Here is the definition of a 541 Trust ®.* A 541 Trust is a trust crafted to utilize Section 541 of the US Bankruptcy Code. This section of the code specifies what property is and is not included in the bankruptcy estate. This is what it says:

“11 U.S. Code § 541 – Property of the Estate

(b) Property of the estate does not include

(1) any power that the debtor may exercise solely for the benefit of an entity other than the debtor;”

If we interpret this excerpt from the code, here is what it means. It refers to the Property of the Estate, that is, the assets of the person filing bankruptcy, also called the Bankruptcy Estate. So, the Bankruptcy Estate does not include assets that the debtor has power to assign to someone other than the debtor. The debtor, generally, is the one who filed for bankruptcy.

It’s as simple as that.

Now, some promoters of the Section 541 Trust are using that old law and touting it as the latest and greatest. It is not new. Moreover, it is not effective as an asset protection strategy, as you will see below. The attorneys on our staff agree.

After all, a 541 Trust is most certainly “an entity other than the debtor,” which 11 U.S. Code § 541 (b)(1) says that a debtor cannot do. Wouldn’t you agree? Why does this matter for this US-based trust? What other type of trusts can protect you when this one cannot? Read below to find out.

How Does a Section 541 Trust Work?

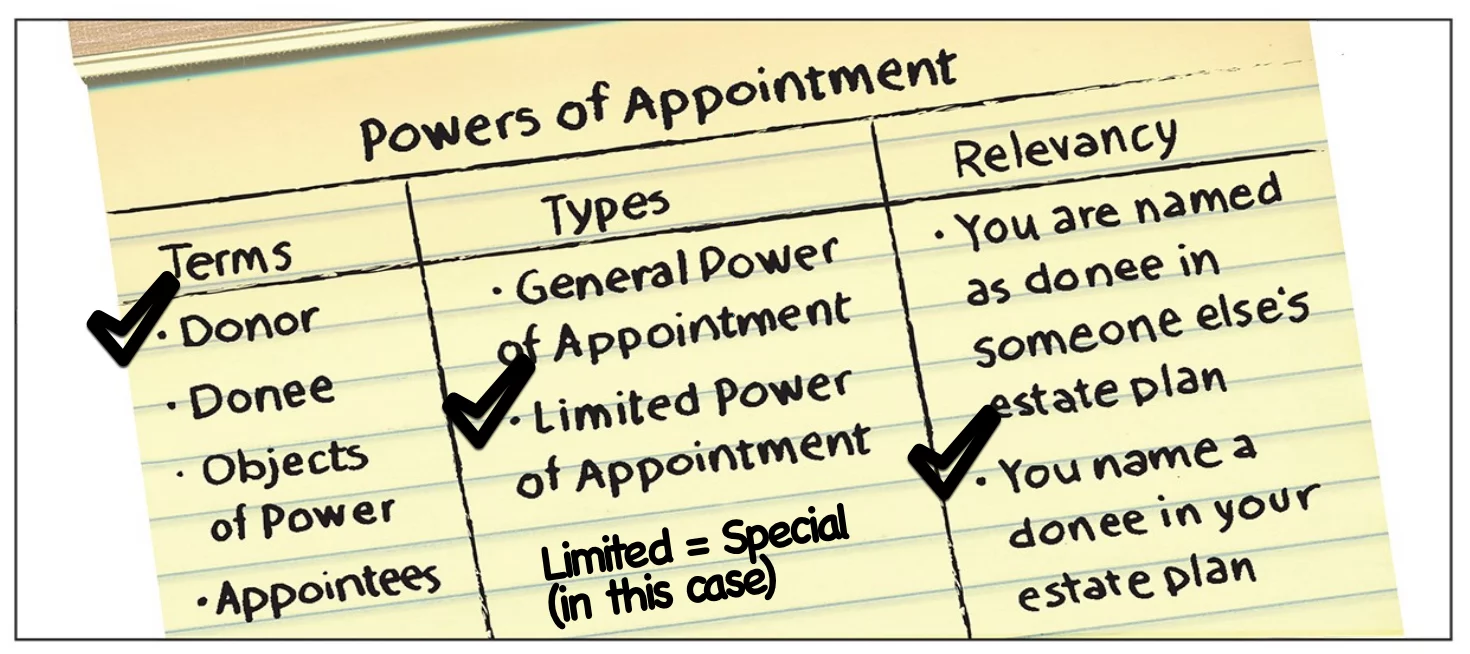

How does it (supposedly) work? Okay, here goes. With the 541 arrangement, the Settlor irrevocably transfers assets into the trust. Thereby, they give away their assets. Nonetheless, the Settlor holds onto the right to assign someone else as ultimate trust beneficiary. One stipulation is that the beneficiary cannot be themselves. They call this right to transfer arrangement a Special Power of Appointment. As such, some also call this trust a SPA Trust.

Special Power of Appointment

Here is where it starts to unravel.

So, is this okay? Is it okay to use a Special Power of Appointment to transfer your assets to somebody else. Sure. After all, they are your assets, right? Well, almost. They were your assets. Once you give them away they are not yours anymore.

Therefore, they do not protect your assets at all. This is because with the Section 541 Trust, you give your assets away to the trust, irrevocably, permanently, once and forever, to never get them back again. You can never be the beneficiary of the trust or its assets. Very generous of you, isn’t it?

Thus, if you give all of your assets away, you no longer have any assets to take, do you? Whoops, almost forgot to mention that. That is, as long as you were not committing a fraudulent conveyance. A fraudulent conveyance is an attempt to avoid a debt by transferring assets to another person or entity (hint, hint, such as a 541 trust).

