also have built in estate planning. So, you get to name who gets your assets when you die, such as your spouse or children or other people you care about.

Offshore Asset Protection Trust Cons

Okay, now the disadvantages of the offshore asset protection trust.

- They tend to cost a bit more than domestic trusts.

Let’s do a comparison using car insurance. The average insurance premium is about $3200 a year. That’s about 5% of the value of a $60,000 car. So, as a comparison if you have $2 million to protect…5% of that is $100,000, which is a lot more than the typical asset protection plan. - Now we’ve never seen an offshore trust fail to protect assets. But we’ve seen many domestic ones fail. So, if you have $2 million to lose, how much does a domestic asset protection trust that doesn’t work really cost? It costs $2 million plus all the income that $2 million will produce over the years. So, a trust that works costs a whole lot less than a trust that doesn’t work…which could be much or all of your money.

- You will need to provide more due diligence, such a notarized copy of your ID, proof of address and professional reference letter. In other words, it’s like going through the body scanner at the airport. They want to keep the good guys in and the bad guys out. The regulations require it.

- It’s dealing with international people and financial institutions with which some people may not yet be familiar.

And that’s why it’s so important to have a professional with experience to guide you. We’ve set up more offshore asset protection trusts than anyone in the world. In addition, we’ve had a relationship with our the head attorney in our offshore law firm in the Cook Islands for over 26 years. Our CEO had our Cook Islands firm stay the night in his personal residence. Moreover, they have several billion dollars under management. In fact, they’re the trustees on our CEO’s own offshore trust.

So those are the eight main advantages and the three main disadvantages of the offshore trust.

Most Trusted Jurisdictions

Speaking of offshore, we looked online at the Corruption Perceptions Index (CPI) showing the most trusted countries. New Zealand is one of the three countries listed as the number one most trusted. Cook Islands, where we set up most of our offshore trusts, is part of New Zealand. As of this article, the US is number 27 on the list. So, according to this annual report, if you want to put your money in a safe, trusted country, you’d be better off in the Cook Islands than you would be in the US.

Asset Protection Trust Background

How They Work

Okay, now as we promised, a little more background on Asset Protection Trusts (APT). Here’s the idea behind it. Let’s say you had the power to directly take money out of the trust. As such, a judge could force you use that power to turn the assets over to your opponent. With an asset protection trust, you have a third-party trustee. In our case, the trustee is our international law firm. Our law firm can step in to protect you when needed.

But the trustee doesn’t need to step in right away.

What we typically do is stick an LLC inside of the trust. We make you the manager of that LLC. So, YOU are the signatory on the bank accounts until you need our law firm to step in to protect you. So, nobody gets directly involved unless someone threatens your assets. In other words, let’s say you think the judge might order you to withdraw the funds from abroad and give them to your legal enemy. When this fear arises, you have our international trustee/ law firm step in to protect you.

Another Trait

Another trait of asset protection trusts is that they are irrevocable. Why? Again, because if you could change it directly the judge could force you to change it and make your opponent the beneficiary of the trust. So, you can still make changes. But because of how asset protection trust law works, you simply ask your trustee to make those changes for you. And if you don’t like how the trustee is taking care of you, you simply fire the trustee and hire another one.

Trigger Trust®

Now, as we mentioned in the beginning we even have a Trigger Trust which is a domestic/offshore hybrid. It’s a domestic trust at first that can convert to an offshore trust when you need to erect the armor plating. With this type of trust, you keep your money locally. That is, you initially keep your assets in the US if you’re a US person. You only involve international institutions when you need to.

But when you DO need to…you’ll have the strongest asset protection available.

Conclusion

So, if your goal is to have an iron-clad asset protection plan in place, an asset protection trust may be worth setting up. We wrote this article so you’ll know the asset protection trust pros and cons, what to expect and how they work.

Are you ready to set up an asset protection trust or just have more questions? Give one of our attorneys or consultants a call at 1-954-400-1050 or fill out a free consultation form on this page.