Fraudulent Conveyance

Just to be clear, a fraudulent conveyance is by-and-large a civil matter, not a criminal matter. You cannot generally go to jail for it. But the judge can use such a ruling to seize your (former) assets, if they are within the judge’s reach.

“Wait a minute,” you say. “You mean to tell me that I have to look a judge in the face and tell him or her that I did not transfer my assets into this trust in order to avoid a debt?”

Yep.

“And I you expect me to do that with a straight face?”

Yep, again.

“Wait, and this is a US-based 541 trust with US-based assets?”

You’re on a roll.

“…and the assets are in a bank over which the US-based judge has jurisdiction to seize the assets?”

Uh, well, yeah.

Okay I think you’re getting the idea.

Another (Huge) Problem of the SPA Trust

Moreover, if your intention is to keep and enjoy the assets, let’s put it bluntly. The trust created under Section 541 is not for you.

But it gets worse.

Using this trust can give you the exact opposite of what you were looking for. That is, it can actually gift wrap your assets in one neat little package, right out in the open, for the judge to take and give to your legal opponent.

Judges are notorious. They seek (at least they are supposed to seek) a fair, equitable and legally-based result. There is the key word, result.

That is true even if you say, “Yeah, but this trust promoter said this Section 541 trust should protect my assets from creditors.” Frankly, the judge could not care less about a theory concocted by a trust promoter. (Sorry, Mr. Trust Promoter, no offense. You’re probably a really nice guy.)

The judge is holding in his or her hand a court-ordered judgment saying that you owe somebody money. Thereby, the judge is looking for a, you got it, result to resolve the case.

You took your money, and gave it to a trust that, in turn, gave it to somebody else. The trust is a US-based trust with a US bank account. In our experience the judge, more often than not, will move the money from that US-bank account to another US-bank account with your creditor’s name on it.

Again, it is as simple as that.

![]()

Our Experience

People call us all the time who tell us someone promoted this trust to them. Someone tells them to move all of their assets into this Section 541 trust. Then they are supposed to count on “friendly beneficiaries” to have their backs.

On the other hand, if that friendly beneficiary doesn’t want to play the game, that they can simply change the beneficiary to somebody else. Alternatively, that beneficiary (or the next one) can secretly give the assets back to them. Or, maybe they can just use the assets without anybody knowing (or some other sham transaction).

The definition of a sham transaction is “a transaction that is made to mislead or deceive others” according to Merriam-Webster. Our goal in the asset protection world is to really protect people, not to deceive people.

You must assume that opposing counsel has a computer that is connected to the Internet. As such, with a simple web search, he or she (or they) can easily drag you — and the marketing material of the Section 541 trust — into the courtroom. The judge will clearly see the game you are trying to play. He will then proceed to dip into your trust’s US bank account and give your legal opponent a nice payday at your (trust’s) expense.

Substance Over Form

The term Substance Over Form is a doctrine which allows authorities to ignore the legal form of an arrangement. Instead, they and to look to its actual substance in order to keep people from using artificial structures to avoid legal requirements. This applies to tax cases, mainly, but we can also use it here to refer to creditor-debtor cases. The Section 541 trust touted as an asset protection trust clearly meets this definition of Substance Over Form. Therefore, we have imminent confidence the judge would not simply overlook the elephant in the room.

In other words, one may be able to fool the inexperienced layperson. But history shows that it is a much higher mountain to climb to fool a thorough, experienced, result-oriented federal judge; especially one with a judgment against you in his hand.

Square Peg in a Round Hole

Section 541 is not about trusts. It is about bankruptcy. It does not say, “If you set up a trust that gives you a special power of appointment and transfer your own assets into it that the judge cannot reverse such a transfer.” It doesn’t say that. So, we cannot twist it to mean that no matter how badly we may want it to.

Again, the relevant portion of Section 541 says, “(b) Property of the estate does not include (1) any power that the debtor may exercise solely for the benefit of an entity other than the debtor…” For example, suppose Susie worked an IBM bookkeeper. Susie signs the paychecks for her department. If she filed bankruptcy, the courts could not use her signatory over the payroll account to seize the assets of IBM. Yes, she has power over one of IBM’s bank accounts. But she is doing so for the benefit of another entity (i.e. IBM).

That is what Section 541 means. It does not mean that we can twist the intent and fabricate a theory creating a newfangled type of trust. Doing so would just make a judge close his eyes and shake his head.

After all, do you want to trust your hard-earned riches to a concocted theory? I would think not.

You would much rather trust your wealth to a trust that is supported by statute, would you not? There are jurisdictions with trust statutes crafted primarily to protect your assets from lawsuits and judgments. We are talking about trusts that have gone through the rigor of legal attacks…and survived unscathed. We are talking about trusts with strong case law history. That is the type of trust that can give you sleep-like-a-baby peace of mind. See the examples below.

541 Trust Summary

In summary, the 541 trust arrangement is a:

- A fraudulent conveyance

- To a US-based entity

- Over which a US-based judge has jurisdiction

- Using a sham, substance-over-form transaction

- That tries to cram a square peg into a round hole

- By using a theoretical (not factual) interpretation

- Of an old bankruptcy law.

In short, if the trust, the trustee and the assets are all in the US, the US courts reign supreme. Thus, the US courts can seize the assets.

If you are thinking about setting up a trust set up under the Section 541 theory, make sure you know this. (1) The assets are not yours anymore. (2) You have no legal power to get them back. (3) This trust is based on theory, not fact. (4) When the judge sees through it he will most likely seize the assets.

The Solution

Therefore, if you want real asset protection, recognize that assets that are beyond the reach of the US courts can enjoy genuine protection. Use actual time-tested techniques that have solid, proven asset protection results. An offshore trust is one of the best examples of this type of solid protective fortress. The Nevis trust and Cook Islands trusts are specific examples of such offshore trusts.

Fortunately, with the offshore trust, you remain the trust beneficiary. Therefore you, through the trust, still retain your assets. Furthermore, a fraudulent conveyance ruling (which, as you recall, is a generally a civil not criminal issue) doesn’t matter because your opponents cannot reach the assets. The bottom line? Offshore trusts work. We know. After all, we have been establishing them for about three decades. Feel free to utilize the phone number on this page or fill out a consultation form above for more information.